On June 28, Yield App, a Seychelles-incorporated crypto investment platform, declared that it would cease all operations on its platform immediately, citing losses from FTX exposure.

According to an official statement, the decision was made to guarantee that all consumers and stakeholders of Yield App receive equitable and equitable treatment.

“This follows the realization of portfolio losses incurred through third-party hedge fund managers that held Yield App assets in custody on the collapsed cryptocurrency exchange FTX, and who are subject to ongoing litigation.”

What investors should be aware of

Yield App experienced portfolio losses due to third-party hedge fund managers‘ custody of Yield App assets on FTX, which are “currently the subject of litigation,” as per the official statement.

A support channel will remain accessible to the public through the official website, although the Yield App has suspended community channels.

Inconsistencies in the Exposure to FTX

Despite the announcement, Yield App’s previous statements have raised concerns about the company’s transparency about its involvement in the stock market collapse.

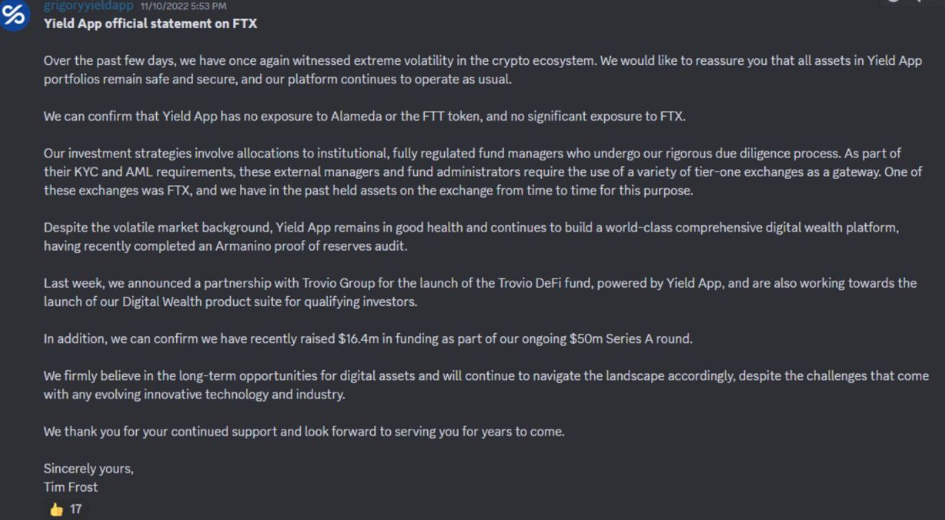

On November 10, 2022, Yield App Tim Frost assured users that the crypto investment firm had “no significant exposure to FTX” in a Discord message.

This year, the insolvent crypto exchange has resolved numerous disputes and conducted asset and claim sales.

In February, FTX divested 8% of its stake in Anthropic, sold its European subsidiary for $33 million, and anticipated the sale of Digital Custody for $500,000.

The bankruptcy proceedings of the collapsed crypto exchange include the ongoing asset liquidation efforts.

“This whole thing doesn’t make any sense. I think it’s super weird they got affected by FTX when it’s already 2 years ago and they gave an official statement.”