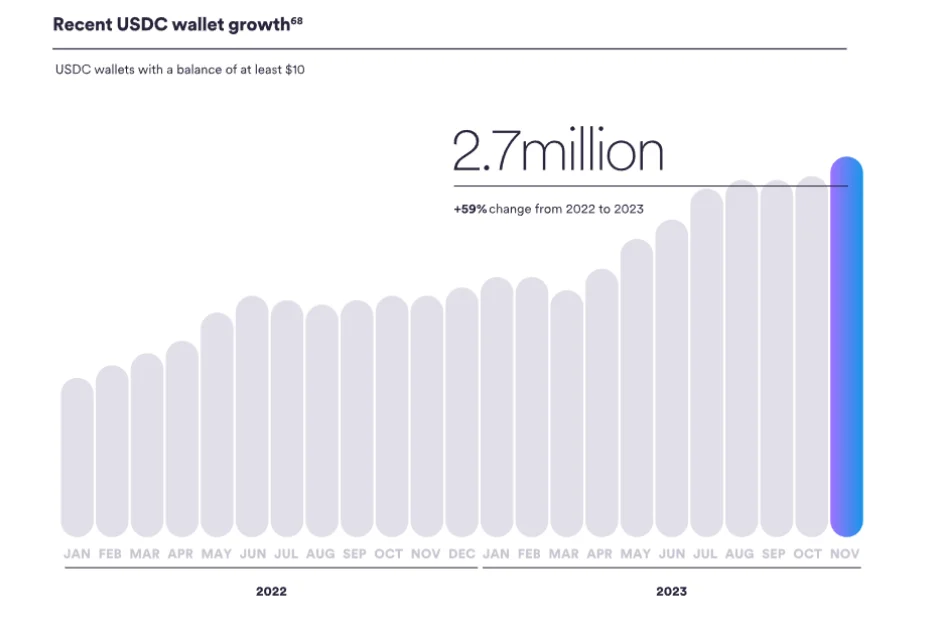

According to stablecoin issuer Circle, on January 15, 2023, the number of wallets holding at least $10 worth of USD Coin increased by 59%.

This expansion occurred notwithstanding the UDC’s circulating supply suffering a $20 billion loss, suggesting that the coin may have attracted consumers despite declining market capitalization.

With its title, “State of the USDC Economy,” the report provided a comprehensive synopsis of the present utilization of USDC. Circle stated in its report that the coin’s circulating supply decreased by about 44% in the first eleven months of 2023, from $45 billion to $25 billion.

“[R]ising interest rates, regulatory crackdowns, bankruptcies, and outright fraud” in cryptocurrencies, according to Circle, caused users to withdraw funds from the ecosystem and invest in traditional markets.

Rising interest rates have enticed investors to more conventional markets, and they cited the “opportunity costs of holding USDC” as a particularly significant factor in this decline.

The report asserts that additional indicators indicate an increase in USDC acceptability despite this contraction. With the minting or burning of more than $197 billion worth of USDC throughout the year, the coin served as “the preeminent bridge between the digital asset economy and traditional finance.” Additionally, the number of wallets containing USDC worth more than $10 increased by 59% from 2022 to 2023, surpassing 2.7 million.

The year 2023 was turbulent for USDC. It experienced a transient loss of its peg in March due to a fleeting yet turbulent banking crisis in the United States. Nevertheless, the Federal Reserve swiftly restored its rate after intervening, reimbursing numerous failed institutions’ depositors.

Circle partnered with Yellow Card to expand USDC usage in Africa and filed for an initial public offering during the first two weeks of 2024 in an effort to raise capital for the growth of the USDC ecosystem.