As their prices hovered around support levels, Bitcoin (BTC) and Ethereum (ETH) saw a rise in unique addresses. Concerns over a market meltdown have kept the two largest cryptocurrencies at their respective support levels for several weeks.

The BTC price has fallen twice in the last two weeks, briefly to near $38,000 level before rapidly rebounding to $40,000. Similarly, the price of Ethereum (ETH) has risen from below $2800. During these fluctuations, the on-chain data development is fascinating.

Bitcoin, Ethereum undergo healthy redistribution

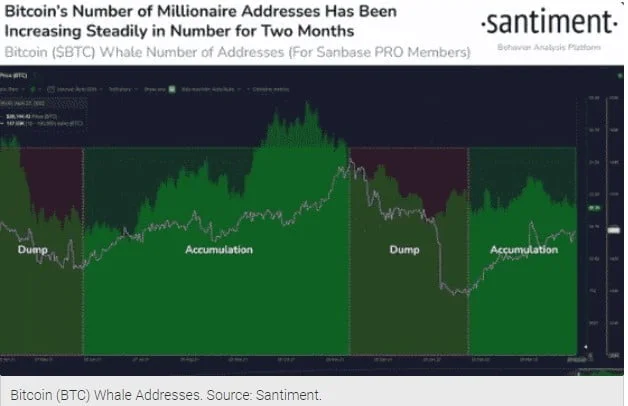

Since Russia’s invasion of Ukraine, the number of Bitcoin addresses has been steadily increasing, according to Santiment, an on-chain analytics platform.

There are 1,629 shark and whale addresses holding between 10k and 100k BTC in the last two months. The whale addresses, interestingly, are either new or have reverted to millionaire status. As a result, the number of whales is growing along with their Bitcoin accumulation.

In fact, current data shows that Bitcoin’s supply is being redistributed between $38k and $45k. As a result, the number of long-term investors has declined while the number of short-term investors has increased.

Ethereum is also undergoing a healthy redistribution of ETH supply at the moment. According to data from Santiment, the number of unique addresses on the Ethereum network has increased somewhat despite the price drop.

This has resulted in an upward trend as well as a bullish divergence in ETH prices. While prices are falling, the growth in daily active addresses is a clear indicator that prices are going positive. As a result, the Ethereum price may gain bullish momentum, as the chances of it falling below the support level are slim.

In fact, when the Ethereum network transitions to proof-of-stake (PoS), the price of ETH may grow more.

BTC, ETH trading beyond strong support level

Bitcoin (BTC) and Ethereum (ETH) whales are buying at dips as sentiment remains in the ‘fear’ zone. BTC and ETH prices have increased by approximately 3% and 1% during the last 24 hours, respectively. Moreover, both BTC and ETH are moving higher in ascending channel patterns. Investors should, however, wait for a clear breakout above resistance levels.