Metaplanet’s shares jumped 15.7% after buying 107 Bitcoin for $6.7 million, raising its total holdings to 855.5, valued at over $56.1 million.

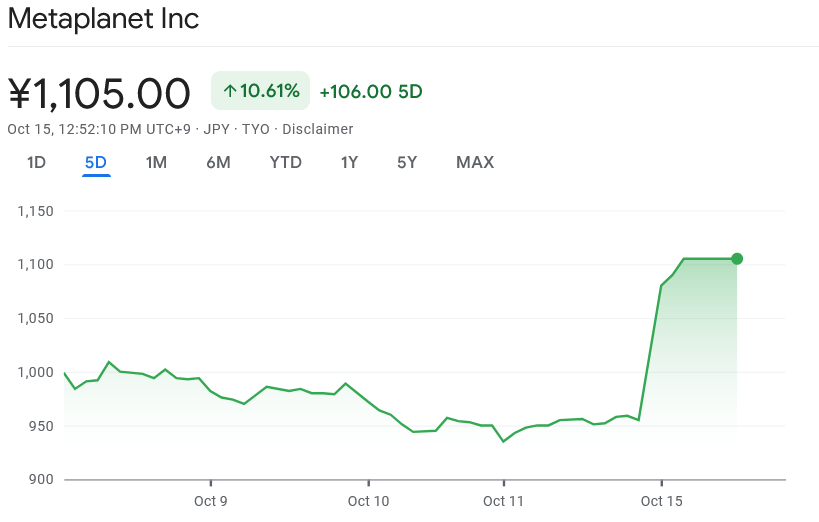

On October 15, shares of Metaplanet increased by 15.7% following the announcement that the Japanese investment firm had made its most recent purchase of around 107 Bitcoin, valued at approximately $6.7 million.

Because of the most recent acquisition, Metaplanet now possesses a total of 855.5 Bitcoin, which is worth more than $56.1 million, according to a statement released by the company on October 15.

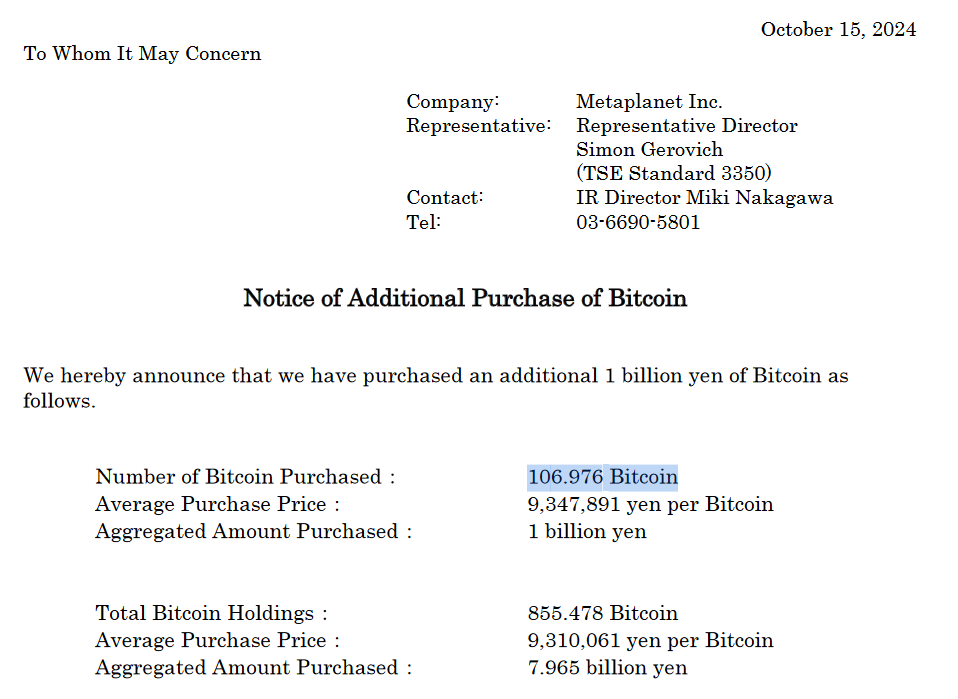

Each Bitcoin cost approximately $62,520, which is 5.8% less than the market price of $66,200 at the time of Metaplanet’s announcement. The company stated that it spent nearly $6.7 million, which is equivalent to one billion yen, in order to purchase 106.976 BTC.

According to the data provided by Google Finance, Metaplanet (TYO: 3350) was trading at 1,105 yen ($7.38) before the Tokyo Stock Exchange broke for lunch at 11:30 am local time on October 15. This is a 15.7% increase from its closing price on October 14.

The company’s share price has increased by 480% since it first disclosed its Bitcoin investing strategy at the beginning of April. As of right now, they havespent the equivalent of $53.2 million for the 855 Bitcoin that it possesses, and the company’s investment in Bitcoin has increased by 5.4%.

There have been four previous purchases of Bitcoin made by Metaplanet earlier this month, which have resulted in a more than twofold increase in the company’s Bitcoin holdings. On October 11th, the company purchased 109 Bitcoin, and on October 7th, it had purchased 108.8 Bitcoin.

According to statistics from Bitcoin Treasuries, Metaplanet obtained a total of 132 Bitcoin in two separate transactions on October 1 and October 3, all of which occurred earlier this month.

According to data provided by CoinGecko, Bitcoin had a price increase of more than nine percent, reaching $65,500, between the time that they purchased Bitcoin on October 11 and the time that it purchased Bitcoin today.

The CEO of Metaplanet, Simon Gerovich, has revealed that MicroStrategy and its executive chairman, Michael Saylor, influenced his company’s Bitcoin investment strategy. Saylor’s company currently possesses over 252,000 bitcoins worth $16.45 billion.

Gerovich’s company announced in May that it will utilize a wide variety of capital market instruments to bolster its Bitcoin reserves. MicroStrategy’s playbook parallels this strategy.

One of the company’s owners provided a loan of $6.8 million so they could buy more Bitcoin in August. According to data from Bitcoin Treasuries, Metaplanet ranks 23rd among publicly traded firms in terms of total Bitcoin holdings.