The US spot Bitcoin exchange-traded funds (ETFs) have witnessed nearly $243 million in outflows due to the increasing tensions in the Middle East

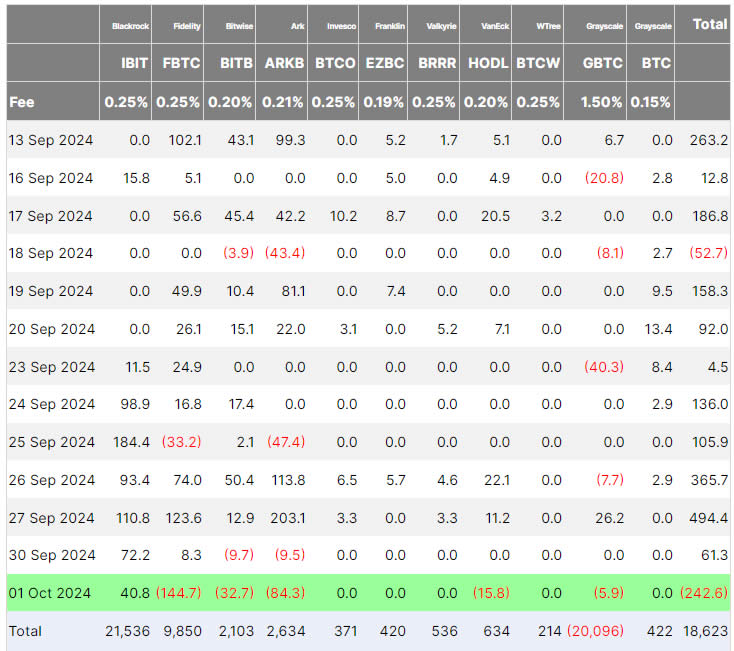

According to data from Farside Investors, the 11 US spot Bitcoin ETFs experienced an aggregate outflow of $242.6 million on Tuesday, October 1. This was the most significant outflow in nearly a month, following the $288 million exit from BTC ETFs on September 3.

Reversing an eight-consecutive trading day trend of inflows that peaked at $494 million on September 27, it was also the third-largest outflow day in the past five months.

On October 1, the Fidelity Wise Origin Bitcoin Fund experienced the maximum outflow, totaling $144.7 million. The ARK 21Shares Bitcoin ETF, which lost $84.3 million, followed that order.

The VanEck Bitcoin ETF experienced a loss of $15.8 million, the Grayscale Bitcoin Trust experienced a loss of $5.9 million, and the Bitwise Bitcoin ETF experienced a discharge of $32.7 million.

Invesco, Franklin, Valkyrie, WisdomTree, and Grayscale’s Mini Bitcoin Trust experienced no transactions.

The BlackRock iShares Bitcoin Trust was the sole entity to generate positive flows on the day, totaling $40.8 million. This marks the 15th consecutive day of non-outflow.

Spot In the aftermath of Iran’s missile strike on Israel on October 1, bitcoin prices plummeted by nearly $4,000. The asset experienced a two-week low of $60,315 before rebounding to $61,620 at the time of publication.

In the interim, the nine US spot Ether ETFs also experienced outflows on the day, with an aggregate of $48.6 million departing the products.

On October 1, Grayscale’s Ethereum Trust continued to experience a significant decline in value, with a loss of $26.6 million. The duo accounted for most of the $25 million loss in the Fidelity Ethereum Trust.