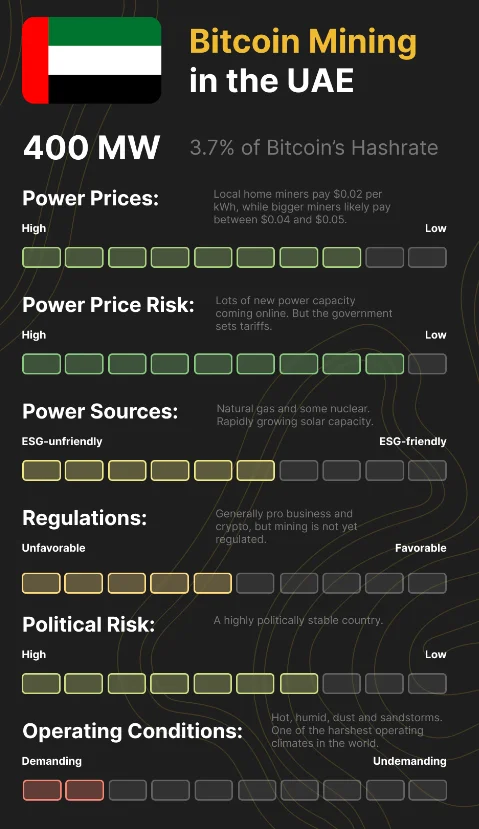

The United Arab Emirates (UAE) is progressively establishing itself as the region’s premier Bitcoin mining location, with a combined Bitcoin mining capacity of 400 megawatts, about 4% of Bitcon’s global hash rate.

With 30 free trade zones, the Middle East has established itself as a Web3-friendly destination for crypto-focused businesses, and by 2023, the region has also steadily ascended the Bitcoin mining hashrate chart.

In May of this year, Marathon Digital, a Bitcoin mining company, partnered with Zero Two, the digital asset branch of Abu Dhabi’s sovereign wealth fund, to launch Bitcoin mining in the United Arab Emirates. In Abu Dhabi, the joint venture established two mines with a total capacity of 250 megawatts.

Abu Dhabi has become a hub for all crypto mining activity in the United Arab Emirates due to its energy efficiency and position as the country’s commercial capital.

According to data provided by the Hashrate index, the United Arab Emirates presumably has a combined Bitcoin mining capacity of approximately 400 megawatts (MW), or 4% of the global Bitcoin hashrate.

The United States, China, Russia, and Kazakhstan are the top four countries in terms of Bitcoin hashrate share, but the United Arab Emirates could progressively ascend the ranks due to its resources.

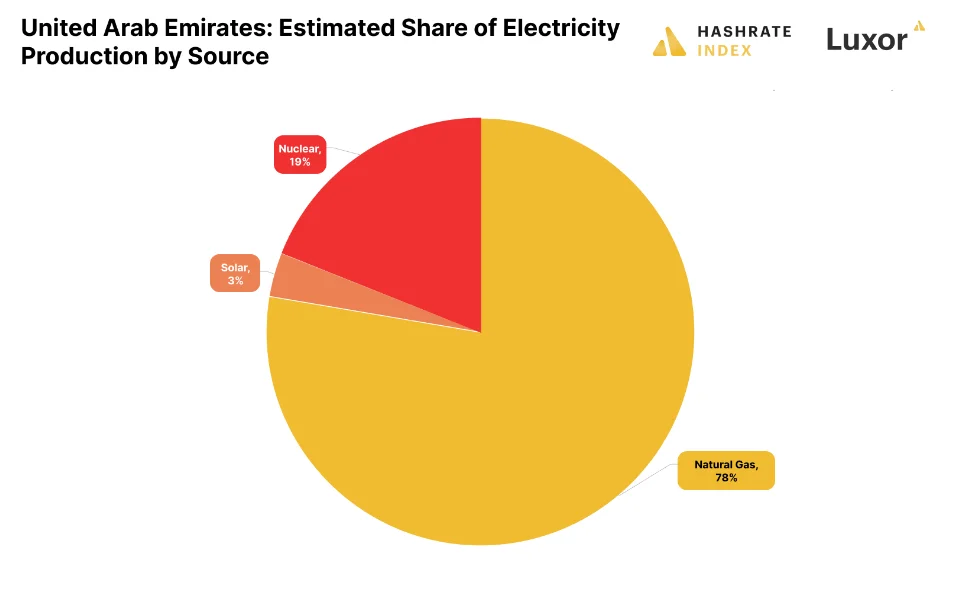

As a global energy market participant, UAE has shifted its focus from its oil and gas reserves to solar and nuclear energy. Historically, the majority of the nation’s electricity was generated by natural gas, but in recent years, nuclear and solar energy have rapidly gained market share.

The demand for electricity in UAE fluctuates substantially between the hottest and coolest months, resulting in a substantial loss of generated power.

In 2021, for instance, the combined power and desalination facilities of the UAE wasted 20 TWh, or approximately $600 million. Bitcoin miners could cover this void and reduce this electricity waste.

With Bitcoin mining focusing on using pure energy sources, the UAE could derive a significant portion of its energy over the next decade from nuclear and renewable sources.

Thus, the nation’s miners could use the surplus from these sources. The country’s zero-tax policy is cited as an additional benefit for miners.

This allows Bitcoin miners to register in one of the country’s over 30 free trade zones and circumvent corporate tax, VAT, and import duties.

Even though there are no specific laws governing the crypto mining industry, miners can operate in legal free trade zones, which could be a significant advantage over operating in the West.