Berkshire Hathaway, led by Warren Buffett, has sold a chunk of its Visa and Mastercard stock and expanded its stake in Nubank, Brazil‘s largest fintech bank.

The industrial conglomerate reported in a securities filing late Feb. 14 that it had purchased $1 billion in Nubank Class A stock in Q4/2021. On the other side, it sold $1.8 billion in Visa stock and $1.3 billion in Mastercard stock, indicating a shift away from credit companies in favour of fintech rivals.

The so-called “Oracle of Omaha,” Warren Buffett, is known for his conservative approach to investment, particularly in the hottest sectors of the market, such as fintech.

The seasoned investor has previously dismissed developing decentralized financial solutions such as Bitcoin (BTC), dismissing it as an asset that “creates nothing.”

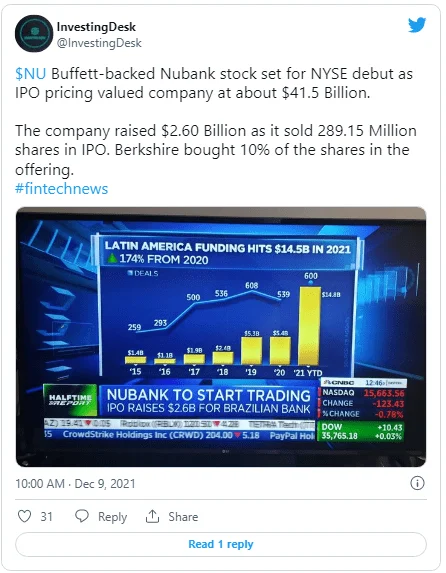

Berkshire Hathaway’s current investment in Nubank, on the other hand, demonstrates Buffett’s recent softening toward fintech. In July 2021, the company invested $500 million in the venture. After Nubank debuted on the New York Stock Exchange in December 2021, it earned $150 million on the investment (NYSE).

Buffett has indicated no intention of selling his Nubank stock thus yet.

Warren Buffett is directly and indirectly involed with Bitcoin

Buffett’s further investment in Nubank demonstrates his understanding of the fintech sector’s fundamental topic, the digitization of financial services, as well as his willingness to work with cryptocurrency firms.

In more detail, starting June 2021, Easynvest, a trading platform acquired by Nubank in September 2020, has been actively marketing a Bitcoin exchange-traded fund (ETF). The ETF, dubbed QBTC11, is backed by QR Asset Management and listed on the B3 stock exchange, Brazil’s second-oldest stock exchange.

Despite his beliefs that Bitcoin is “rat poison squared,” it appears that Nubank, which remains exposed to the developing crypto industry through Easynvest, could exploit the additional revenue prospects to benefit its top investor, Warren Buffett.

In 2021, this is mostly due to the growth of crypto-related investment products. According to Bloomberg Intelligence statistics, their numbers more than quadrupled in the year, going from 35 to 80, while the total value of the assets they held increased to $63 billion from $24 billion at the start of 2021.

As Bitcoin investment vehicles grow more widespread, Emily Portney, chief financial officer of Bank of New York Mellon Corp., another firm in Buffett’s investment portfolio, warned that digital assets might become a “substantial source of revenue” for investment banking firms.