The Global Securities Regulators Conference features SEC Commissioner Mark Uyeda praising tokenization’s security, transparency, and ETF innovation.

In a recent update by FOX Business reporter Eleanor Terrett, U.S. Securities and Exchange Commission Commissioner Mark Uyeda emphasized the transformative potential of tokenization during his keynote speech at the Global Securities Regulators Conference.

Commissioner Uyeda highlighted the substantial benefits that tokenization provides for financial markets.

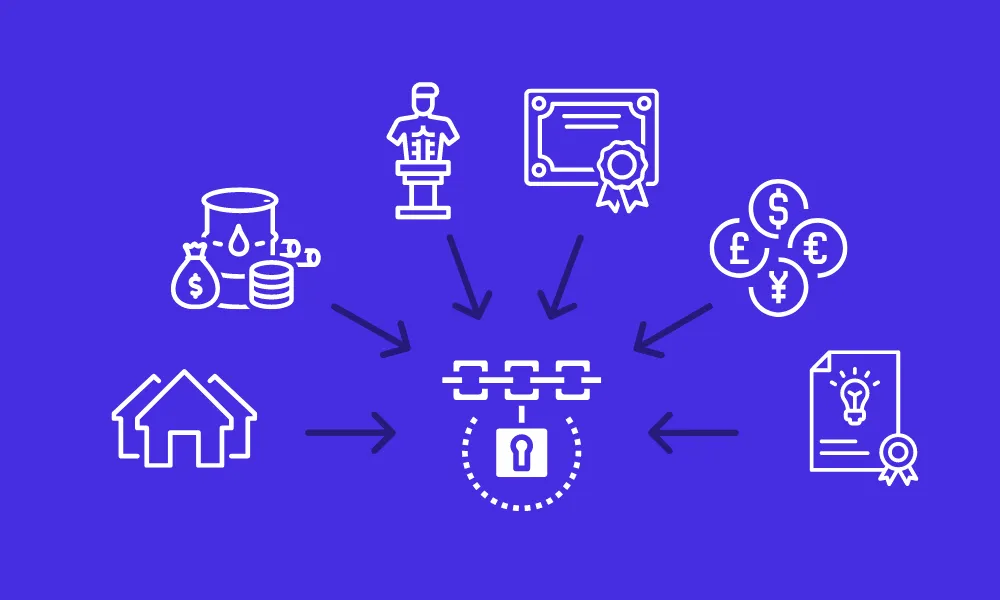

Tokenization improves security, transparency, and transaction immutability by converting traditional assets into digital tokens on blockchain networks.

This technological transition also significantly reduces transaction costs by streamlining processes and reducing reliance on intermediaries.

Tokenization’s Advantages and Commissioner Uyeda’s Insights

Speakers at the Global Securities Regulators Conference, including Commissioner Mark Uyeda, lauded the advantages of tokenization.

In his speech, he underscored its potential to enhance the security, transparency, and transactional immutability of financial transactions.

Furthermore, Commissioner Uyeda observed that tokenization has the potential to eliminate the necessity for numerous intermediaries, thereby reducing transactional costs, thereby streamlining processes.

This demonstrates a substantial shift in financial markets toward increased efficiency and accessibility.

The Future of ETFs and Innovations in Tokenization

As tokenized assets acquire prominence, there has been a growing sentiment among Exchange Traded Fund (ETF) experts and digital asset analysts that traditional ETFs may face extinction within the next two decades.

A recent panel featuring Niccole Bardoscia, Head of Digital Assets Trading at Intesa Sanpaolo, Senior Bloomberg ETF Analyst Eric Balchunas, and other industry experts provides evidence that discussions on this subject have gained momentum.

Additionally, recent developments underscore considerable progress in tokenization technology.

The digital assets sector’s leading player, Ledgible, has introduced a comprehensive tax solution that is specifically designed for tokenized real assets.

The initiative aims to ease the compliance burdens for businesses and organizations amid evolving federal regulations, such as the IRS Form 1099-DA, which requires detailed disclosures on digital asset transactions.