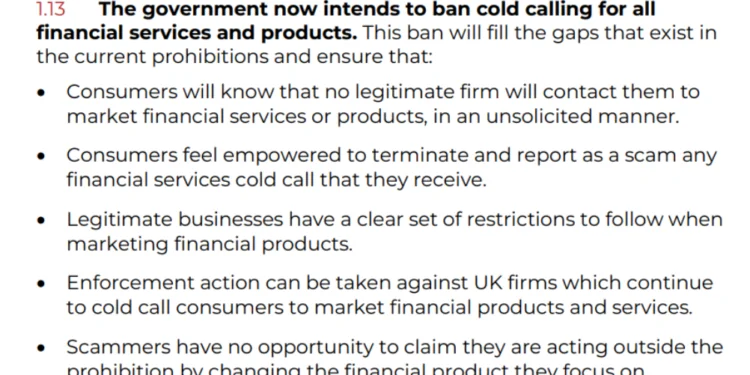

In preparation for a ban on finance and crypto-related cold calls in the UK, His Majesty’s Treasury has issued a consultation paper seeking evidence to determine the complete impact on businesses and the costs of implementing the ban.

To modernize its approach to intelligence-led policing, the U.K. government announced on May 3 an ambitious anti-fraud strategy that would add 400 new positions. The National Crime Agency estimates that fraud costs the country approximately £7 billion ($8.7 billion) annually.

The economic secretary of the Treasury, Andrew Griffith, condemned the increasing number of cold calls for financial services and products that frequently target the most vulnerable members of society, stating, “The government will not tolerate this behavior.”

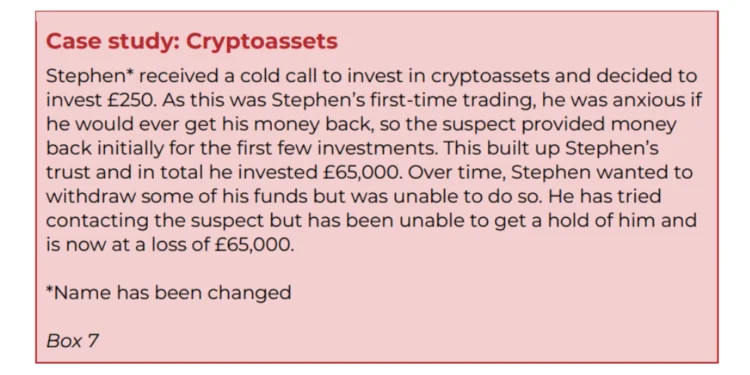

As shown above, the Treasury highlighted numerous instances in which cold calls led to investor losses, one of which involved cryptocurrencies. While the U.K. government has previously enacted numerous prohibitions and restrictions on cold calling, fraudsters frequently find ways to circumvent the law.

To impose a ban on all financial cold calls, the Treasury posed 19 questions to stakeholders to ensure optimum impact on fraudsters and minimal impact on businesses that rely heavily on cold calling prospects. Consultation ends on September 27, 2023.

Recently, the British government rejected an appeal to regulate cryptocurrencies as wagering.

“HM Treasury and the FCA [Financial Conduct Authority] will work with the industry to ensure crypto firms are made fully aware of the standards required for approval at the FSMA gateway. Further communications will be provided in due course to ensure standards for approval are clearly available to crypto firms operating in the UK.“

According to the government’s response, such an approach has the potential to utterly undermine the internationally accepted recommendations of international organizations and standard-setters.