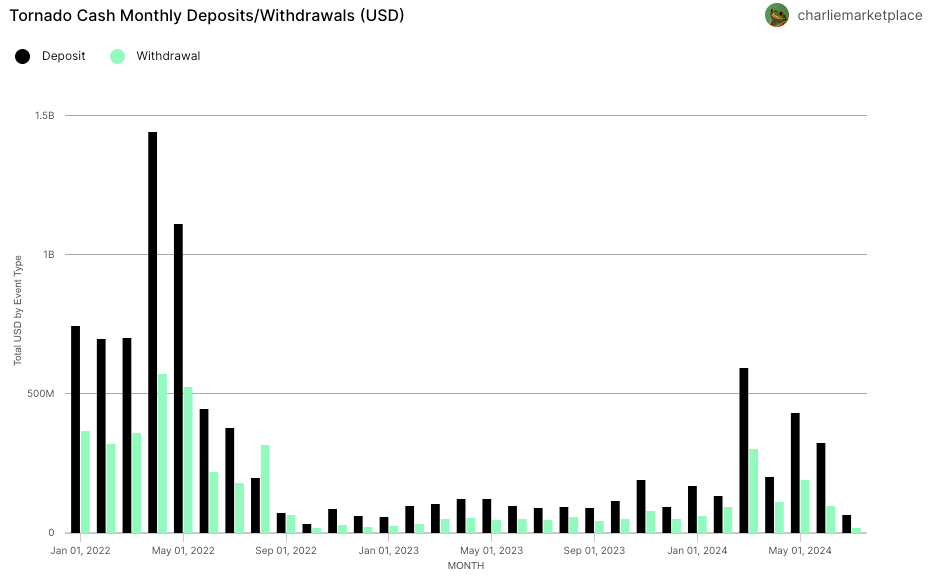

Despite sanctions, Tornado Cash saw a 50% increase in deposits, reaching $1.9 billion in the first half of 2024.

The deposit volume of Tornado Cash, a crypto aggregator that has been banned, has experienced a surprising increase in the first half of 2024, despite the ongoing legal challenges faced by its founding team and the sanctions that have been imposed.

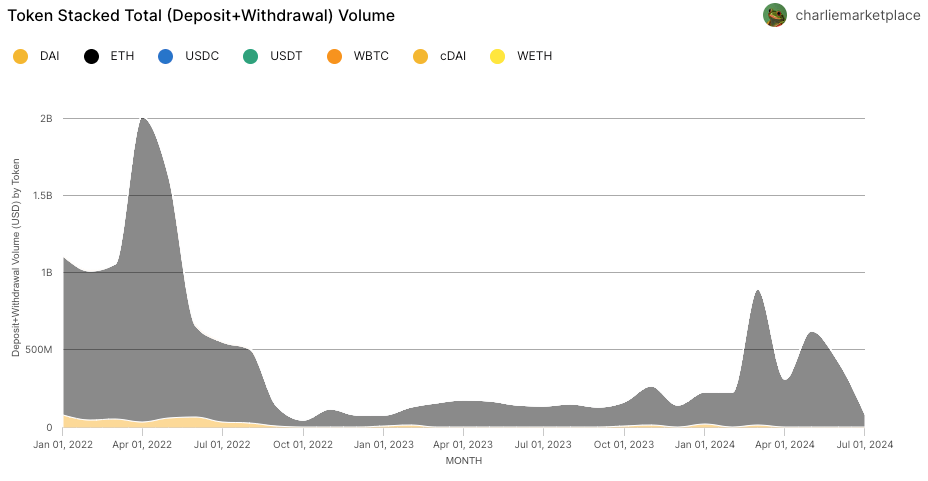

According to Flipside Crypto data, Tornado Cash has received approximately $1.9 billion in deposits in the first six months, representing a substantial 50% increase from the total number of deposits throughout 2023.

Tornado Cash was officially sanctioned by the Office of Foreign Assets Control (OFAC) in August 2022 when it was discovered that the North Korean cybercrime consortium Lazarus Group had employed the protocol to launder approximately $455 million in illicit funds.

By virtue of the OFAC sanctions, any individual who engaged with the protocol would be included on a “blacklist,” which would prevent their wallet from being accepted at any legally compliant crypto exchange.

Essentially, any client engaged with the protocol would encounter significant challenges when attempting to convert the crypto into fiat from a centralized exchange that complies with OFAC regulations.

In spite of these sanctions, the mixing service continues to be a preferred destination for large cybercrime groups that are seeking to obscure the flow of illicit funds.

Since May, the hacker responsible for the $100 million Poloniex exchange exploit has transferred $76 million to the aggregator, according to data from blockchain analytics firm Arkham Intelligence.

Additionally, the illicit entities responsible for the HECO Bridge and Orbit Chain exploits transferred $166 million and $48 million to the mixer, respectively, during the first half of the year.

A Tornado Cash deposit was used to finance one of the confirmed wallet addresses used in the $235 million hack of Indian crypto exchange WazirX on July 18. This information was published more recently.

The Tornado Cash sanctions have been the subject of an ongoing lawsuit challenged by numerous crypto industry figures, initially submitted in 2022.

The plaintiffs contended that the sanctioning of Tornado Cash is “unlawful and unconstitutional” under the US Constitution, as the anonymous mixing service cannot be considered a country or a “entity.” They also contended that the prohibition of Tornado Cash violates the right to free expression.

Several prominent crypto firms, such as Coinbase and crypto advocacy organizations The Blockchain Association and Coin Center, have since endorsed the litigation, asserting that the sanctions are unlawful.

However, Tornado Cash has consistently failed to establish controls to prevent money laundering, and the US Treasury has declared that crypto mixers pose a national security hazard.

However, the legal and regulatory assault on Tornado Cash’s mixing protocol has presented challenges for the three co-founders, Alexey Pertsev, Roman Storm, and Roman Semenov.

Following his conviction for money laundering in 2023, Alexey Pertev was sentenced to five years and four months in Dutch prison.

Roman Storm was apprehended in the United States in August on suspicion of money laundering. He subsequently entered a plea of not guilty to all charges.

He was released on a $2 million bond shortly after his detention. Subsequently, on March 31, he sought to have all charges dismissed.

The third co-founder, Roman Semenov, is still at large.