The first phase of the Bank of Korea’s central bank digital currency (CBDC) testing, which began in August 2021, has been completed successfully. The second phase of the testing is expected to be completed by June this year.

The first round of the South Korean central bank’s CBDC simulated testing was finished in December, and the second step is presently ongoing, according to YNA news. The first round of the mock test focused on some of the sovereign digital currency’s most basic functions, such as distribution and issue.

The CBDC pilot’s second phase would put real-world features like cross-border remittance, retail payments, and offline payments to the test. According to the bank:

“We will confirm the possibility of operating various functions, such as offline settlements, and the application of new technologies, such as one intended to strengthen privacy protection during the second phase of the test.”

For the second phase, the Bank of Korea (BOK) is trying to onboard financial institutions, similar to what China is doing with its digital yuan. Unlike China, however, BOK-issued digital currency would prioritize user privacy.

The central bank intends to complete the second phase by June 2022, following which it will develop an official launch and commercialization strategy.

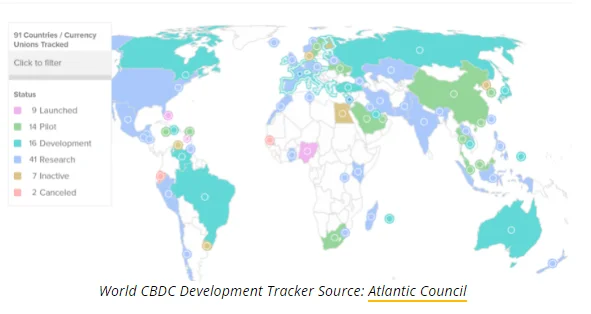

As a result, South Korea has joined a restricted group of countries that have either begun or finished the pilot phase of CBDC testing. According to data from the Atlantic Council, 91 countries are working on their own digital currency, with only 14 having reached the pilot stage.

South Korea has lately revealed its aspirations to become a world leader in the metaverse, as well as one of the major crypto-compliant nations in recent years. While China is now leading the CBDC game, many European and Asian peers have hastened their development plans in order to keep up with it.