Banks that support cryptocurrencies accept them as a form of payment and provide customers access to cheaper transaction costs. We’ll examine the best crypto-friendly banks in 2023 in this post.

Despite the fact that banks are afraid of cryptocurrencies, some have welcomed customers who use this cutting-edge digital money. One may be forced to ask, what are crypto-friendly banks?

What are crypto-friendly banks?

Banks that support cryptocurrencies are those that let you trade digital assets like Bitcoin, Ethereum, Ripple, and other altcoins for fiat money like USD, EUR, and GBP.

The currencies are available for deposit and withdrawal, and you can use them to make online and offline payments just as you would with your country’s fiat currency.

Therefore, banks that accept cryptocurrencies provide you with complete banking services including savings accounts, credit cards, and investment services.

How to Select a Crypto-Friendly Bank

You may select a crypto-friendly bank by considering some of the factors that are stated below.

- Customer Feedback

- Fees

- Reputation

- Services provided

Customer Feedback

Examine online reviews from past clients of potential crypto-friendly banks before choosing one. You may use this to determine whether or not the bank has been beneficial to its clients.

Fees

There shouldn’t be any fees associated with depositing or withdrawing cryptocurrency from a bank that supports it. This is so that the banks may profit from the differential between the purchase and sell prices of the various currencies.

Reputation

Because a bank with a bad reputation won’t be able to provide the services anticipated from a respectable bank, the reputation of the bank should be excellent.

Services provided

All the financial services that you would anticipate from a typical bank should be available from a crypto-friendly bank.

Advantages of Crypto-Friendly Banks

When you open an account with a bank that accepts cryptocurrencies, you might get a lot of benefits. The following are some benefits of crypto-friendly banks:

- You may exchange digital assets like Bitcoin, Ethereum, and others into fiat currencies like USD, EUR, and GBP using the bank.

- You may utilize your digital assets, such as Bitcoin, Ethereum, etc., to make payments via the bank.

- You can use the bank for making investments.

- You may keep your digital assets in the bank.

- You may utilize the bank to get credit card and loan options.

Disadvantages of Crypto-Friendly Banks

Additionally, there are a few drawbacks to banks that accept cryptocurrencies. These consist of:

- Finding a bank in your location that accepts cryptocurrencies could be challenging.

- Banks that accept cryptocurrencies are not subject to financial or governmental regulation. As a result, you may not get the same degree of customer care as you would at a traditional bank.

- Your digital assets are not covered by insurance. This implies that you will lose your digital assets if the bank is hacked.

- If you wish to change your fiat money into digital assets and vice versa, there are substantial transaction costs.

Top 10 Crypto-Friendly Banks In 2023

More and more institutions are embracing cryptocurrencies and digital payment methods as they grow in popularity. Here is a list of the top 10 crypto-friendly banks in case you’re seeking one.

- JP Morgan

- Wirex

- Revolut

- Fidor

- Simple Bank

- Bank Frick

- Ally Bank

- Juno

- USAA

- BankProv

JP Morgan Chase

One of the biggest and most prosperous banks in the world, JP Morgan Chase was the first in the US to create its own cryptocurrency (JPM Coin) using blockchain technology for international payments.

Six crypto funds have been added to the bank’s cryptocurrency services for its wealth management customers, along with interoperability with key cryptocurrency exchanges.

Chase does not, however, provide crypto trading. To purchase and sell cryptocurrency, users may use Coinbase, Gemini, and other well-known exchange sites by connecting their bank accounts.

JPMorgan Chase has become one of the most prosperous crypto companies as it continues to provide more cryptocurrency chances for its clients.

Wirex

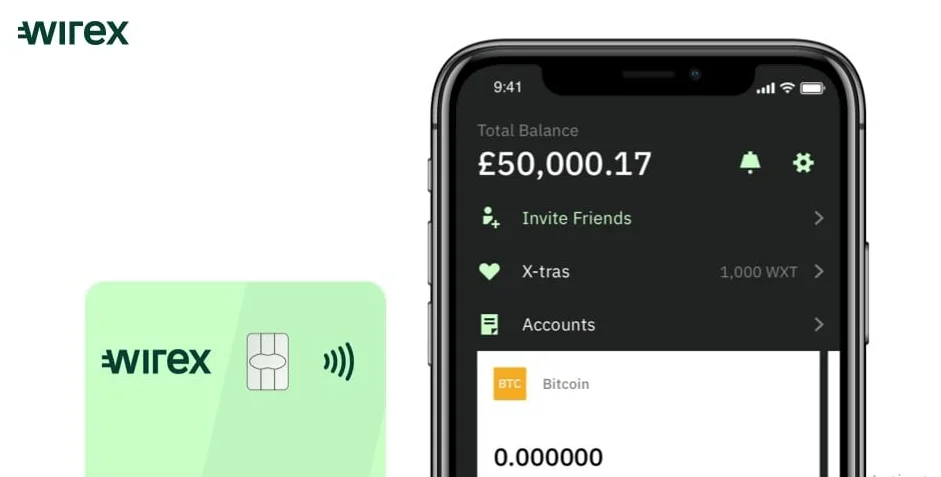

A digital banking platform called Wirex is established in London and provides both cryptocurrency and conventional banking services. Wirex is one of the best crypto-friendly banks and supports crypto companies, financial institutions, and exchanges.

Wirex supports over 150 digital assets on multiple blockchain networks using the in-app DApp Browser. With a Wirex account, you may also purchase, store, and manage a variety of cryptocurrencies, including the typical BTC, LTC, XRP, ETH, etc. Account users can also exchange their crypto holdings for a number of fiat currencies, such as USD, EUR, and GBP.

Additionally, they provide up to 10% interest for crypto deposits and up to 16% interest for deposits made in savings accounts using fiat money.

They provide you with a debit and credit card connected to your account as an extra benefit, and if you use this card to make in-store retail transactions, you’ll earn 0.5% cash back in BTC (Wirex calls it crypto back).

Revolut

The digital banking platform enables users to purchase, exchange, and store cryptocurrency. Along with the US, Revolut welcomes clients from Europe, the UK, Australia, Singapore, Japan, and Switzerland.

Users of the well-known online bank may deposit money in their home currency, convert it at market-leading rates, and send and receive money exactly as they would with a conventional bank account.

On both Android and iOS, users can buy crypto straight from the Revolut app. You can purchase cryptocurrency anytime you want using the program. Alternatively, you may program an automatic exchange to buy a cryptocurrency when a certain exchange rate is achieved.

You may obtain early pay and an FDIC-insured account by signing up for free. Revolut’s app allows for crypto purchases, which is one of the reasons it is seen as such a crypto-friendly bank. Customers may now utilize wallets like Ledger to withdraw cryptocurrency, something they previously couldn’t do.

However, purchasing cryptocurrencies via Revolut may not be the ideal option if you want to pay the fewest costs possible. Revolut charges a 2.5% standard fee with an additional 0.5% for transactions exceeding £1000.

You may lower the charge to 1.5% by switching to metal or premium accounts. Additionally, Revolut provides its users with a debit card that can be used at ATMs, in stores, and online.

Fidor

Fidor has been popular among crypto aficionados since 2014. Fidor now only functions as a digital bank in Germany. Fidor is very simple to start up and has affordable prices.

Fidor charges €5 in monthly fees, however, if you do more than 10 transactions each month, you may avoid paying these costs. Fidor collaborated with Bitcoin.de, a German exchange, in 2014. Customers were able to purchase crypto thanks to this arrangement shortly after depositing money.

They are now Kraken’s financing source, thus people who live in Germany and utilize Kraken will find this bank to be an obvious option. They are unlikely to abruptly halt your cryptocurrency transactions since they have direct links with crypto exchanges.

Simple Bank

Initially, Simple Bank was a Fintech firm. It has developed into one of the top banks for US people today thanks to its FDIC-backed/insured status.

This bank interacts with several cryptocurrency exchanges as one of the most well-known crypto-friendly banks in the US.

Through Simple Bank, direct buy-sell transactions are possible. Simple Bank offers its users access to popular cryptocurrency tokens including Bitcoin, Ethereum, Ripple, Litecoin, and more as part of its worldwide cryptocurrency network.

Simple Bank does not impose a cap on the number of cryptocurrency transactions a client may make, in contrast to other banks. InstantSend Technology, which automates and expedites the whole transaction process, is a distinctive element of its platform.

Bank Frick

A Liechtenstein-based bank called Bank Frick offers services for crypto-banking. For both professional market players and private customers, Bank Frick now offers trading in Bitcoin Cash (BCH) and safe custody of the cryptocurrency.

“The bank stores the cryptocurrency assets of its clients in cold storage wallets. These cannot be externally hacked since they are physically cut off from the Internet.

Additionally, customers may save these assets in the bank as a deposit. This offer was created by Bank Frick exclusively for institutional customers, mining companies, and affluent cryptocurrency investors.

You may purchase cryptocurrencies using euros, dollars, and Swiss francs.

Ally Bank

The business was established in 2009, and it consistently ranks as one of the best US online banks. Ally Bank is a fantastic option for Americans who use cryptocurrency.

Crypto enthusiasts can buy and sell cryptocurrencies from different exchanges using the online bank, which is open twenty-four hours a day. You now have a lot of flexibility because you can select from a large number of exchanges that give you access to a variety of cryptocurrencies.

Customers don’t have to pay commission fees to buy equities. A few examples of funds that give exposure to crypto are the Grayscale Bitcoin Trust (GBTC), Osprey Bitcoin Trust (OBTV), or futures like the ProShares Bitcoin Strategy ETF (BITO).

Despite not having native exposure to cryptocurrencies, the Coinbase interface and cryptocurrency funds are a close second. It offers a well-regarded mobile app that is excellent for banking wherever you are. Ally bank is a fantastic alternative if you’re seeking a full-service bank with cryptocurrency choices.

Juno

One of the greatest alternatives available to you for its banking services, cryptocurrency trading, cashback debit card incentives, and loyalty program is Juno, one of the top crypto-friendly banks.

Juno combines the numerous advantages of a cryptocurrency exchange with all the redeeming characteristics of a conventional bank account.

You may instantaneously exchange money in the bank for money on the blockchain thanks to the way Juno is built. Cryptocurrency trading is simple and practical, enabling you to HODL your coins or move them to self-custody blockchains like Ethereum or Polygon.

It’s one of the top onramps for cryptocurrency in that regard. The premium services from Binance or Coinbase provide more assets and better pricing execution, but it doesn’t.

Among the cryptocurrencies offered by Juno at the moment are USDC, BTC, and ETH. With a $300 purchase at the brands of your choice, Juno’s cashback debit card gives up to 10% cashback.

USAA

The United Services Automobile Association, often known as USAA, is a financial services provider for American service members with headquarters in Texas.

Officers and enlisted members of the U.S. military who are currently serving, have retired, or have been separated with distinction are served by the company.

A well-known corporation, USAA was among the first US banks in its lengthy history to make an investment in a cryptocurrency exchange.

Early on, USAA realized that its members had a need for cryptocurrency services. As a consequence, it teamed up with Coinbase in 2015 to provide its customers with the option of handling cryptocurrencies.

Over the last several years, USAA has invested over $150 million in Coinbase, enabling its customers to engage with one of the biggest cryptocurrency exchanges. Customers may use their USAA account to monitor their crypto wallets on Coinbase. They can connect their bank accounts, monitor all of their transactions, and check balances using Coinbase.

BankProv

BankProv is one of the finest banks accepting cryptocurrencies that is active in the US. The target audience for BankProv is especially companies that provide services for digital currency. It provides everything from exchange services to further investments in the world of cryptocurrencies.

Additionally, it provides adaptable account choices that enable you to exchange between USD and cryptocurrencies. The bank offers various cash management services as well as cryptocurrency-backed lending options. To fund their operations, businesses may get loans based on cryptocurrencies.

BankProv belongs to both the Depositors Insurance Fund and the Federal Deposit Insurance Corporation (FDIC) (DIF). Each depositor is covered by the FDIC up to $250,000, while the DIF covers the remaining amounts.

Despite the bank’s many benefits, one of them is the need for you to establish a company to access its cryptocurrency services.

Conclusion

Institutions are progressively becoming more receptive to cryptocurrency, and this article examines the best banks that you may want to join up with.

Banks are undoubtedly a safer alternative than cryptocurrency exchanges, but you must make sure that the bank you choose is crypto-friendly and subject to financial authority regulation.

You can use a digital wallet to store, exchange, convert, and withdraw your digital assets from a bank that accepts cryptocurrencies.