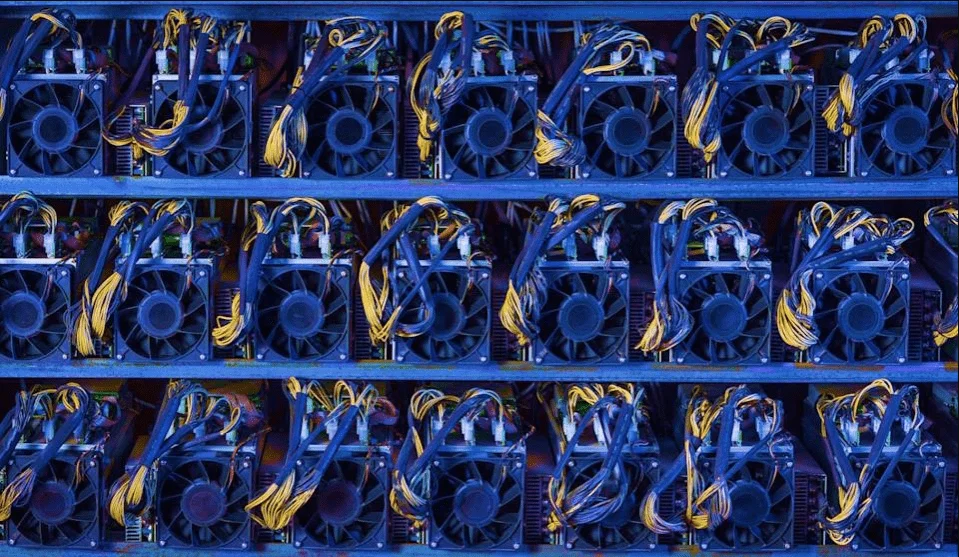

Viridi’s new exchange-traded fund (ETF) will invest in firms that provide green crypto mining infrastructure.

There has been the creation of an exchange-traded fund in the United States that is focused on more environmentally friendly cryptocurrency mining activities and infrastructure.

The new Viridi Cleaner Energy Crypto-Mining and Semiconductor ETF, which trades under the symbol ‘RIGZ’ on the New York Stock Exchange, began trading on Tuesday, July 20, under the symbol ‘RIGZ.

In addition, the product is part of a rising push to attract mainstream investors who are interested in concerns like as environmental, social, and governance (ESG).

According to Law360, Viridi Funds, the company that developed the new investment product, noted that the fund also invests in crypto mining infrastructure businesses as well as semiconductor companies such as Samsung Electronics, Nvidia Corp., and Advanced Micro Devices, among other companies.

Wes Fulford, the CEO of Viridi and a former CEO of Bitfarms, stated that the fund will be focused on renewable energy screening.

In his opinion, the exodus of cryptocurrency mining from China to North America was a positive development, as more than half of crypto mining companies in the region are now powered by sustainable energy sources:

“Obviously, with what’s happened in China the power used is dramatically lower than it was at the beginning of June. And it’s also providing the added benefit that more computing power is finding its way to other jurisdictions, sort of decentralizing the network even further, which adds to the security.”

Bitcoin and Ethereum, according to Fulford, meet the letters “S” and “G” from the ESG principles very effectively; the newly created EFT will address the letter “E” from the principles as well. It is still early in the development of this nascent asset class, according to him, and there has yet to be a “tidal wave of institutional flows.”

CNBC reports that new data suggests that Bitcoin mining is not nearly as harmful to the environment as it once was, largely because older, less efficient equipment have been shut down in China and activities have been relocated to more ecologically friendly regions.

After dropping from fifth to second position, North America now accounts for approximately 17 percent of all worldwide Bitcoin mining activity.

It was claimed on July 18 by Cointelegraph that huge crypto mining operations situated in the United States will reap significant benefits from rising market share and hash rate dominance in the coming years.

It singled out Riot Blockchain, Marathon, Hut 8, and Hive Blockchain as the companies that could reap the greatest benefits from China’s massive mining influx.