The crypto capital market is a field where you can earn large sums of money in the shortest period due to the high level of price volatility. The supply of digital assets does not depend on the government of banks.

The emission of every specific crypto asset is established in its algorithm, so no one can print additional currencies or cut the supply as banks do with fiat money.

The cryptocurrency market has the following characteristics:

- price;

- trade volume;

- capitalization.

While many people think the price is the main indicator to judge crypto assets, in fact, capitalization is what really matters.

What is Market Cap Crypto?

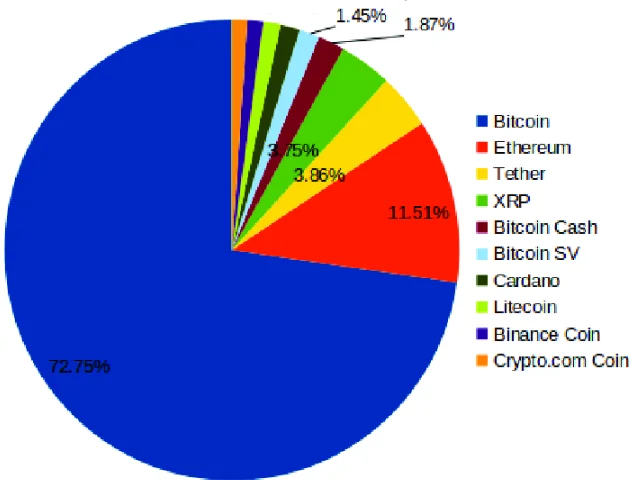

Generally, capitalization snows the level of dominance of an asset among its competitors. Crypto capitalization shows how valuable and attractive this or that coin is for investors.

The top cap crypto assets are Bitcoin and Ethereum, which have the largest indicator. To calculate it, multiply the number of coins in circulation globally by the present value. So, crypto assets that are released in small amounts (limited emission) have good chances to increase their capitalization if their price grows.

Price plays a crucial role in capitalization. So when you look at a digital asset, check out cap and price, as well as supply. Better to buy coins with a limited supply.

There is also the term “diluted market cap”. It is applied when all the coins supply is already in circulation.

All crypto assets are segmented into the following groups by market cap:

- Mega cap

- Large

- Middle cap

- Small.

It is wrong to think that only mega and large-cap assets deserve attention. Being more sensitive to market trends, middleman small-cap assets are more volatile and have bigger chances of increasing in price.

So when you plan crypto investments, do not forget about diversification. To learn more about the cryptocurrencies market and stay up to the latest news, welcome to the WhiteBIT blog.