SBI Group, Tokyo’s largest financial services company, will now allow average Japanese investors to purchase cryptocurrencies through its newly created ‘crypto asset fund,’ according to the company.

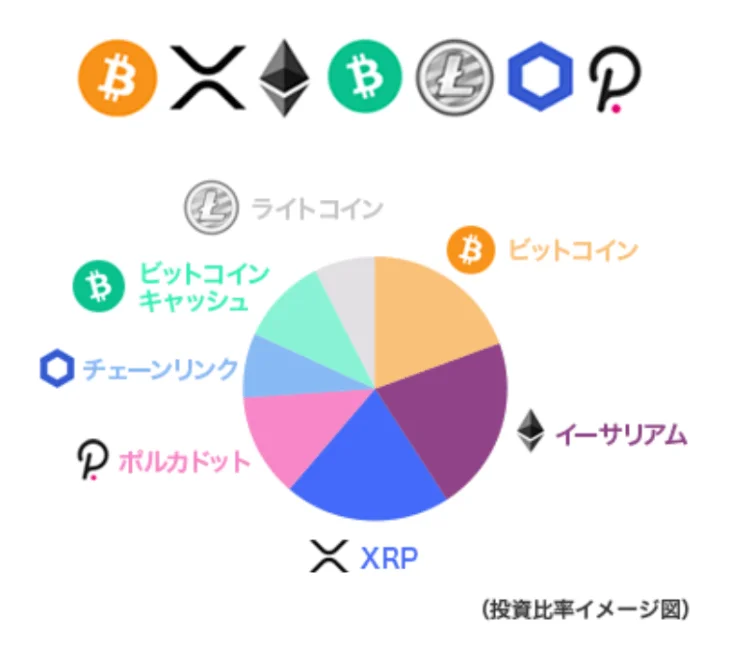

SBI Group, Tokyo’s largest financial services provider, will now allow ordinary Japanese investors to buy cryptocurrencies through its newly formed ‘crypto asset fund.’ Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK), and Polkadot are among the seven cryptocurrencies included in the fund (DOT).

The crypto-asset fund, which will be traded and managed by SBI Alternative Fund, was launched on December 2nd with a designated capital of 5 million yen, or $45,000 at the time of writing. The corporation, on the other hand, may decide to release the capital in smaller chunks of 1 million yen apiece.

Prior to making a purchase, investors will have to go through an application process that involves an anonymous collaboration agreement with SBI Alternative Fund, according to the official announcement. The company’s explanation for this action is as follows:

“Since it is not suitable for all customers, it can only be purchased by customers who meet certain standards set by our company.”

In addition, SBI VC Trade, a subsidiary firm that deals with cryptocurrency trading, will handle the crypto investments made by such anonymous associations. SBI further stated that none of the seven cryptocurrencies included in the crypto-asset fund will have a ratio greater than 20%.

SBI has indicated that the fund “cannot be cancelled within one year,” between February 1, 2022, and January 31, 2023, to ensure the service’s survival. Unrealized capital gains taxes will be imposed on investors, as well as other shared charges like establishment and liquidation costs and audit costs.

SBI has set an age limit for this fund of 20 to 70 years old, and every purchase will be subject to a three-month lock-in period, with the goal of “reducing investment risk by diversifying time.” Every month, the corporation will rebalance the investment ratio allocation.

SBI Holdings invests in Coinhako, a Singaporean cryptocurrency exchange

SBI continues to expand its presence in other countries, in addition to helping Japan’s crypto acceptance. The company has made an investment in Coinhako, a Singaporean cryptocurrency exchange. Coinhako obtained SBI finance shortly after receiving regulatory permission from the Singapore Monetary Authority (MAS).

Using SBI’s financial injection and its pre-existing worldwide network, Coinhako hopes to “extend our operations to other countries in Southeast Asia.”