Goldman Sachs and Galaxy Digital have formed a strategic partnership that allows clients of Goldman Sachs who want to invest in the crypto industry to gain exposure through Galaxy Digital’s offerings.

According to a new Securities and Exchange Commission filing, Goldman Sachs has been selling customers exposure to ETH through Galaxy Digital’s Ethereum Fund.

Clients of Goldman Sachs who want to invest in spot exposure Ethereum (ETH) have been offered a position in Galaxy’s ETH Fund.

Goldman was mentioned as a receiver of introduction fees for introducing clients to the fund in a Galaxy filing dated March 8, revealing this practice.

Galaxy Digital is a crypto-focused financial services company founded by billionaire Mike Novogratz. As of the end of Q4 2021, it had $2.8 billion in assets under management (AUM).

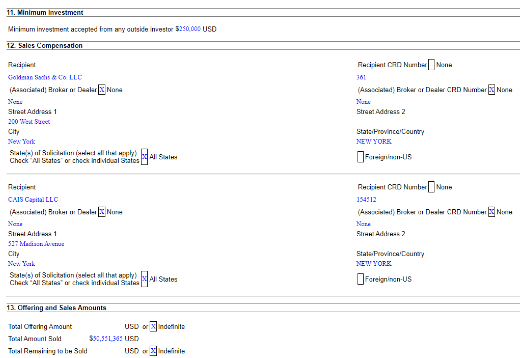

The actual amount purchased by Goldman clients is unknown, although the minimum investment per investor is $250,000. Galaxy’s ETH Fund has made sales of slightly over $50.5 million since its start, according to the report.

CAIS Capital, an independent asset management business, was also named as a receiver of placement fees for sending its clients to Galaxy’s ETH Fund in the petition. Goldman’s introduction fee and CAIS’s placement fee were not revealed.

Goldman Sachs and Galaxy Digital’s previous partnerships

This isn’t the first time Goldman and Galaxy Digital have collaborated. Goldman started trading Bitcoin (BTC) futures via CME Group Bitcoin futures in June, with Galaxy Digital providing liquidity.

Employees at Goldman Sachs are also becoming more interested in cryptocurrency. Goldman Sachs executive Roger Bartlett revealed on February 25 that he was leaving the traditional financial institution to join the Coinbase cryptocurrency exchange.

In a LinkedIn article, he stated that he will oversee global financial operations to “embrace opportunities afforded by digital assets and its ecosystem.”

Lloyd Blankfein, Senior Chairman of Goldman Sachs, is likewise intrigued by the crypto area. In view of extraordinarily high inflation rates and individual bank accounts being frozen around the world, he wondered on March 7 why cryptocurrency was not “having a moment.”