Despite the market’s current bearish trend, Bitcoin balances on leading exchanges continue to be a source of bullish expectations.

According to Glassnode’s latest on-chain analysis, there have been large outflows of Bitcoin from the market, with the exception of a few exchanges.

The Bitcoin exchange balances are edging closer to relative equilibrium.

The market appeared to be achieving a balance between inflows and outflows from exchanges, according to the report, which was released earlier this week. While one group of exchanges was seeing net outflows, another was experiencing net inflows.

Binance, Bittrex, and FTX are the main culprits, according to Glassnode, for huge inflows. Since July 2021, the three exchanges have received a total of 207,000 BTC in inflows. This represents a 24.3 percent increase, the report said.

In terms of inflows, Binance and FTX continue to stand out among the three exchanges. The two exchanges now have a combined total of 103.2k BTC, while they used to hold only about 3k BTC two years ago.

The increase, which would normally be very bearish for the market, has a bullish component to it. The increasing balance domination of Binance and FTX, according to Glassnode, is due to the proliferation of derivatives trading in the market, where Bitcoin is most likely being used as margin collateral.

Binance and FTX represent the stand-out exchanges in market share increase over the last two years, both of which have a corresponding increase in futures market dominance, the analysts observed.

In terms of outflows, Glassnode reported that BTC supply has decreased at Huobi, Gemini, Kraken, and Bithumb in recent months. Huobi took the biggest damage, falling from over 400k BTC in 2020 to just around 12.3k BTC at present.

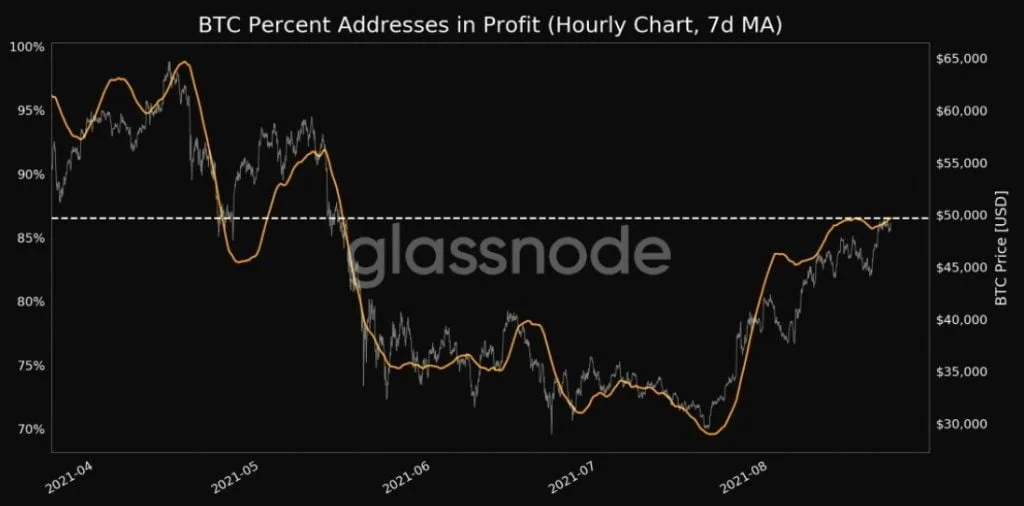

Glassnode, on the other hand, disclosed that since March 2020, 574,876 BTC (or 3.655 percent of Bitcoin’s circulating supply) has left exchange coffers. In September 2021, the market reached a relative equilibrium, according to the report.

The net outflow was made even more impressive by the fact that more metrics were in favor of exchange inflows than outflows, according to Glassnode.

The influence of outflows on Bitcoin’s price

Bitcoin’s price has been influenced by exchange supply in the past. On major exchanges, a decline in supply normally stimulates demand, which eventually drives prices up.

This is one of the reasons Glassnode emphasizes the on-chain data. The firm expects that if market I sees higher demand at current exchange supply levels, the price of Bitcoin might skyrocket. If demand does not rise, there may be a “re-invigoration of sellers.”

At the time of writing, Bitcoin is trading at around $39,900, up 2.24 percent in the last 24 hours. However, the market has dropped 4.06 percent in the last week, as Bitcoin’s market worth has remained below $800 billion due to a surge in liquidations.