The Financial Services Regulatory Authority (FSRA) of the United Arab Emirates has incorporated new provisions on digital assets into its Anti-Money Laundering and Sanctions policy.

The FSRA formally declared revisions to its Anti-Money Laundering and Sanctions Rules and Guidance, or the AML Rulebook, on December 21. Among the modifications made were sections of the FATF Travel Rule that pertain to digital assets.

Ali Jamal, chief executive officer of Cryptos Consultancy, identifies the crucial revisions in the document as the explicit enforcement of the FATF’s Travel Rule on digital assets through the refinement of wire transfer provisions; this has a substantial effect on organizations subject to the jurisdiction of the AML Rulebook.

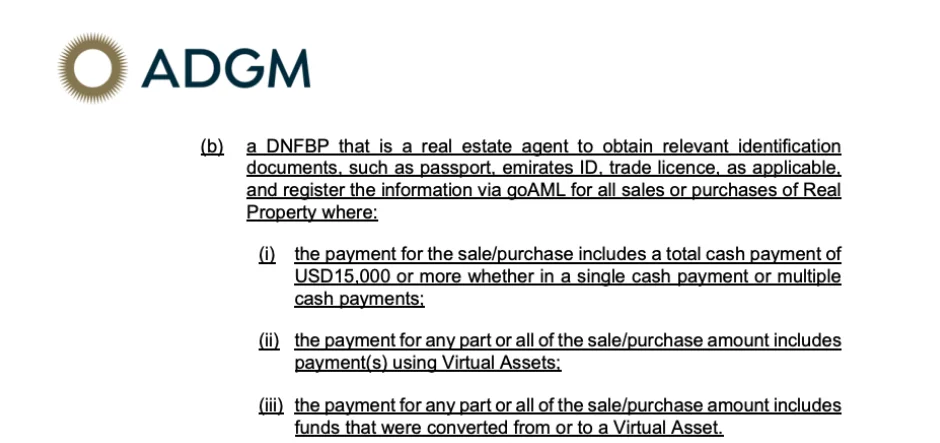

This revision is pertinent to authorize financial sector firms, designated non-financial businesses, and professions.

Jamal stated, “These modifications will ensure strict adherence to targeted financial sanctions and improve clarity and conformity with the UAE’s comprehensive federal regulatory framework that combats money laundering, financing of terrorism, and proliferation.”

According to a record of detailed amendments, the new revisions contain provisions that explicitly define digital assets as one of the existing payment methods.

The document states that “payments made using virtual assets may comprise any portion or the entire sale/purchase amount.”

PwC, a professional network, identifies the UAE as one of the most progressive nations in adopting crypto regulations in its December 2023 report.

The UAE government has reportedly completed the development of stablecoin laws. It has already implemented an AML regulatory framework, a crypto regulatory framework, and the Travel Rule, according to an analysis by PwC.