According to Trade group UK, the finance industry, which conducts $14.5 trillion in payments annually, could benefit from a blockchain-based ledger for payments and settlements.

UK Finance expressed its satisfaction with the Regulated Liability Network (RLN), a blockchain-based ledger for central bank digital currencies (CBDC) and tokenized assets, following the conclusion of its effective experimental phase on September 17.

UK Finance summarized the results of an experimentation phase of the network with 11 institutions, asserting that the RLN has the potential to facilitate innovation and provide new financial functions, such as programmable payments.

The trade group urged “further engagement with regulators and other public bodies” to further develop the RLN, which it claimed could reduce the cost of failed payments and fraud.

The legal and regulatory framework of the United Kingdom is “sufficiently adaptable” to facilitate what UK Finance refers to as a “platform for innovation.” However, it requires “further regulatory engagement and implementation.”

Jana Mackintosh, the managing director of payments at UK Finance, stated, “The private sector is interested in investing in the future of commercial bank money, and the most effective approach to achieve this is through a partnership with regulators.”.

Mackintosh identified the $14.52 trillion (11 trillion British pounds) in payments conducted annually in the United Kingdom as the primary objective of the RLN, which employs distributed ledger technology (DLT).

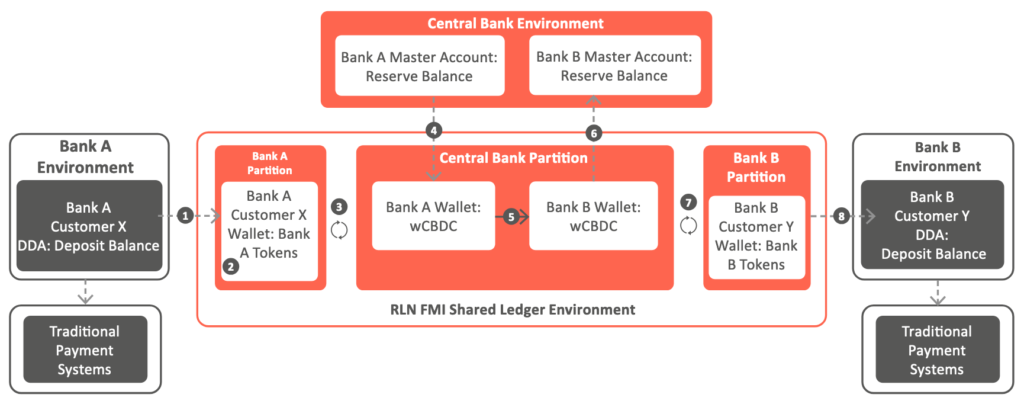

Each entity that has access to the ledger can record, transfer, and settle funds, tokenize and program payments and settlements, and secure and unlock funds. The ledger can also accommodate wholesale CBDCs, commercial banks, and electronic money.

A discovery from the experiments was that the RLN could provide new firms with a “common point of access” to — and enable them to interface with — “established institutions and enhanced payment and settlement systems,” noted UK Finance.

It also asserted that the platform could assist in achieving the objectives for the UK payments industry outlined in a July Bank of England discussion paper, which includes “the objectives of promoting sustained innovation and maintaining the singleness of money.”

In April, the trade association initiated the experiments in collaboration with the following banks: Barclays, Citi, HSBC, Lloyds, Mastercard, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money, and Visa.