Many investors are of the opinion that cryptocurrency could be significantly useful amid geopolitical conflicts and uncertainties, according to Arcane research.

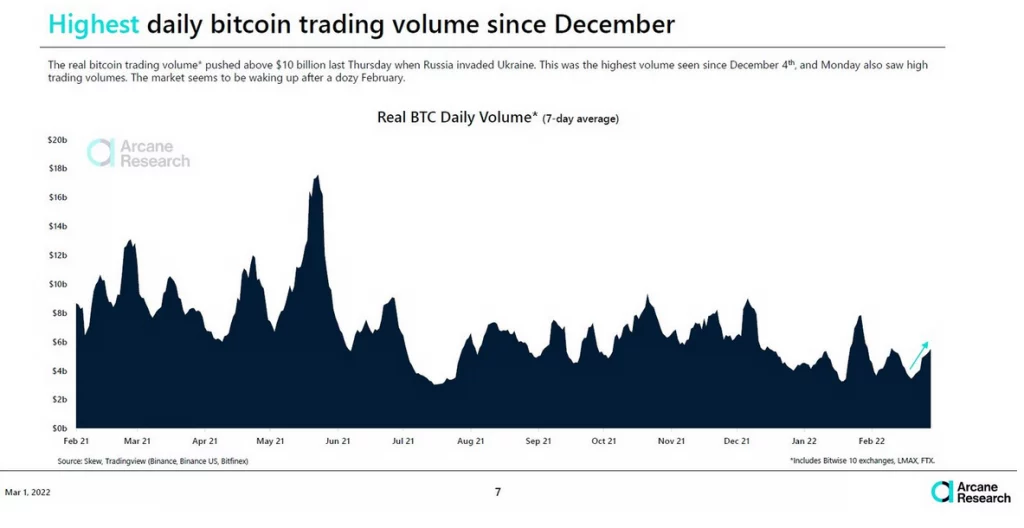

Bitcoin “real” daily volume soared to levels for the first time in three months on the heels of the Russian invasion of Ukraine.

Last Thursday (Feb. 24, the first day of the invasion), real daily BTC trading volume surpassed $10 billion, according to the latest weekly update report from blockchain analytics firm Arcane Research, marking the largest daily volume recorded since Dec. 4.

The business mentioned “new crypto narratives” that have emerged as a result of the ongoing crisis, such as crypto fundraising in Ukraine, increased demand about the western block, and Russia implementing “the toughest capital controls in decades.”

On Feb. 24, when the price dropped 10%, strong selling pressure from investors trying to take risks off the table may have led to the increase in daily BTC volume.

The term “real trading volume” refers to information obtained from exchanges that are thought to be trustworthy and devoid of wash trading. In this case, Arcane Research used data from the Bitwise 10 exchanges (which include Coinbase, Kraken, Poloniex, and Binance), as well as LMAX and FTX.

Crypto data aggregators such as Coingecko, which collects data from over 500 exchanges, estimated BTC’s trading volume on Feb. 24 to be about $25 billion. Messari’s genuine BTC volume chart (which includes a few more exchanges) shows a similar picture to Arcane’s, with a peak of roughly $11.6 billion in volume last Thursday.

According to Messari data, the true daily BTC volume has dropped to roughly $7.5 billion since February 24.

Arcane Research also pointed out that on Feb. 28, the price of BTC had its greatest daily percentage gain in almost a year, surging 14.5 percent in just 24 hours. The firm ascribed the growth in part to increasing speculation on crypto’s use cases amid the current Russian invasion, as well as Russian and Ukrainian crypto adoption (albeit the actual volume is rather tiny in global terms).

“Investors are speculating that crypto will become increasingly important apolitical and trustless money in a time of escalating geopolitical uncertainty, conflict, and capital controls. This speculation may have contributed to the 15% increase in the Bitcoin price over the past seven days.”

Cryptocurrency In Ukraine And Russia

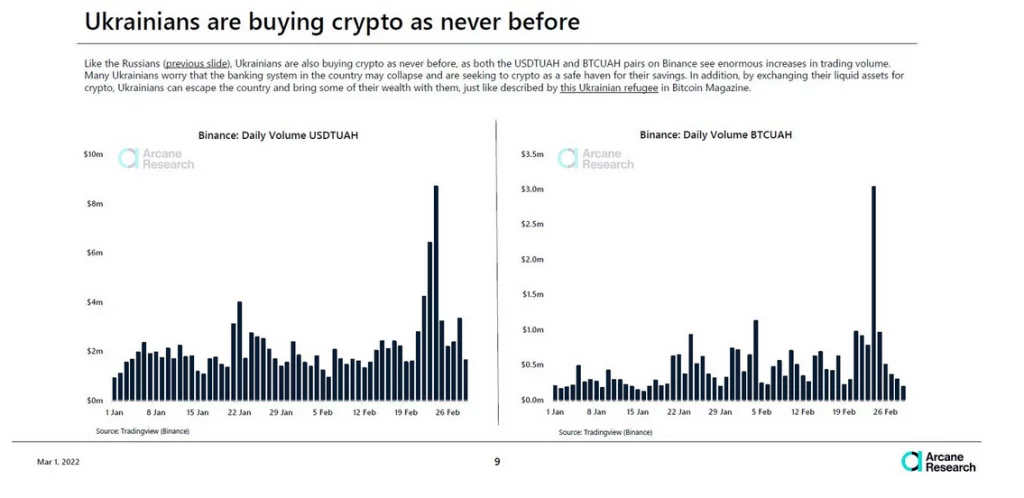

There have been flow-on repercussions for the adoption of cryptocurrencies as financial services and markets in both Russia and Ukraine have been significantly affected.

According to the report, statistics from last month showed a considerable increase in cryptocurrency purchases by Ukrainian individuals.

Daily Tether (USDT) stablecoin purchases on Binance via the Ukrainian hryvnia (UAH) jumped from around $2.5 million on Feb. 24 to around $8.5 million on Feb. 25 as the full-scale Russian invasion began. The BTC/UAH chart followed a similar path, rising from roughly $1 million to $3.0 million in the same period.

A similar trend was observed in Russia, with Ruble-based USDT purchases rising from roughly $15 million on February 21 to $34.94 million on February 28. Daily Bitcoin transactions likewise rose from around $5 million to as high as $15 million on February 25, before settling down into the $12 million areas.