Ethereum mergers love Lido because, unlike previous staking services, it returns a token called Staked ETH, which may be plugged into multiple DeFi protocols.

On April 12, Ethereum core developer Tim Beiko announced on Twitter that the world’s second largest cryptocurrency network had reached the “last chapter of [proof-of-work].”

If you haven’t heard about this event, dubbed “the merging,” here’s the lowdown: Ethereum is migrating to a new consensus method known as proof of stake (PoS).

PoS-based networks use economic incentives rather than building and maintaining vast farms of computers in the Siberian tundra to run your crypto network.

To participate, simply purchase and stake the network’s native coin.

You are awarded with a dividend if you correctly stake and execute your validating obligations.

However, if you execute fraudulent transactions or fail to adequately authenticate network blocks, you may lose some of the money you have staked (this is known as “slashing”).

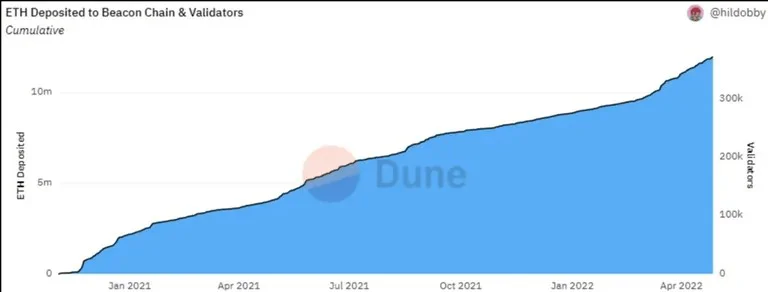

And, while Ethereum has not yet made the switch, the ability to stake ETH has been available since December 2020.

According to Dune Analytics guru hildobby, almost 12 million Ethereum have been staked (about $34 billion at today’s pricing).

This presently accounts for slightly more than 10% of the total Ethereum supply.

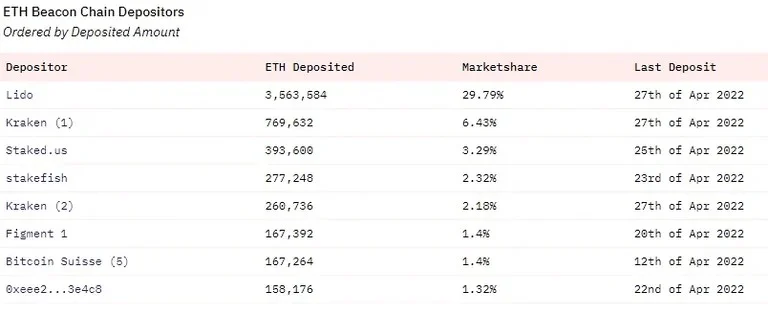

Understanding the different types of stakers offers information on how decentralized the next iteration of Ethereum will be.

Solo stakers (individuals who set up a computer at home and manually stake Ethereum), staking providers, and pooled staking are examples of these types. Here’s how it’s broken down.

Lido is a mechanism for pooled staking. Kraken is a cryptocurrency exchange.

Staked.us is a staking-as-a-service company that provides services across all PoS networks. Stakefish and Bitcoin Suisse both provide a comparable service.

Address 0xeEE27662c2B8EBa3CD936A23F039F3189633e4C8 follows. Given the quantity of Ethereum staked by this address, it could just be an unnamed address associated with another crypto business.

However, it presently holds more over $450 million in Ethereum.

This is a large sum of money for a single staker operating a validator from their flat.

Anyway, another notable figure among these figures is the enormous market share held by the pooled staking service Lido.

The reason for this, though, is straightforward. To engage in staking on other platforms, you normally need to deposit 32 Ethereum.

This is clearly a lot for the ordinary fan. Kraken, for example, accepts deposits of any size. The same may be said with Lido and Stakefish.

Unlike other staking services, however, Lido rewards you with a token known as Staked ETH (or just stETH). Because this is an ERC-20 token, it can be plugged into a variety of DeFi protocols.

This means that Lido users can receive a nice yield for staking while also adding percentage points to that payout by depositing their stETH in other DeFi protocols.