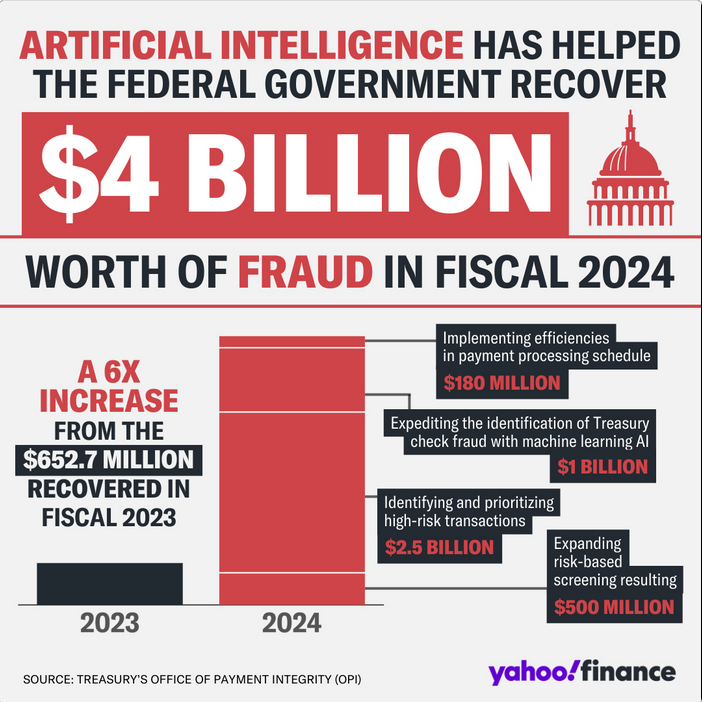

The U.S. Treasury used AI to recover $4 billion in fraud and improper payments in the 2024 fiscal year, a significant increase from $652.7 million recovered the previous year. The department began implementing machine learning AI in late 2022 to analyze large data sets and enhance fraud detection.

In the 2024 fiscal year, the United States Department of Treasury employed artificial intelligence to analyze data and recover $4 billion in “fraud and improper payments.”

The Treasury reported on Oct. 17 that its implementation of AI resulted in a nearly fourfold increase in fraud recovery compared to the previous fiscal year, during which it recovered $652.7 million.

In late 2022, the Treasury implemented machine learning AI, a technology adept at analyzing immense quantities of data and formulating predictions and decisions based on its acquired knowledge.

“It’s really been transformative,” said Treasury official Renata Miskell, who told CNN, “Leveraging data has upped our game in fraud detection and prevention.”

“Fraudsters are really good at hiding. They’re trying to secretly game the system. AI and leveraging data helps us find those hidden patterns and anomalies and work to prevent them.”

The agency “takes seriously our responsibility to serve as effective stewards of taxpayer money,” according to Deputy Secretary of the Treasury Wally Adeyemo.

According to Juniper Research, the cumulative cost of online payment fraud is anticipated to exceed $362 billion by 2028.

Currently, the Treasury processes approximately 1.4 billion payments annually, with a total value of $6.9 trillion. The Treasury announced in May that it would increase the utilization of AI to improve government regulatory and enforcement initiatives against financial offenses.

It is not the sole US department that is utilizing AI. The Internal Revenue Service announced in September 2023 that it had implemented artificial intelligence (AI) to identify tax cheaters by analyzing intricate and substantial returns from law firms and hedge funds.