“By including fundamental measurements into index development, investors will be able to allocate funds to the most efficient DeFi tokens based on sensible economic data,” stated Guillaume Le Fur, CEO of Compass Financial Technologies.

Compass Financial Technologies, a fund manager based in Switzerland, has developed the “Compass Crypto Basket Fundamental DeFi Index,” which includes ten Decentralized Finance (DeFi) coins (CCBFDEFI).

The company was created in 2017 and specializes in crypto, commodities, multi-assets, and real estate indexes and services. It oversees financial products worth $5 billion that are linked to its indices.

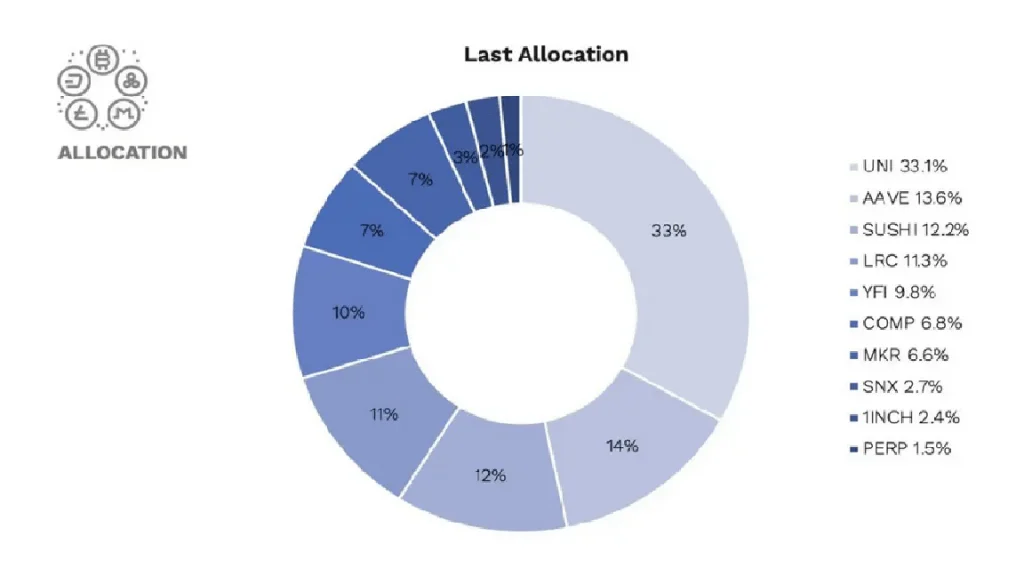

On February 22, the CCBFDEFI went online, providing institutional exposure to a collection of ten DeFi tokens that are individually weighted based on “liquidity, market capitalization, and protocol revenue criteria” as well as on-chain data.

Each token’s maximum weighting is capped at 35%, and a new group of assets is chosen each month.

UniSwap (UNI), Compound (COMP), Aave (AAVE), and SushiSwap are among the more than 20 approved tokens that can be utilized as components for the Index each month (SUSHI).

The institutional appetite for crypto exposure is “increasing dramatically,” according to Compass Financial Technologies CEO Guillaume Le Fur, as companies seek compliant ways to participate in the sector.

The CCBFDEFI is now available on the firm’s website, as well as Bloomberg and Refinitiv’s, and complies with EU Benchmark Regulations (EU BMR).

Under a license deal with Compass Financial Technologies, the product is also available for usage.

In late January, Compass Financial Technologies announced a partnership with top crypto fund manager CoinShares to use its indices as reference prices for CoinShares Physical Exchange-traded Products (ETPs), which have no management fees and pay staking rewards.

The company introduced a suite of EU BMR compliant crypto indexes in April of last year, covering everything from reference prices to smart-risk control and volatility targets.