Bitcoin (BTC), the world’s largest cryptocurrency, has been showing increased volatility around $40,000 levels. The BTC price has corrected 2.85% as of press time and is currently trading at $40,546 with a market cap of $771 billion.

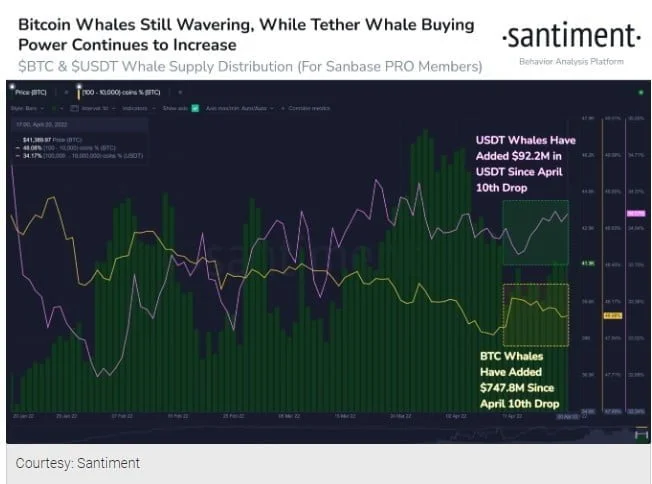

Whales have been accumulating during the recent price dip below $40,000, according to Santiment, and on-chain data sources. It stated:

Bitcoin whale addresses holding 100 to 10k $BTC have collectively accumulated 18,104 more $BTC since the April 10th price drop below $40k. However, their holdings are still down substantially since October. Meanwhile, $USDT buying power looks promising.

Crypto analyst Ali Martinez argues based on current technical chart levels. “Bitcoin needs to get back above $40,800 for a chance to rebound to $45,000 or even $50,000.” Be aware a decisive daily close below $39,400-$38,500 can invalidate the optimistic outlook and result in a retracement to $35,000 or even $30,000 for $BTC.”

Bitcoin, which was trading close to $43,000 earlier on Thursday, has lost steam after remarks from the Federal Reserve. The United States central bank has been considering a tighter monetary policy, which would act as a headwind for risk-on assets such as stocks and cryptocurrency.

The Fed has hinted at raising interest rates by 50 basis points at the next FOMC meeting in May.

The Altcoin Market’s Movement

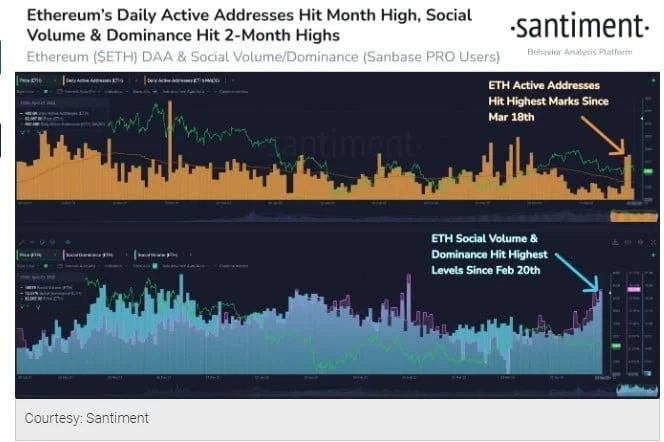

The broader cryptocurrency market, like Bitcoin, has been under pressure. Ethereum (ETH), the world’s second-largest cryptocurrency, is down 3% but still holding at its key support levels of $3,000. Santiment, an on-chain data supplier, says:

Ethereum’s address activity really picked up this week, with Wednesday’s 592k addresses being the highest number of unique interactions in over a month. Meanwhile, social discussion for $ETH has hit its highest levels in over two months.

All of the top ten altcoins, on the other hand, have corrected anywhere between 3-5 percent. Recently, the altcoin market has witnessed active trading, with altcoins like Terra (LUNA) showing rapid movements.