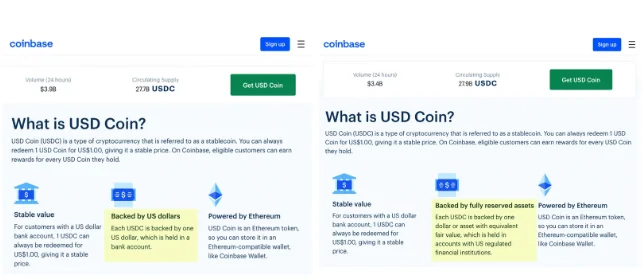

Contrary to the “backed by U.S. dollars in a bank account for USDC on Coinbase,” the website now states that USD Coin is “backed by fully reserved assets.”

USD Coin (USDC), Circle’s dollar-pegged stablecoin, appears to have lost one of its most significant competitive advantages over Tether (USDT) (USDT).

Following an audit that revealed that not all of USDC’s reserves were stored in cash, major crypto exchange Coinbase made a significant update to the USD Coin page on its website.

This is in direct opposition to the previous declaration that “each USDC is backed by one US dollar held in a bank account.”

When visiting the USD Coin webpage on Coinbase, visitors are now met with a statement stating that USDC is “backed by 100% reserved assets.” The new claim is as follows:

USD Coin is the eighth-largest cryptocurrency, having a market capitalization of more than $28 billion. According to the latest Consolidated Reserves Report, USDC is the second-largest stablecoin after Tether, which has almost $63 billion in total assets.

USDC has grown in popularity as a stablecoin entirely backed by US dollars since its debut. Tether, on the other hand, has had multiple run-ins with regulators due to unreported commercial paper accounting for about half of USDT’s total reserves.

However, an examination by Grant Horton, a multi-national tax consultancy firm, revealed that 61 percent of USDC’s reserves were maintained in cash and cash equivalents, with only 9% retained in commercial paper.

Cash is defined as deposits at banks and Government Obligation Money Market Funds, while cash equivalents are securities with an original maturity of less than or equal to 90 days, according to the audit report.

The USDC reserves, according to the article, comprise Yankee CDs and US Treasuries, but are not “fully backed by US dollar deposited in a bank account.”

The phrasing for the USD Coin on the Coinbase website was updated the day the mainstream media contacted Coinbase about the claim and related marketing material, according to Bloomberg.

Andrew Schmitt, a spokesman for Coinbase, reminded reporters that each USDC is backed by one dollar or an asset of comparable fair value:

“Users can always redeem 1 USD Coin for US$1.00. We have added additional detail to our website for customers to understand more about USDC reserves.”

Circle, which manages USDC alongside Coinbase as part of The Centre consortium, recently revealed aspirations to become the first full-service national digital currency bank in the United States.

Circle CEO Jeremy Allaire stated that the organization is open to operating under the oversight and risk management needs of regulators.

He claimed that USDC will grow to “hundreds of billions of dollars in circulation” as part of the announcement, continuing to support high-trust economic activity and becoming a popular instrument in financial services and online commerce applications.