Bitcoin and other cryptocurrency markets surged prior to inflation data and a predicted Santa Claus rally, as measured by US PCE inflation.

Today, the Bureau of Economic Analysis of the United States will release November’s personal consumption expenditures (PCE) inflation data. The annual PCE inflation is anticipated to decrease to 2.8% from 3.0% last month, with no monthly increase.

In addition, the Fed’s preferred inflation barometer, the Core PCE, is anticipated to increase 0.2% month-over-month, with the annual rate falling to 3.3%, its lowest level since 2021.

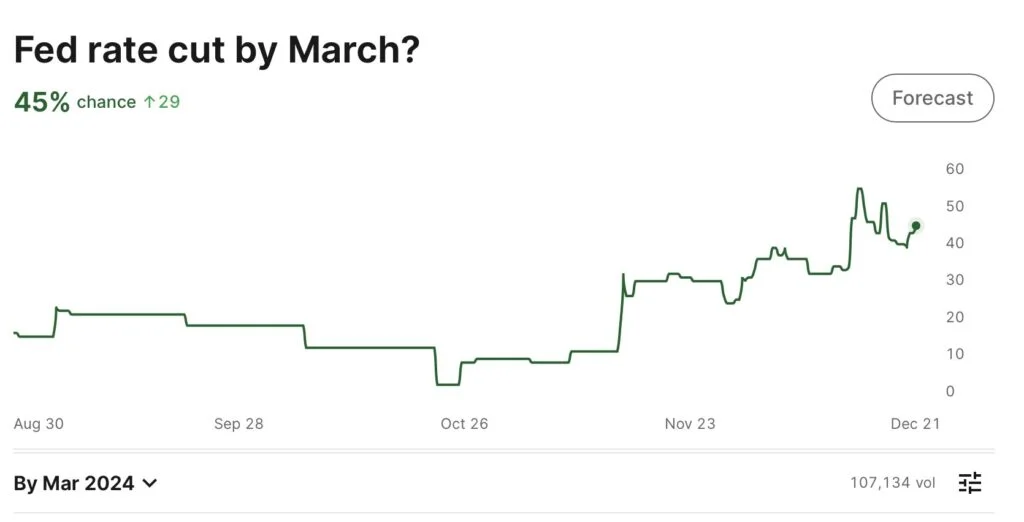

Most Wall Street estimates reflect the market consensus following the recent projection by Fed Chair Jerome Powell of three rate cuts in 2024. The current market probability for the Fed to initiate rate cuts in March is 45%. In addition, the CME FedWatch predicts that a 25 basis point rate cut in March is 71% probable.

The US Dollar Index (DXY) stabilized around 101.8 on Friday, so the monetary policy outlook remains dovish. However, the DXY is still poised to decline for the second consecutive week in anticipation of the Fed’s rate cuts.

In addition, the yield on 10-year US Treasury notes continues to decline, falling below 4% last week. It has increased marginally to 3.89 percent as investors await inflation data.

The reduction in interest rates by the Federal Reserve and other macroeconomic indicators validate an additional upswing in the value of Bitcoin and the cryptocurrency market. In anticipation of a significant bullish surge, spot Bitcoin ETF approval and Bitcoin halving factors are also considered by investors and traders.

Bitcoin and Cryptocurrency Market Rally

In anticipation of a Santa Claus rally, Bitcoin, Ethereum, and leading altcoins, including Solana (SOL), BNB, XRP, Cardano (ADA), Avalanche (AVAX), and others, are all higher today.

Since everyone is bullish, I tried to find some bearish factors but couldn't find any.

— Ki Young Ju (@ki_young_ju) December 22, 2023The price of Bitcoin has increased by 1% in the past twenty-four hours and is currently trading above $44,000, despite an 18% decline in trading volume. In the preceding twenty-four hours, the price of Bitcoin has fluctuated between $43,387 and $44,367.

However, profit harvesting may occur on the market due to Friday’s expiration. The options are scheduled to expire on 25,000 BTC at a notional value of $1.11 billion, with a put call ratio of 0.70 and a maximum pain point of $42,000.

A $490 million notional value of 217,000 ETH options is approaching its expiration; the put-call ratio is 0.60, and the maximum pain point is $2,200.