Travala expanded its payment options to support Solana-based tokens for booking hotels and flights.

Travala, an online travel ticketing service on the Solana blockchain, has broadened its crypto payment alternatives to major tokens.

During the Solana Breakpoint conference in Singapore on September 21, Travala CEO Juan Otero disclosed an agreement to integrate with Solana, a layer-1 blockchain ecosystem.

The partnership enables travelers to reserve hotels and flights on the Solana blockchain by utilizing Solana, the native token of Solana, and the main stablecoins Tether and USD Coin.

The Solana blockchain is a direct competitor of Ethereum, concentrating on the faster and more cost-effective execution of decentralized applications (DApps) and smart contracts.

Travala Facilitates Direct SOL Deposits and Withdrawals

Travala has a history of accepting payments via Bitcoin and a variety of other cryptocurrencies, such as Ether. However, the Solana integration enables users to deposit and withdraw the supported tokens directly on their Travala accounts, with zero-fee transactions on travel bookings.

The collaboration was met with enthusiasm by crypto investors and devotees on X, who anticipated a smooth travel booking process.

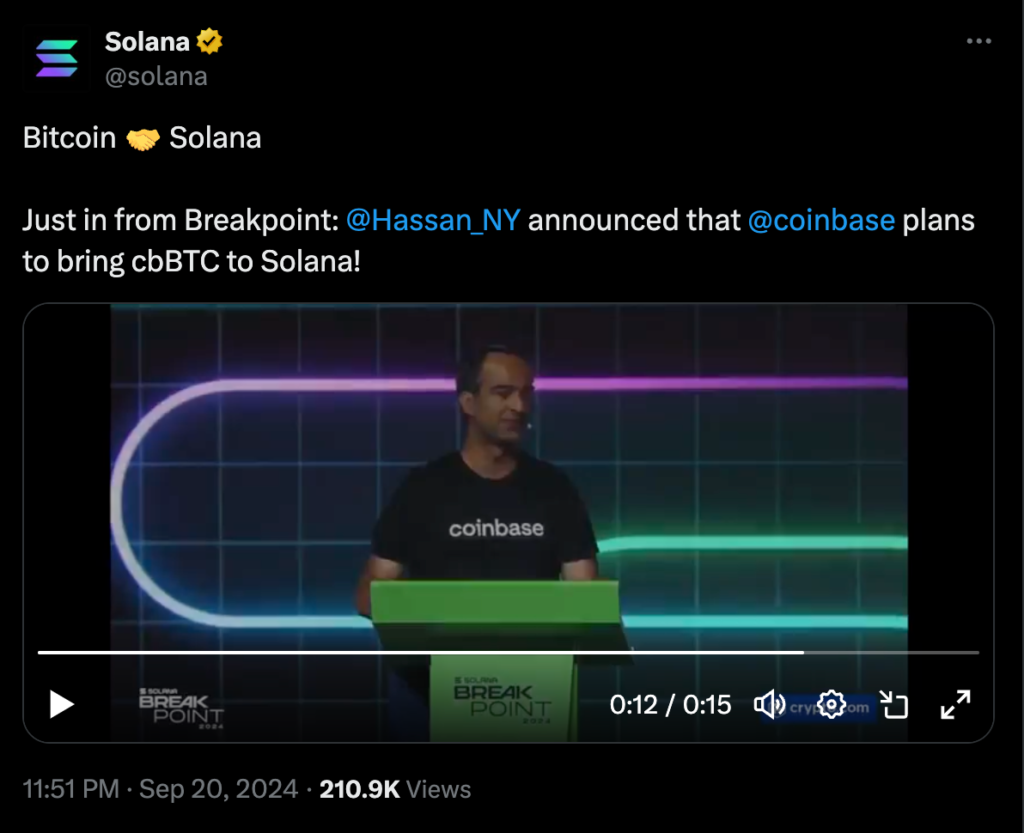

Solana is Drawn to Coinbase’s Packaged Bitcoin Offering

Exchange of cryptocurrency Coinbase is also placing a wager on the Solana blockchain by planning to introduce its new “cbBTC” asset, which is a wrapped Bitcoin, to the Solana network. However, Coinbase’s country director for Singapore, Hassan Ahmed, stated that no specific date had been disclosed for its launch:

“We recently launched cbBTC on base, but our users love Solana, and so do we. So we are very excited to announce that we will be bringing native cbBTC to Solana as well.”

Wrapped Bitcoin products enable users to maintain asset control while employing Bitcoin as collateral for decentralized finance applications.

Solana’s bundled Bitcoin asset, cbBTC, was initially introduced on the Ethereum and Base networks.

cbBTC is backed at a 1:1 ratio by Bitcoin, which is held by the centralized exchange, according to Coinbase. The platform does not have any separate order books or trading pairs for cbBTC.