Market prices fell for the fourth week in a row, despite cryptocurrencies popping up everywhere—in events like Fidelity retirement plans, which raised grave concerns at the U.S. Department of Labor—in unsecured DeFi mortgages, and in an alleged pump-and-dump scandal involving a Republican member of Congress.

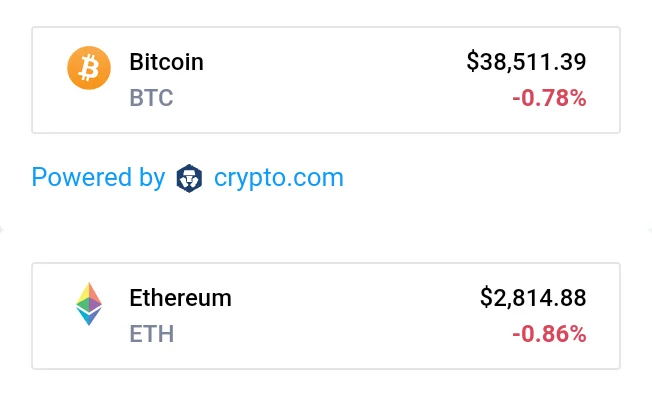

Bitcoin and Ethereum were both on course to achieve weekly gains by Tuesday, when each reached a seven-day high of $40,714 and $3,026.

However, by the weekend, both of the top cryptocurrencies had plummeted dramatically.

Bitcoin was down approximately 3.4 percent from this time last Saturday to $38,340 today, while top rival Ethereum was down 5.7 percent to $2,794.

Several notable cryptocurrencies had significant seven-day losses, including Solana (SOL), which fell 9.2 percent to $92.42, XRP, which fell 13.8 percent to $0.61, and Terra’s LUNA, which fell 10.8 percent to $81.22.

Avalanche (AVAX) and Polkadot (DOT) both declined nearly 17 percent, with AVAX trading at $60.72 and DOT at $15.66.

Polygon and NEAR Protocol, two of the top 20 coins by market cap, lost the most, falling 20% to $1.11 and 29% to $11.18, respectively.

This weeks headlines

On Monday, Canadian central bank officials denied the notion that cryptocurrencies offer a viable alternative to the Canadian dollar in the face of rising inflation.

Carolyn Rogers, the bank’s senior deputy governor, spoke before the House of Commons, saying, “I think if Canadians are looking for a solid source of payment and a stable source of value, cryptocurrencies don’t really fulfill that standard. We don’t see cryptocurrencies as a mechanism for Canadians to avoid inflation or as a reliable source of value.”

The Forth Worth City Council overwhelmingly adopted a resolution on Tuesday to accept a donation of three ASIC Bitmain AntMiner S9 rigs from the Texas Blockchain Council. The miners will be connected to a private network at City Hall.

Buenos Aires Mayor Horacio Rodriguez Larreta held a virtual presentation on Tuesday about streamlining city government.

One of Larreta’s suggestions is to allow citizens to pay their taxes in cryptocurrencies such as Bitcoin. Another uses blockchain technology to protect people’s personal information.

Later same evening, the New York State Assembly in the United States enacted a two-year prohibition on energy-intensive proof-of-work (PoW) crypto mining. The bill will now be sent to the state Senate for a second round of vote.

Though the bill does not seek an outright ban on mining, it does prohibit mining companies from renewing operating permits if their activities use fossil fuels.

After El Salvador, the Central African Republic became the second country to accept Bitcoin as legal cash on Wednesday.

The Central African CFA franc (XAF), backed by France and used in Cameroon, Chad, Congo, Equatorial Guinea, and Gabon, will serve as the official currency alongside Bitcoin.

In Central America, Panama passed legislation on Thursday to regulate cryptocurrency and legally recognize DAOs.

According to Congressman Gabriel Silva, the bill, which now goes to President Laurentino Cortizo for signature, will help the Central American country—and tax haven—become a hub of creativity and technology in Latin America.

To the north, A bipartisan group of U.S. politicians, including the ranking Republican on the House Agriculture Committee, filed legislation to grant the Commodity Futures Trading Commission (CFTC) the authority to oversee digital asset creators and exchanges.

The bill basically states that while the Securities and Exchange Commission (SEC) will be in charge of all securities, the CFTC will be in charge of all non-security assets, though the distinctions between crypto securities and non-security assets are still ambiguous in several cases, and have been a sticking point in the crypto industry for a while, most notably in the SEC’s ongoing case against Ripple.