Today, the larger cryptocurrency market is up 5%.

Bitcoin (BTC) has rebounded 7% to $41,500 levels, which is a surprising move. Following a period of high volatility in the market, the market has recently rebounded.

The anticipated executive order from the Biden administration appears to be getting a thumbs up from the market.

Given the current geopolitical circumstances resulting from the ongoing Russia-Ukraine military crisis, Bitcoin and the crypto market as a whole can play a significant role.

Commodity prices have been rising recently, with gold taking center stage. Risk assets, such as Bitcoin and stock, have, on the other hand, experienced significant losses.

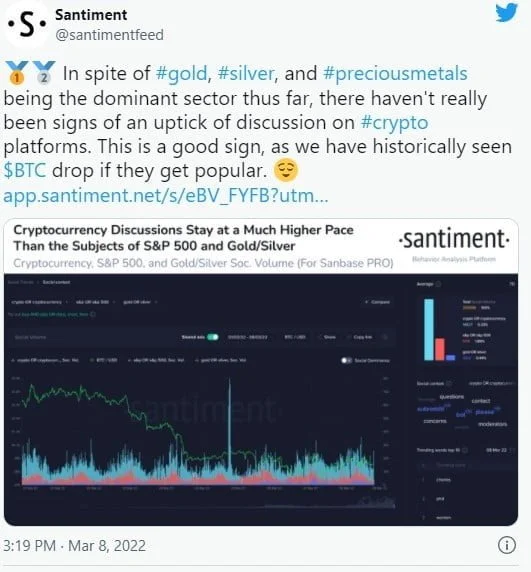

However, according to Santiment, an on-chain data provider, crypto debates are picking more steam.

DBS Holdings Group Ltd. Chief Executive Officer Piyush Gupta stated in his recent report on March 9 that private cryptocurrencies such as Bitcoin will continue to emerge as a substantial store of wealth. He continued, “

Regulators and politicians “will be loath to give up control of monetary policy and economic management tools, and will therefore be very circumspect about letting private money grow. Having said this, I do think that private money (crypto) will continue to grow as a meaningful store of value, much like gold is today.”

Terra’s LUNA leads while altcoins follows

The altcoin market is bouncing back in a similar way to Bitcoin. Ethereum (ETH) is up 6% and is presently trading at $2,708 with a market capitalization of $324 billion dollars.

With a healthy 18 percent rise, Terra’s LUNA is leading the altcoin market boom. At the time of publication, LUNA was trading at $94.

LUNA has also demonstrated excellent durability throughout recent market volatility, resulting in strong returns for investors. Analysts predict that LUNA will break through $100 and set a new all-time high.