The Zimbabwe Reserve Bank (ZRB) declared new measures to combat its new currency, Zimbabwe Gold (ZiG) usage in the black market and enhance its adoption in the domestic market.

Using its X account, the Zimbabwe Reserve Bank (ZRB) directly appealed to the public, urging individuals to report unlawful currency traders and establishments that declined to accept its new currency.

This ongoing endeavor was to counter illicit foreign exchange trading, which occasionally occurred at unofficial exchange rates. Bloomberg reports that the ZiG has appreciated 1.9% relative to the U.S. dollar since its tangible introduction.

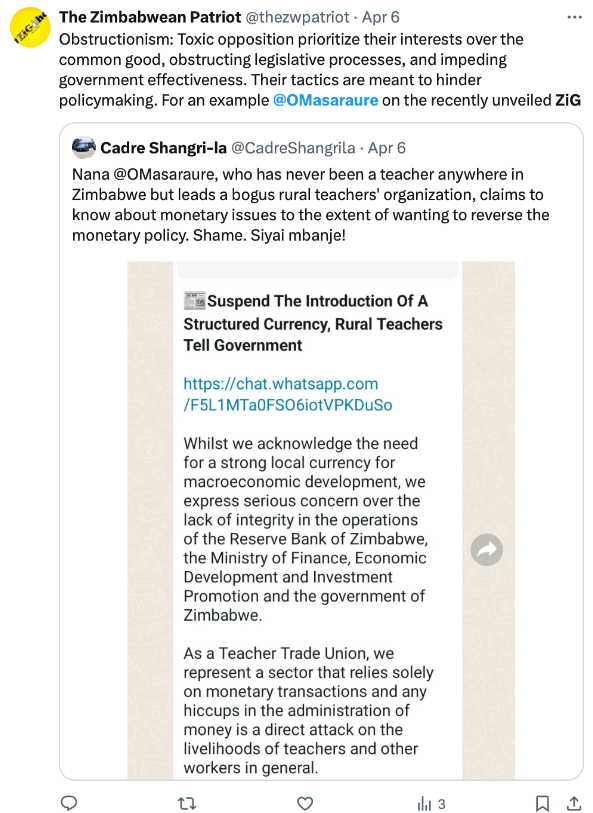

Concerns Around ZiG’s Launch

The Zimbabwean police arrested 224 unauthorized FX traders, according to Crime Watch Zimbabwe of South Africa, which published the news on May 15.

The RBZ Financial Intelligence Unit (FIU) suspended 90 bank accounts and fined 40 individuals. Additionally, the FIU monitored bank services for indications of illicit ZiG trade.

“A substantial decline in the number of illicit money changers operating in the Central Business District (CBD) [of the capital Harare] and surrounding areas,” according to the organization’s report. According to the RBZ X post from June 4, the struggle persists.

Coin deficiency is an additional concern for the central bank. RBZ stated in an X post that went live several hours after the message about illegal traders, “The Bank specifically seeks to expand economy-wide availability of small change in the following denominations: ZiG1, ZiG2, ZiG5, ZiG10.”

Additionally, the RBZ announced that as of June 10, ZiG currency would be withdrawable using debit cards from the government-owned Homelink financial services company in seven cities; additional financial institutions would provide this service in the future.

Zimbabwe has utilized the ZiG as its sixth currency for the past fifteen years. It was initially a digital currency pegged to the price of gold and is presently supported by both gold and foreign currency. The general public’s reaction to its tangible debut in April was mixed.

The GBDT (gold-backed digital token), formerly known as the gold-backed token, encountered skepticism and censure due to its similarity to central bank digital currency.

From this point forward, the GBDT operates as an “investment instrument” distinct from the tangible Zig. The use of several foreign currencies remains permissible in Zimbabwe.