The strong 82.8% rise since the rising wedge formation began on July 13 surely looks to be a success for bulls even if ETH price rejected the $2,000 barrier on August 14.

As the network anticipates the Merge transaction to a proof-of-stake (PoS) consensus network on September 16, the ideal of “ultrasound money” unquestionably draws closer.

Some detractors note that the move away from proof-of-work (PoW) mining has been put off for years and that the Merge does not deal with the scalability problem. It is anticipated that the network would transition to parallel processing (sharding) in late 2023 or early 2024.

The EIP-1559 burn mechanism, which was first deployed in August 2021, was crucial for making ETH scarce, as crypto analyst and influencer Kris Kay demonstrates:

Despite removing the need to fund the pricy, energy-intensive mining operations, the highly anticipated switch to the Ethereum main chain received a lot of criticism. The inability of ETH stakers to withdraw their coins, which results in an unsustainable transient offer-side drop, is highlighted below by “DrBitcoinMD”.

Undoubtedly, a supply shock resulted from the reduced number of coins for sale, particularly in light of Ether’s recent 82.8% surge. Though no guarantees were offered for immediate transfers after the Merge, these investors were aware of the dangers associated with ETH 2.0 staking.

Option markets demonstrate questionable sentiment

Ether’s derivatives markets data may help investors identify where whales and arbitrage desks are located. When traders overspend for upside or downside protection, the 25% delta skew is a warning indication.

The skew indicator would increase to exceed 12% if those market players were concerned about an Ether price fall. Generalized enthusiasm, however, has a negative 12% skew.

Since Ether started the uptrend, the skew indicator has been neutral, even when it hit the $2,000 barrier on August 14. Due to the fact that ETH option traders are now evaluating comparable risks of both an upward and downward price movement, the lack of change in market mood is quite alarming.

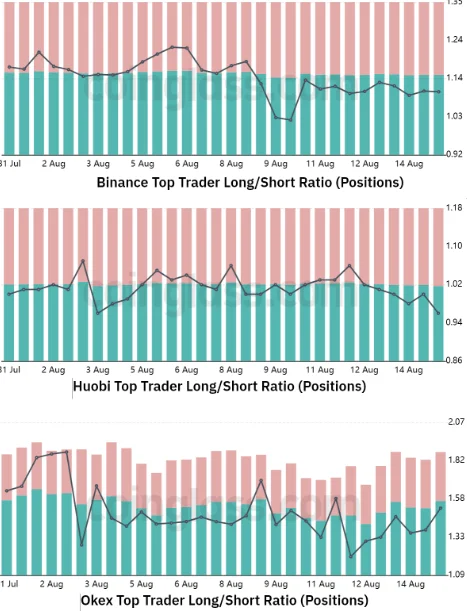

The long-to-short data, however, indicates little confidence near the $2,000 level. Externalities that may have just affected the options markets are not included in this statistic. In order to better understand how professional traders are positioned, it also collects information from exchange customers’ holdings on the spot, perpetual, and quarterly futures contracts.

Since there are sometimes methodological differences between various exchanges, readers should focus on trends rather than exact numbers.

The long-to-short indicator shows that professional traders modestly lowered their leverage long bets even though ETH price surged 18% between August 4 and August 15. For instance, the Binance traders‘ ratio slightly increased from the period’s beginning value of 1.16 but still ended below that value, which was about 1.12.

Despite Ether’s 18% increase since August 4, there hasn’t been a major shift in whales’ and market makers’ leverage holdings. There is probably a reason why options traders are pricing the risks of Ether’s upward and downward movements similarly. Strong support for the proof-of-work split, for instance, would put pressure on ETH price.

Professional traders aren’t now optimistic that the $2,000 barrier will be quickly overcome, that much is certain.