Despite the government’s invasion of Ukraine this week, Russian Bitcoin (BTC) miners are said to be operating normally, although it is unclear how the local BTC sector and the broader market will be impacted by the rising global issue.

Miners in Russia accounted for about 11.2 percent of the worldwide BTC hash rate in August 2021, according to estimates from the Cambridge Bitcoin Electricity Consumption index.

With the United States and its NATO allies imposing sanctions on Russia’s government, it’s unclear how the local BTC industry and the broader market will be affected.

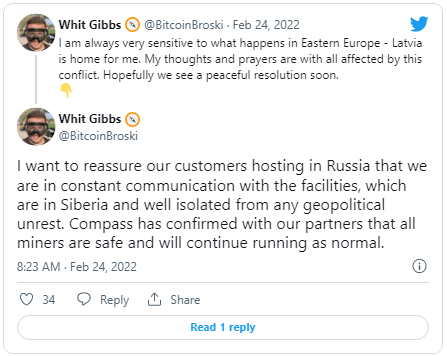

While some crypto mining companies, such as Ethereum-focused Flexpool, have suspended operations in Russia as a result of the invasion, BTC miners Compass Mining has assured customers hosting in the country that its mining infrastructure will stay active.

Compass Mining CEO Whit Gibbs offered his condolences to all those affected by the turmoil on Twitter earlier today, assuring the community that its Eastern European facilities are safe and secure in Serbia, far from any “geopolitical unrest.”

On Thursday, the Biden administration said that “sweeping financial sanctions and tough export controls” will be imposed on Russia’s major financial institutions, government, high-ranking officials, and technological industry.

Notably, the severe limits do not appear to apply to the international payments network SWIFT or cryptocurrency transfers. Many observers believe that now is the time for the Russian crypto sector to develop since it might soon become a significant instrument for circumventing various sanctions.

Russia might support a decentralized currency

BTC bull and Morgan Creek digital co-founder Anthony Pompliano stressed in a newsletter to investors earlier that the Russian government might take advantage of this opportunity to move away from the US dollar reserve system and support a decentralized currency with a global appeal:

“This game theory leads us to Bitcoin. The next best option to being the producer and distributor of the global reserve currency is to be the most advanced user and holder of a global reserve currency that no single country controls.”

“As a result of this motivation, these superpowers have realized that Bitcoin will be critical for decades to come.” Countries with a big ownership position, as well as mining and other pro-bitcoin initiatives in their own country, will have a significant edge,” he noted.

According to Bloomberg, Matthew Sigel, VanEck’s head of digital assets research, expressed similar comments, stating that the Bitcoin network will allow Russia to mitigate the possible harm caused by being cut out of the Western financial system:

“Neither dictators nor human rights activists will encounter any censor on the Bitcoin network.”