Analysts observe that gold has outperformed “digital gold (Bitcoin)” in the aftermath of geopolitical turmoil, with the XAU/USD crossing $1,900.

The aftermath of Russia’s expected incursion into Ukraine triggered more market woes on Feb. 22. Bitcoin (BTC) fell to new lows.

As Bitcoin falters, gold comes to the rescue

BTC/USD hit $36,400 on Bitstamp overnight Tuesday, the lowest since February 3, according to data from Coinscreed’s top analysts and TradingView.

Volatility was high as Russian President Vladimir Putin delivered a nearly hour-long statement on the condition of the Ukraine conflict.

Putin ended by recognizing the two breakaway republics in the country’s east, then sending Russian soldiers into area that is still officially Ukrainian.

Stocks and risk assets tumbled as a result, with Russian companies taking the brunt of the fallout as fears of a full-scale war grew.

The Russian currency plummeted in lockstep, breaking through the 80-per-dollar barrier and approaching its 2016 lows of 85.6.

Later in the day, the West was anticipated to impose sanctions, potentially fueling additional losses.

Gold, unlike Bitcoin, came out on top as a surprise winner, avoiding losses to maintain its safe-haven status.

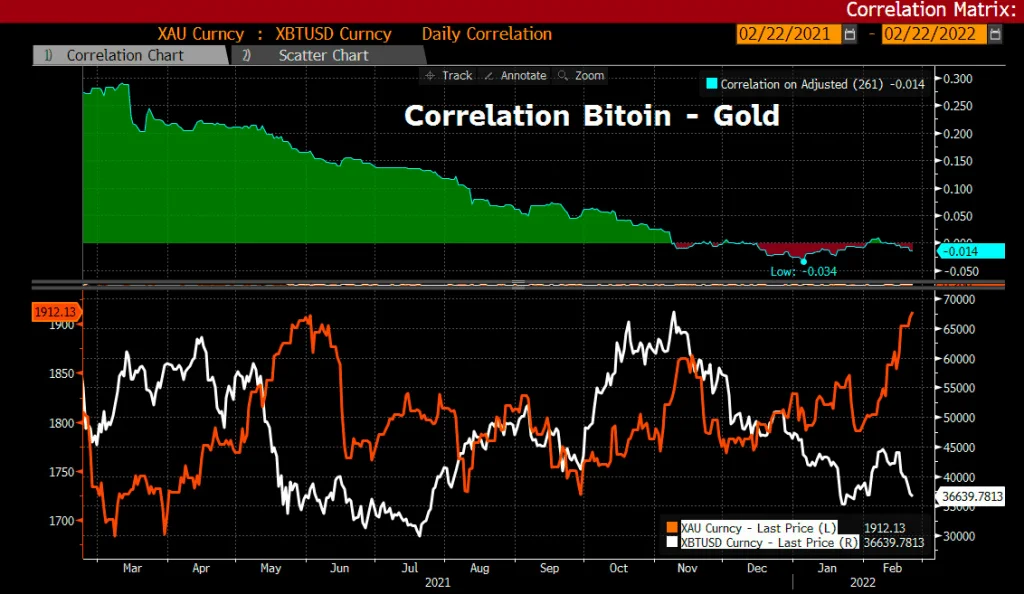

“It appears that Bitcoin will not be a safe haven in geopolitical crises,” said market analyst Holger Zschaepitz.

“Digital gold (Bitcoin) has plummeted to $1900/oz. Correlation between digital & analog Gold is now even neg. Narrative that digital Gold is better way to escape has not panned out in Ukraine.”

At the time of writing this article, XAU/USD was up more than 6% year to date, while BTC/USD was down 23%.

“It’s actually amazing to see Gold performing so well in these times of significant uncertainty, crawling upwards, while risky assets like stocks and Bitcoin are struggling,” Coinscreed contributor Chide Austin argued.

Investments in gold-backed exchange-traded funds, or ETFs, increased in February, according to Zschaepitz.

For the on-chain metric, a bearish cross looms.

For BTC traders, Russia has thus taken center stage, as storm clouds gathered over Asian markets on Monday.

A tech market sell-off spurred by a new Chinese regulatory crackdown resulted in two days of significant losses for some of the biggest equity investments, including Tencent.

“$39.6k is now the new critical resistance that Bitcoin bulls must break through,” noted popular analyst Matthew Hyland on Tuesday.

He went on to say that moving average convergence/divergence on the three-day chart was now set to print a bearish crossing, contrary to previous expectations of a bullish breakout heralding new BTC price strength.

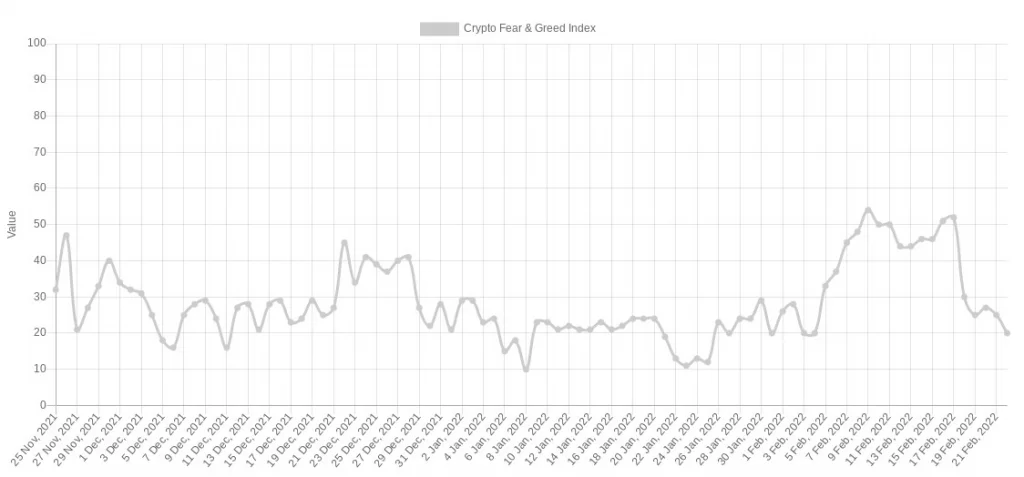

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

The Crypto Fear & Greed Index has dropped to 20/100, far into the “severe fear” range, as a result of the recent events.