This article basically contains information on Bitcoin the first cryptocurrency ever invented and will serve as an eye-opener for beginners who want to know more and invest in the cryptocurrency.

In 2008, a white paper authored by a pseudonymous person gave birth to the notion of Bitcoin. Bitcoin (BTC) first appeared on the internet in 2009.

In its early days, the asset was more of a currency, but it grew in popularity and utility over time.

Bitcoin’s price climbed over time, eventually reaching more than $50,000 per coin, despite the fact that it began off absolutely worthless in US currency terms.

In the crypto business, the asset is now frequently considered as a wealth storage vehicle rather than a currency.

Bitcoin is the only cryptocurrency that has its own blockchain. When understanding how the Bitcoin network works, it’s vital to remember that the system was designed to address a specific set of issues relating to the role of trust in online trading.

Bitcoin is a self-contained public key cryptosystem that allows peers to exchange digital currency through a series of digitally signed transactions rather than messages.

A Bitcoin transaction’s basic process flow is identical to that of a series of encrypted messages shown in a diagram of public key cryptography and digital signatures. “An electronic coin is a chain of digital signatures,” Satoshi Nakamoto, Bitcoin’s creator, says in the white paper.

This is the fundamental method of creating a digital money, which has been employed in a variety of projects since the 1980s.

Remember that the primary flaw in these early digital cash systems was their reliance on trusted third parties to administer the central mint and avoid double-spending.

Satoshi had to design a means to overcome the double-spend problem without relying on trusted authority operating centralized servers in order to create a fully peer-to-peer, or P2P, transaction system. This is the part where things start to get interesting…

Introducing the blockchain technology

Satoshi discovered that in order for a peer-to-peer transaction system to work, all transactions must be auditable by the public via a shared database, or ledger, that contains the history of all previous transactions.

Satoshi’s answer was to create a distributed P2P “timestamp server” that could be used by everyone on the network. This timestamp server operates by continuously hashing blocks of data (messages, transactions, and so on), which are then timestamped and widely distributed around the network.

Each block’s timestamp refers to the previous block’s hash, forming a chain of cryptographically secure, verifiable data that grows in security with each consecutive block. The term “blockchain” was coined by Satoshi to describe this distributed timestamp server.

The timestamp server has traditionally been a centralized system maintained by a trusted authority, such as a bank or other business. Previous attempts at digital currency, such as eCash and E-gold, have failed in this area.

Even if a company employs the most advanced and secure technology available, insider fraud is always a possibility. So, how do we protect a distributed timestamp server across a peer network? This is where Satoshi’s creativity shines through.

Mining for proof-of-work and the Nakamoto consensus

There must be a means to prevent Sybil attacks (where one entity fabricates several identities to infiltrate a network) and assure consensus when nodes freely join and leave the network for this P2P transaction system to stay secure against malicious attacks and malfunctioning nodes.

To address these concerns, Satoshi created a proof-of-work (PoW) method based on Adam Back’s Hashcash, which was also used in Bitcoin forerunners B-money and Bit Gold but with significant changes.

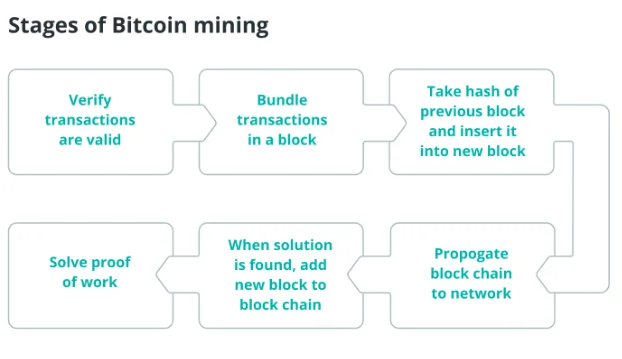

Mining is the process through which the network continuously validates broadcasted transactions and records them in the distributed ledger in the form of linked “blocks” of transaction data, producing a cryptographically secure, verifiable history of transactions over time.

This is where Bitcoin’s design differs from past digital currency iterations.

Unlike previous proof-of-work tokens, which were issued and valued based on the amount of work required to create them or some other set of rules, the Bitcoin protocol rewards miners who solve a proof-of-work with a predetermined amount of Bitcoin at predetermined intervals, resulting in an autonomous, automated mint for BTC, whose value is intrinsic to the system rather than dependent on some other metric or resource.

The protocol currency and accumulated transaction fees are rewarded for time, energy, and resources put into securing the network and validating transactions, providing an economic incentive for miners to remain good actors even if certain groups obtain a majority of hashing power and thus become capable of compromising the entire network.

Satoshi not only used the proof-of-work technique to create a currency, but he also used it to achieve consensus, as the longest chain of confirmed blocks is always the leader. Nakamoto consensus has been coined as a result of this.

UTXOs: A Bitcoin Transaction’s Anatomy

“What is a Bitcoin?” you might wonder. Given what has been said thus far, this question appears to be straightforward, yet it is not. What is this asset that we’re trading on this peer-to-peer global financial network? What does the number signify when looking at the BTC balance in a digital wallet?

As we’ve seen, the Bitcoin network’s method of facilitating value transfer isn’t as straightforward as Alice sending a single transaction to Bob’s account and a central server updating their respective balances. Looking under the hood of Bitcoin reveals what it really is…

Multiple unspent transaction outputs, or UTXOs, of prior transactions received in the past that can be spent in the future make up the Bitcoin total shown in one’s public key address, or wallet. Remember how Satoshi defined an electronic money as a “chain of digital signatures.”

The entire value of many chains of ownership realized via digitally signed transactions is the total amount of Bitcoin visible and accessible at a given address.

UTXOs are similar to pocket money in that they are made up of numerous value units such as dollars, quarters, dimes, nickels, pennies, and so on. Similarly, when one performs a Bitcoin transaction, these outputs become inputs in a new transaction that the sender has approved.

The sender will get “change” in the form of additional UTXOs to settle the balance by the time the transaction is confirmed (minus the transaction fees that incentivize miners to validate the transaction into the next block).

Apart from the network fees and the lack of pre-defined units of value, Bitcoin UTXOs are very similar to cash and coins. In a nutshell, UTXOs are an electronic money abstraction.

The UTXO design of Bitcoin transactions is a peer-to-peer application of Grigg’s triple-entry accounting, with the blockchain acting as a neutral method for documenting ownership chains for the digital asset.

The UTXO model is not without flaws. For one thing, the impossibility of a user to change their UTXO set outside of a transaction context allows for more ownership tracing.

While the addresses are represented as public key addresses, blockchain analytics has progressed to the point that it can now accurately map the flow of transactions around an address, potentially tying its ownership to a specific service account or other person.

Second, if the UTXO set grows larger and larger as the blockchain grows in size, data efficiency may become an issue. The optimization of UTXOs is at the heart of much of the development effort aimed at making Bitcoin transactions more efficient.

The monetary policy of Bitcoin

Much of the discussion surrounding Bitcoin portrays it as a ground-breaking technology that aims to separate money and government. Bitcoin, on the other hand, is evolutionary in the history of money. Money has always been a technological and social phenomenon created by and for people, so it’s only natural that it would receive a systemic upgrade as part of a global cultural trend toward increased digitization.

Before looking at Satoshi’s answer, it’s crucial to understand how and why the legacy monetary system works the way it does.

Current monetary systems are “fiat,” meaning they are backed by the state’s sovereign authority through arbitrary edict. Because the state mandates its use as a medium of trade, a store of value, and a unit of account — the three properties of money — such currencies have value.

The state demands that taxes be paid in the national currency, which is the most visible indication of its enforcement.

Governments and empires stamped the face of the current ruler of the territory into the hard metal currency hundreds of years ago, establishing a link between state authorities and money.

Fiat money is now printed pieces of paper issued by a central mint under the supervision of the state department. Rather than being backed by any commodity, this money is backed by the government.

The US used to be on a gold standard, with banknotes backed by and redeemable for precious metal reserves, but during the Great Depression, capital flight to a safe haven in the form of gold drove the government to decouple the dollar from its underlying commodity.

Gold, on the other hand, has its restrictions. The structural difficulties of a gold-based monetary system would have ultimately led to the state progressively abstracting the relationship to the underlying resource, to the point where, in a way, the scaffolding would have become the building.

Fiat currency can be viewed as a technical response to the need to simplify money administration on a large scale.

People place a lot of faith and responsibility in the government to properly monitor the mint and avoid economic instability because it can issue pieces of paper backed by nothing but the power it has. Inflation happens when a government prints too much money, depreciating the value of money in the economy dramatically.

Hyperinflation has resulted from catastrophic mismanagement of the money supply by several governments. It’s not uncommon for the price of the dollar to swing by exponential amounts in such volatile settings, with the currency becoming more valuable as kindling or paper mache than a reliable medium of commerce.

Is the state now a boogeyman, enslaving the people to arbitrary financial systems from which they have no control? There are probably many Bitcoin supporters who would agree with that assertion, but one should consider the bigger picture.

People committed to the unwritten social compact behind the money, entrusting the state to manage the intricacies of such a system, which is why state-managed currencies became popular. This question of trust is critical to comprehending Bitcoin’s place in the history of money.

Hasu, a pseudonymous cryptocurrency researcher, wrote about Bitcoin’s social contract, claiming that Satoshi’s innovation was in combining an automated, updated social contract with a protocol layer that successfully enforces it. Hasu underlines the four essential rules of this updated money contract, as described by Eric Lombrozo, in his essay:

- Only the owner of a coin can produce the signature to spend it (confiscation resistance)

- Anyone can transact and store value in Bitcoin without permission (censorship resistance)

- There will only be 21 million Bitcoin, issued on a predictable schedule (inflation resistance)

- All users should be able to verify the rules of Bitcoin (counterfeit resistance)

The flaws that plagued earlier money systems are avoided in this system via a predictable, globally accessible software protocol that distributes trust and power outside of a single institution and into an open network of users.

This radical experiment in monetary policy and value exchange is still ongoing, so we’ll have to wait and see if this social contract, and the technology that enforces it, can withstand the obstacles that have plagued previous and current systems.

Bitcoin’s distinguishing features

Bitcoin is not a single entity, as you may have discovered while reading this article. It’s a complex system that may be viewed from a variety of perspectives, including computer science, distributed computing, finance, money, record-keeping, and so on.

The next sections will look at the Bitcoin network’s distinctive qualities, as well as the design philosophy underlying them and the issues the network faces in maintaining these properties.

Duality of network tokens

The distinction between the Bitcoin network and the Bitcoin money may be confusing to novices to Bitcoin. After all, the Bitcoin blockchain’s original purpose was to support a digital cash system, and it is this use in particular that has become a worldwide phenomenon.

While they are closely intertwined by design, distinguishing the two can assist provide a more holistic, whole-systems perspective.

The Bitcoin network is a multistakeholder, open-source system that serves as a worldwide settlement layer and accounting system for borderless, peer-to-peer transactions.

Miners, developers, merchants/companies, and users are all stakeholders, and they are all working together to offer security and uptime to the network, improve the protocol, construct services on the network, and, finally, use the network.

Miners are nodes that confirm transactions broadcast to the network and store them on a cryptographically safe and verifiable distributed ledger of transaction data.

This computationally intensive procedure not only protects the network from numerous assaults, but also acts as the Bitcoin currency minting process in the form of block rewards.

Bitcoin Core is an open-source software project that has been developed by a number of different teams and individuals all over the world. Some of these programmers are paid members of established teams, while others contribute to the protocol on a volunteer basis.

The Request for Comments proposal system that developed the protocols that make up the internet today is mirrored in the Bitcoin Core development process. Anyone can submit a Bitcoin Improvement Proposal to the open-source community for feedback. If there is widespread social agreement that a proposal should be implemented, the program will be updated at a later date.

Many companies have formed to give services to Bitcoin’s users, just as many have formed to provide services to the bundle of protocols we call the internet throughout the years.

Wallets that allow users to transact Bitcoin through an intuitive user interface, exchanges that allow users to swap Bitcoin for fiat and other cryptocurrencies, Bitcoin-based escrow systems for P2P commerce, secure document timestamping, and more are examples of these services.

Asset custody, non-repudiation, data immutability, and other issues that businesses that use Bitcoin in their technical stack confront are frequently unique hurdles and hazards that traditional IT enterprises do not encounter.

Users include everyone from the most die-hard cypherpunk hodler to the day trader to the beginner who just wants to see what the hoopla is all about. Because all of these actors are crucial to Bitcoin’s success, it’s critical that the incentives are aligned across the ecosystem. In this case, a cryptocurrency is really beneficial.

The fact that Bitcoin is a financial infrastructure in the form of globally accessible commons established, maintained, and used by a network of peers is part of its innovation. Because it is also an autonomous network that mints the Bitcoin digital money, the system’s economic incentives allow it to evolve and persist in the future.

Decentralization

When it comes to Bitcoin and other crypto/blockchain networks, decentralization isn’t a one-size-fits-all approach. It is, in many ways, an abstraction of an ideal state of affairs: a future in which the vital systems that sustain our lives, such as the existing financial system, are maintained by a resilient, capable network of peers rather by trusted administrators. It is, for many, the entire idea of systems like Bitcoin and other blockchains – their raison d’être.

Despite its abstract nature, decentralization has become a fundamental aspect of the bitcoin industry’s messaging and is frequently one of the first things a novice finds while exploring the area. Yet, strangely or appropriately, there is a lack of clarity and consensus in vision and practice about what the phrase actually implies.

For the purposes of this guide, we’ll dissect the complicated concept briefly in order to provide some context for Bitcoin newbies.

To begin, it’s critical to recognize that decentralization involves both technological and social components, which are frequently intertwined. A thorough examination of Bitcoin’s decentralization, for example, would have to consider the entire protocol stack from top to bottom, including the various subsystems within it, how the network adapts over time, the distribution of power among the various stakeholders, and the influence of external forces such as corporations and governments.

Given that the network has yet to be compromised since its inception, evidence suggests that Bitcoin is technically decentralized from a fundamental design standpoint. In terms of social resilience, the network is quite resistant to excessive internal or external impact.

While many actors have attempted to use the network to gain power or influence for their personal gain throughout the years, the system has remained credible neutral and durable.

Externally, if a government or ad hoc agency truly intended to shut down the network, it would not be impossible to trace the energy usage of mining operations and prohibit the use of Bitcoin in trade. The currency’s viability as a widely adopted monetary system would be jeopardized without a strong network of stewards to maintain it and the inability to utilize it as intended.

Despite the skeptics and the hypotheticals, Bitcoin has survived. Despite the fact that China has prohibited Bitcoin at least five times, the country accounts for a significant portion of the network’s hashing power. Bitcoin has died roughly 400 times, according to 99Bitcoin’s curated list of Bitcoin obituaries.

A widely acknowledged paradigm for assessing the decentralization of these unique techno-social systems has yet to emerge. This is likely to change in the future, not only for the advantage of having industry standards, but also to protect Bitcoin and other value networks from evolving legislative frameworks.

The continued decentralization of Bitcoin is vital for it to survive in any meaningful way, whether in recognition of or in spite of the world’s regulatory institutions.

Immutability

Satoshi concluded that nonrepudiable — i.e., nonreversible — payments had to be a basic component of the protocol in order to construct a peer-to-peer transaction system that did not rely on trusted third parties.

While such tools are part of the established financial system to address inter-party disputes or repair human or technical faults, the administrative capacity to change a transaction record will surely be exploited. To be functional and resistant to seizure, censorship, and fabrication, a digital money system without central authorities must be immutable.

Bitcoin’s immutability is achieved through a continuous proof-of-work consensus mechanism. Every consecutive block increases the confidence and validity of a transaction by exponential orders of magnitude once it has been processed by miners and appended to the blockchain data structure.

Cryptocurrency pioneer Nick Szabo compares the process to “a fly trapped in amber” in a conversation with Tim Ferriss, with the fly representing the transaction and the amber representing the collected proof-of-work. Bitcoin relies heavily on the link between time and transactional assurance.

While a new block is validated typically every 10 minutes, it is recommended that a transaction be fully confirmed after waiting up to six extra block cycles. This is often referred to as “finality.”

Security

“When we can secure the most important functionality of a financial network by computer science rather than by the traditional accountants, regulators, investigators, police, and lawyers, we go from a system that is manual, local, and of inconsistent security to one that is automated, global, and much more secure.”

— Nick Szabo, “Money, Blockchains, and Social Scalability”

Large-scale information and communication systems require a high level of security. The internet was designed from the start to be a communications network that could endure nuclear war. Bitcoin was built to operate in an antagonistic, unstable environment, despite the geopolitical background and underlying purpose being entirely different.

Decades of study and development into safeguarding the integrity and uptime of distributed systems inspired the network’s security paradigm.

Because there are no central administrators who can be trusted to right the ship, truly peer-to-peer computer systems pose particular challenges and risks in this field. Because the Bitcoin network allows a full monetary system with enormous value at stake, robust security is critical.

Bitcoin’s proof-of-work consensus algorithm protects the network from Sybil assaults (the creation of a large number of bogus accounts to swarm and overload the network) and sporadic or defective nodes (due to power outages or poor maintenance), resulting in a fault-tolerant Byzantine system.

The ability of a distributed system to sustain consensus in the face of poor information, partial network failure, or even hostile agents is known as byzantine fault tolerance.

The name refers to a scenario proposed by Leslie Lamport, Robert Shostak, and Marshall Pease in their landmark article “The Byzantine Generals Problem,” in which they use the example of a number of army generals cooperating in a battlefield context with restricted communication options.

How can the generals agree and execute a shared strategy with poor information and situational awareness, or even trust that another general will not turn traitor and single-handedly alter the tide of battle? Their conclusion: The attempt will not be self-defeating as long as at least two-thirds of the generals are loyal.

Bitcoin’s decentralization is enabled by a clever alignment of incentives among the network’s stakeholders: miners, developers, merchants, and users, as previously mentioned.

Simply said, any determined attempt to capture the network or rearrange the chain will cause the currency’s value to drop, rendering any intended advantage useless.

The expense of being a lousy actor far outweighs any potential benefit. As a result, it is in everyone’s best interest to simply follow the rules and work together to advance the Bitcoin ecosystem’s maturation and adoption.

The Bitcoin network has never been compromised at the base layer and has had practically 0% downtime since its introduction in January 2009, making it one of the most secure computer systems on the planet.

Anonymity/pseudonymity

One of Bitcoin’s most distinguishing features is that it abandons the account-based paradigm of identifying network users in favor of a public key cryptosystem in which entities are represented by cryptographic key pairs rather than given names. Bitcoin addresses are alphanumeric strings of 26 to 35 characters that begin with either 1, 3 or bc1. While there are services that allow users to map names to their public key addresses to make them more user-friendly, engaging with these cryptographic key pairs is part of the Bitcoin user experience by default.

Cryptographic keys are critical to online privacy and have long been a foundational component of privacy-preserving systems ranging from digital currency to email and routing protocols like Tor.

They’re everywhere in the plethora of information and communication technologies that pervade our lives, yet many systems abstract the experience by having the keys controlled and coordinated by trusted third parties rather than by users directly.

The cypherpunks greatly impacted this emphasis on cryptographic keys as a primitive for private online conversations and transactions.

Timothy May’s manifesto, in particular, emphasizes the revolutionary potential of allowing individuals to transact and message anonymously on communications networks using only digital signatures as a means of verification — no identities required.

Cryptographic key pairs are not only a substitute for identification in the context of Bitcoin, but they are also a value in and of itself. These keys are digital bearer assets that grant the possessor sole ownership of the underlying assets.

They are commonly referred to as wallets because they allow one to transfer and receive Bitcoin between other public key addresses. “Not your keys, not your crypto,” as the motto goes.

The achievement of true ownership and administration of one’s assets without relying on custodial services provided by trustworthy third parties is one of Bitcoin’s most significant features.

But, in comparison to modern-day alternatives, how does Bitcoin’s privacy approach fare? While Bitcoin’s anonymity has long been a defining feature of the currency and a source of contention with regulators, data analytics of blockchains has advanced to the point where casual use of Bitcoin has effectively become de-anonymized.

Because all transaction data is public, advanced analytics techniques may be used to correlate public key addresses to other external accounts, such as exchanges and other fiat on/off-ramps, using a transaction graph.

Cryptocurrency mixers, for example, can assist disguise transaction flow and prevent linking to external accounts and real-world identities, but these tools have started to face active government shutdown. Much of the future development of the Bitcoin protocol is focused on improving its privacy features.

Transparency

The properties of Bitcoin as both a (largely) privacy-preserving system and a transparent one may catch the Bitcoin beginner off surprise. Isn’t it true that these two qualities are mutually exclusive? Certainly not.

Indeed, it is the balance of these two characteristics that makes Bitcoin and blockchain so powerful and helpful as an open financial system.

We’ve established that Bitcoin’s privacy model is based on the substitution of cryptographic key pairs for names and accounts.

These key pairs are the instruments that allow users to securely transact on the network using digital signatures. How can we believe that the records we’re dealing with are accurate if we don’t know who we’re dealing with?

These transaction flows, as well as the ownership chains of these precious bits, are stored in a shared ledger of cryptographically verified, secure data with blockchain.

One of blockchain’s main value propositions is data verification, which is achieved by combining a mutual ledger of secure yet open data with a consensus system that allows network participants to consistently agree on the ledger’s legitimate state.

Participants in the Bitcoin network can trust the validity of the ledger rather than each other or a trusted third party if all peers on the network share a transaction record dating back to the genesis block and the cost of reverting previously timestamped transactions outweighs any benefits by an exponential amount.

While the Bitcoin network places a lot of focus on financial transactions for obvious reasons, the blockchain has also proven to be effective for other uses. Proof-of-existence, a method of using the Bitcoin blockchain to timestamp documents and other digital files by associating the hash of a piece of data with an owner’s private key, denoting ownership, agreement, or consent around a certain action or bit of information, was the first non-financial application of the Bitcoin blockchain.

From the documentation and enforcement of legal contracts to the provenance of data surrounding a digital or physical asset to the installation of a global, automated notary public, the application cases are numerous.

Speed

There is a critical distinction to be made when discussing Bitcoin’s speed. Is it the number of transactions Bitcoin can handle in a certain length of time or the time it takes to execute a single transaction that we’re talking about? These are two separate but connected observations in evaluating Bitcoin’s value proposition over time.

Transactions per second are a standard metric for determining a cryptocurrency’s performance and scalability. The Bitcoin network averages only 4 transactions per second at the time of writing this article, a pitiful figure when compared to Visa’s 1,700 transactions per second.

This statistic is frequently used in discussions about Bitcoin’s scalability and feasibility as a digital currency.

How long does it take Alice to send Bitcoin to Bob, on the other hand? The average block time is around 10 minutes, with transaction finality certain after 6 blocks, or 60 minutes, depending on the amount in transaction fees paid by Alice to promote priority validation by miners.

While Bitcoin’s transaction throughput and confirmation times may be improved, it’s crucial to remember that these are peer-to-peer transactions that are executed and secured by a worldwide network that operates across borders. This is crucial to grasping the value proposition of Bitcoin.

While it lacks sheer speed at the moment, Bitcoin avoids the need for central clearinghouses to process Visa and ACH bank payments in favour of an ultra-secure global settlement layer. Millions of dollars in worth may be transported around the world in less than an hour and validated with low fees and without the necessity of trusted third parties.

In the short to medium future, maturing layer-two scaling solutions like Lightning will enable a trust-minimized way to execute high-frequency Bitcoin transactions off-chain while maintaining the Bitcoin blockchain’s integrity.