PayPal’s cryptocurrency services have introduced millions of its users to cryptocurrencies, including Bitcoin. In particular, nearly 350 million Paypal account holders now have an easy way to own the fastest growing asset class in history.

However, the crypto community greeted this news of PayPal’s new offering with mixed reactions ranging from cautious optimism to outright attacks.

This article explores why the PayPal movement has prompted such reactions and examines the pros and cons of buying cryptocurrencies on the PayPal platform.

For users who are wondering, “Can I buy bitcoin with PayPal?” This article will show you how to do just that.

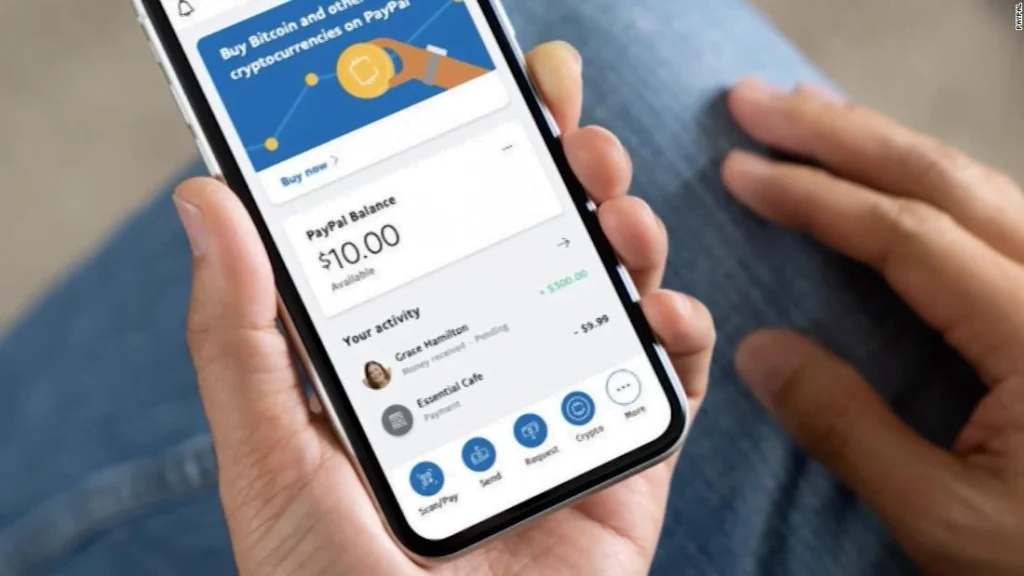

How to buy cryptocurrencies with PayPal

First, users need to log in to their PayPal account. Once logged in, they must have available funds. This may involve linking users’ credit or debit cards or a bank account.

Due to strict requirements and regulations regarding cryptocurrencies, PayPal also requires users to pass Know Your Customer (KYC) verification.

KYC verification involves submitting documents that verify the user’s identity, such as B. a driver’s license. Verification may include sending a copy of users’ ID and proof of address. Interested users must also submit a W-9 tax form.

As readers may know, the eligibility requirements for buying cryptocurrencies through the PayPal platform are straightforward.

However, as mentioned above, when exchanging, the users have to go through similar procedures, like submitting a driver’s license for identity verification to comply with KYC and anti-money laundering (AML) measures. This can bring additional benefits such as Increasing the maximum daily withdrawal limit.

Therefore, interested PayPal users should do their due diligence and research the exchange requirements. Comparing the exchange requirements with those of PayPal can be useful when investing.

Before users start buying cryptocurrencies using their PayPal account, it is advisable to review the positive and negative aspects of buying Bitcoin on PayPal.

The advantage of selling bitcoin through PayPal

Introducing more than a quarter-billion users to cryptocurrencies definitely has advantages. The crypto community may be reluctant to admit this, but PayPal is offering the industry a boon by introducing a low-risk approach to cryptocurrency ownership.

Here’s a different perspective. Let’s say a PayPal user buys cryptocurrencies on the platform. Since they’ve already invested in it, that investment should prompt them to do more research online about their new asset and cryptocurrencies in general. After all, it’s natural to want to understand what you have.

Therefore, sufficient additional research down the cryptographic rabbit hole is inevitable. This thirst for knowledge must lead to a desire for direct ownership of one’s digital assets.

In fact, first-time users who have recently been introduced to cryptocurrencies will benefit the most from this offer.

This advantage is especially true for people with low-risk tolerance. These users may find that buying cryptocurrencies on a trusted platform like PayPal is a friendlier way to “own” cryptocurrencies.

PayPal is one of the most well-known brands for online payments and the introduction of cryptocurrencies can be interpreted as a vote of confidence.

It can take 10 minutes or more for bitcoin to appear in a user’s real wallet when transmitted over the blockchain. What about Bitcoin transfer to PayPal? immediate.

In addition, PayPal promotes users through partnerships with interested stores. This allows PayPal users to make qualifying purchases of products and services with their cryptocurrency holdings.

Regardless, many ardent cryptocurrency advocates in the community see this move as a hoax to trick people out of direct ownership.

Users can be better served if they remember the old cryptographic adage: not your keys, not your coins.

Now that the positives have been addressed, the article presents popular arguments why users should not use PayPal to buy Bitcoin and other cryptocurrencies.

Why you shouldn’t buy Bitcoin with PayPal

When it comes to buying cryptocurrencies, users have a variety of options such as using a centralized exchange (CEX), a decentralized exchange (DEX), or a cryptocurrency wallet. But ordinary retail consumers may experience greater risk aversion because they don’t understand the technology behind cryptocurrencies.

PayPal makes it easy to buy digital currencies. Buying Bitcoin with PayPal is very easy for most users living in eligible countries. However, there are some crucial snags that users should be aware of before deciding to use the platform for their cryptocurrency purchases.

Users have to go through a similar approval process with crypto exchanges

PayPal users wishing to buy cryptocurrencies through the platform must verify their identity. Verification involves providing necessary documents such as passports for users to buy cryptocurrencies.

But even major cryptocurrency exchanges require their customers to go through a similar approval process when they sign up for the first time. Therefore, it may be better for users to buy their cryptocurrencies directly on an exchange than on the PayPal platform.

Users hold their fiat equivalent, not cryptocurrencies

Users never hold their cryptocurrencies directly on PayPal. Bitcoin – and the other cryptocurrencies offered – are held in custody by the company. Therefore, PayPal users can only “own” their cryptocurrencies indirectly.

However, since users are not allowed to transfer their crypto assets off the platform, they technically do not own any digital currency.

More experienced users will quickly find that they can neither send their bitcoins to PayPal nor exchange coins from within the app. PayPal also does not provide its users with a digital wallet or even a wallet address.

The lack of private keys means PayPal account holders with cryptocurrency holdings on the platform are still technically holding fiat. When users withdraw their cryptocurrencies, the only type of liquidity available is fiat currency. This also means that users cannot transfer bitcoin to PayPal.

Why should PayPal offer cryptocurrencies? This approach appears to be PayPal’s self-service scheme to gain access to cryptocurrencies. PayPal achieves this goal with its own customers’ funds. Additionally, they are gaining notoriety by promoting their acceptance of cryptocurrencies while minimizing their own risk.

Another point of criticism arises from the restrictions that PayPal users can place on their cryptocurrencies. For example, not only can users not move cryptocurrencies in their PayPal balance to their own wallets, but they also cannot trade between cryptocurrencies within the app itself. Technically, PayPal users don’t hold any of the cryptocurrencies, they do hold PayPal.

Users cannot lend their cryptocurrencies

Decentralized finance uses smart contracts, which are self-executing algorithms that are triggered when predetermined conditions are met. Smart contracts, therefore, make it possible to exclude third parties from financial transactions.

One of the main attractions of DeFi is its ability to generate high returns. Since interest rates are not controlled, they are free to be set by the market. It’s not uncommon to hear about double-digit returns on borrowing certain currencies.

Even Bitcoin can offer lenders significant returns that would embarrass banks. PayPal does not offer its users the ability to generate passive income from their cryptocurrency holdings. This inability is a significant disadvantage for cryptocurrency holders looking to maximize their returns.

Users can experience high transaction fees with PayPal

PayPal is notorious for charging high fees. And PayPal bitcoin fees are no exception. However, cryptocurrency exchanges are also notorious for charging exorbitant spreads. Spreads are the difference between the bid and ask price of a currency pair.

Users who live in a country where they can deposit fiat currency directly into an exchange are lucky. The regulations allow them to buy cryptocurrencies and own their assets in their own wallet.

Buying cryptocurrencies on a cryptocurrency exchange and setting up digital wallets can be difficult.

Certainly, more work is required and more education is required. But with knowledge comes the realization that it is better for users to hold their crypto assets directly.

Users will realize that not only do they have full and complete control over all their assets. With this recognition comes the potential to maximize yields.

This potential is due to the many ways DeFi provides passive income opportunities such as betting to support a blockchain network and providing liquidity or income farming for decentralized exchanges to help them run smoothly.

A limited number of cryptocurrencies

There are more than 1000 cryptocurrencies. Most of these are microcaps or small-cap coins. Microcaps offer investors their biggest gains as the upside potential for small-cap gems is huge. However, with greater upside comes greater risk, and microcaps carry the greatest risk of all.

Out of risk aversion, PayPal only offers four of the most popular cryptocurrencies: Bitcoin, Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTE). These coins represent some of the earliest cryptocurrencies in existence, with Bitcoin and Ethereum leading the pack.

As these coins are more established, it means they have matured. These four currencies are therefore less susceptible to volatile price movements.