Speculating on the price movements of cryptocurrencies through a contract for difference (CFD) trading account or buying and selling listed currencies through an exchange is known as cryptocurrency trading.

Jump to section

CFD trading is a type of derivative that allows you to bet on Bitcoin (BTC) price changes without owning the underlying currencies.

For example, you can buy when you think the value of a cryptocurrency will go up, or sell when you think the value will go down.

Both are leveraged instruments, meaning you only need a small deposit known as margin trading cryptocurrency to have full exposure to the underlying market.

However, since your profit or loss is still determined based on the total size of your investment, using cryptocurrency trading increases both your profits and losses.

Additionally, cryptocurrency options are used by investors to reduce risk or increase exposure to the market. Crypto options trading refers to the “derivative” financial instrument that derives its value from the price of another asset – in this case, the underlying cryptocurrency.

Before even thinking about venturing into cryptocurrency trading, it is important to have a thorough understanding of the assets and technologies involved. Bitcoin is the soil from which thousands of other cryptocurrencies grew.

As with stocks and other financial markets, trading cryptocurrencies can be complex, involving a variety of components and requiring expertise. Bitcoin was the first crypto asset to be launched in 2009 and remains the largest cryptocurrency in terms of market cap and distribution.

However, over the years an entire industry of other digital assets has sprung up that can be traded for a profit. All other non-BTC cryptocurrencies are known as altcoins, the largest being Ether (ETH).

This guide explains cryptocurrency trading strategies and familiarizes you with cryptocurrency trading platforms and apps, the components of a trade, trading styles, and the role of technical and fundamental analysis in creating a comprehensive trading strategy.

How to trade cryptocurrency for beginners

There are many different approaches to cryptocurrency trading. To start trading cryptocurrencies, a reasonable knowledge of the subject is required first. It is also important to understand the risks involved and laws that may apply depending on your jurisdiction and decisions should be made accordingly.

Steps for cryptocurrency trading

- Sign up for a cryptocurrency exchange

- Fund your account

- Pick crypto to invest in

- Start trading

- Store your cryptocurrency

Sign up for a cryptocurrency exchange

You must open an account with a cryptocurrency exchange unless you already have cryptocurrency. Some of the best cryptocurrency exchanges out there include Coinbase, eToro, and Gemini. All three of these services have a straightforward interface and a wide range of altcoins to choose from.

To open an account with a cryptocurrency exchange, you need to provide personal information, just like with an exchange.

When creating an account, you must provide, among other things, your address, date of birth, social security number (in the United States), and email address, known as Know Your Customer (KYC) requirements.

Fund your account

You need to connect your bank account after signing up with a cryptocurrency exchange. Most cryptocurrency exchanges accept debit card bank deposits and wire transfers. Bank transfers are typically the cheapest way to fund your account and are available on Coinbase and Gemini.

Choose a cryptocurrency to invest

Most cryptocurrency traders invest their money in bitcoin and ether. However, trading technical indicators is possible as these cryptocurrencies move more predictably than smaller altcoins.

Many cryptocurrency investors invest part of their money in altcoins. Despite being more risky than large-cap cryptos, small-mid-cap cryptos have greater upside potential.

Start trading

You can try cryptocurrency auto trading with software like Coinrule if you are looking for a cryptocurrency trading strategy. Cryptocurrency trading bots implement a process designed to generate the highest possible returns based on your investment goals.

You can make money fast, hold your coins, or diversify your portfolio with automated cryptocurrency trading, which can offer you a conservative, neutral, or aggressive path. You can even actively explore cryptocurrency trading on some sites while automating trading on others.

Store your cryptocurrency

If you are actively trading BTC, you need to keep your money on the exchange to access it. For example, you should have a bitcoin wallet when buying cryptocurrency to hold it in the medium and long term.

Software wallets and hardware wallets are two types of cryptocurrency wallets. Both are secure, but hardware wallets offer more protection as they store your cryptocurrency on a physical device that is not connected to the internet.

Basics of cryptocurrency trading

Bitcoin’s value is determined second by second, day by day by a market that never sleeps. As a standalone digital asset whose value is determined by an open market, Bitcoin presents unique volatility challenges that most currencies do not have.

Therefore, it is important for newbie traders to understand how crypto markets work so that they can safely navigate the markets, even if they occur intermittently, and get the most benefit from their participation in the cryptocurrency trading economy.

Bitcoin trading can vary in scope and complexity, from a simple transaction like withdrawing into a fiat currency like the US dollar, to using a variety of trading pairs to profitably navigate the market and grow your investment portfolio. Naturally, as a cryptocurrency trade grows in size and complexity, so does a trader’s level of risk.

First, let’s go through some basic concepts.

Structure of a crypto trade

A cryptocurrency trade consists of a buyer and a seller. Since there are two opposite sides to a negotiation – a buy and a sell – one will inevitably earn more than the other.

So trading is inherently a zero-sum game: there is a winner and a loser. A basic understanding of how cryptocurrency markets work can help minimize potential losses and maximize potential gains.

When a price is agreed between a buyer and seller, the trade is executed (via an exchange) and the market valuation for the asset is determined. Most of the time, buyers tend to place orders at a lower price than sellers. This creates both sides of an order book.

When there are more cryptocurrency buy orders than sell orders, the price usually increases as there is greater demand for the asset.

On the other hand, if more people are selling than buying, the price will go down. In many exchange interfaces, buys and sells are represented in different colors. This is intended to give the trader a quick indication of the market situation at all times.

You may have heard the saying in retail: “Buy low, sell high”. This adage can be difficult to understand because high and low prices can be relative, although the adage gives a basic account of the incentives of buyers and sellers in a market.

Put simply, when you’re looking to buy something, you want to spend as little as possible. When you want to sell something, you want to make the most of the deal. While this is good wisdom in general, there is also the added dimension of asking for an asset rather than shorting an asset.

Buying an asset (desire) means buying an asset and making a profit based on its upward movement in price. In contrast, shorting an asset essentially means selling an asset with the intention of buying it back if its price falls below the point at which you sold it and profiting from any fall in price.

However, short selling is a bit more complicated than this brief description and involves the sale of borrowed assets that are later repaid.

Styles of trading

- Day trading

- Swing trading

- Position trading

Day trading

Also known as “intraday trading”, day trading involves traders entering and exiting positions within the same day.

Pros

- Faster profits

- Better risk control; unaffected by overnight market shifts

Cons

- The appeal of short-term gains can lead to obsessive, addictive behavior

- Traders can lose money faster

- Compressing trading strategies within a day is difficult

- The fast-paced nature can cause a lot of stress

- Can only act on relatively short-term trends

Swing trading

Swing traders follow short- to intermediate-term trends that can range anywhere between 1 and 30 days.

Pros

- Easier to grasp than day trading

- Less risk with more informed, longer-term decisions

- Requires less time to manage than day trading

- Significantly less stressful than day trading

Cons

- Requires more preparation and research in making decisions

- Holding onto positions can create emotional attachments

- Requires more discipline in sticking to a strategy

Position trading

Also known as “trend trading”, position trading entails buying and holding an asset for longer periods of time.

Pros

- More forgiving, as small mistakes can be absorbed over time

- Easier to learn

- Less stressful than day trading and swing trading

- Can start small and build slowly over time

- Easier to predict the overall trends of the market

- Less time consuming

Cons

- By committing money to certain positions, less is available for other opportunities

- Keeping positions open over long periods of time is risky, as the market can change drastically while the trader is less alert

- Profits are solely long term. Unable to reap benefits in the short term

Reading the Markets

To the layman, “the market” may seem like a complex system that only an expert can hope to understand, but the truth is that it comes down to people buying and selling. Cryptocurrency trading may seem like an esoteric concept at first. However, once you start understanding it, the idea becomes much simpler.

The aggregate of active buy and sell orders is a snapshot of a market at a given point in time. Reading the market is the ongoing process of identifying patterns or trends over time that the trader can act on. Overall, there are two market trends: bullish and bearish.

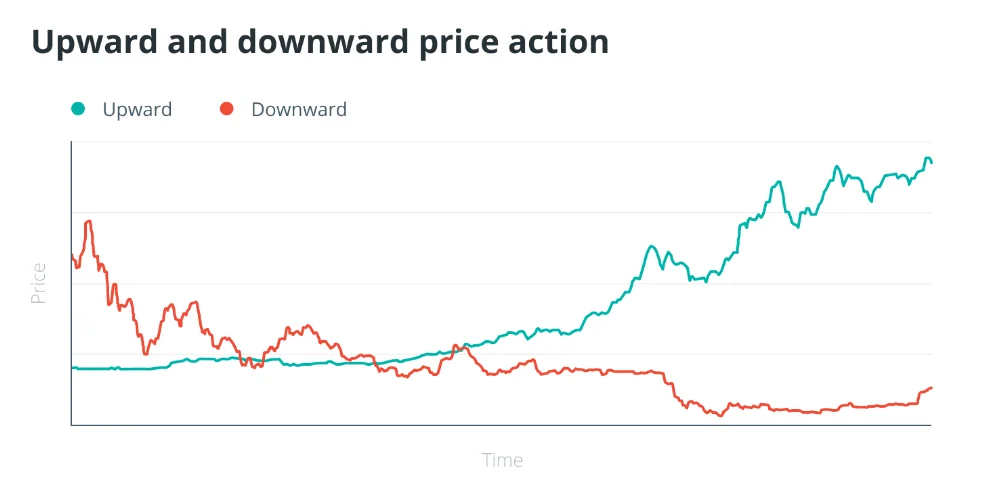

A bullish market or bull market occurs when price action appears to be increasing steadily. These upward price moves are also known as “bombs” as the influx of buyers pushes prices higher.

A “bear market” or bear market occurs when price action appears to be steadily decreasing. These falling price movements are also known as “dumps” since bulk selling causes the price to fall.

Uptrends and downtrends can also exist in other larger opposing trends depending on what time horizon you are looking at. For example, a small downtrend can occur within a broader long-term uptrend. Generally, an uptrend will result in price action forming higher highs and higher lows. A downtrend lowers highs and lows.

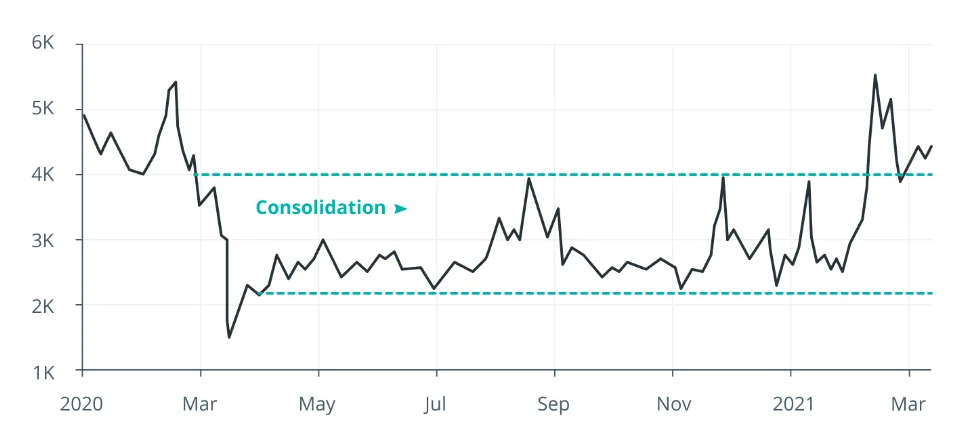

Another market condition called “consolidation” occurs when the price is trading sideways or within a range. Typically, periods of consolidation are easier to spot on higher timeframes (daily charts or weekly charts) and occur when an asset is cooling off after a strong uptrend or downtrend.

Consolidation also occurs before trend reversals or during periods of low demand and trading volume. Prices are essentially trading within a range during this market condition.

Technical Analysis

Technical analysis (TA) is a method of analyzing past market data, mainly price and volume, to predict price movements. While there are a variety of AT indicators of varying complexity that a trader can use to analyze the market, here are some basic macro and micro-level tools.

Market Structure and Cycles

Just as traders can spot patterns over hours, days, and months, they can also find patterns over years of price fluctuations. The market has a fundamental structure that makes it susceptible to certain behaviors.

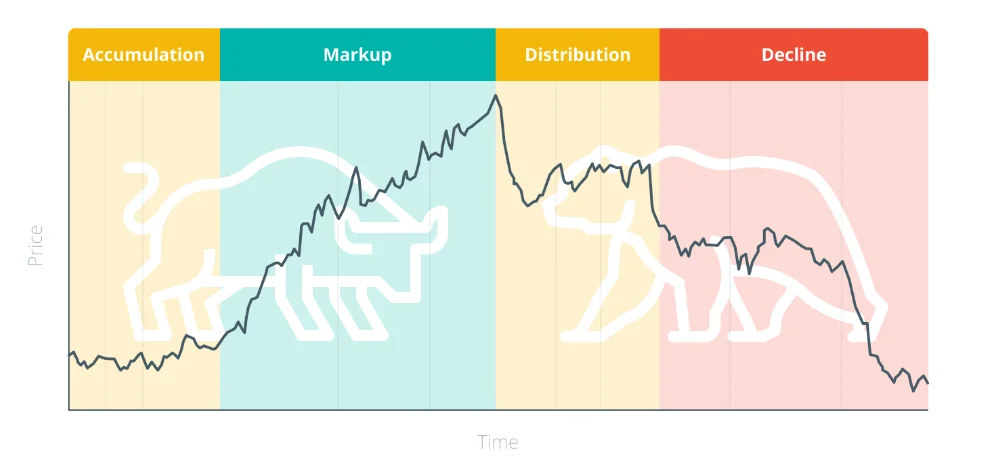

The cycle can be divided into four main parts: accumulation, premium, distribution, and decline. As the market moves between these phases, traders will continually adjust their positions, consolidating, tracking, or correcting as they see fit.

Bulls and bears are very different creatures and behave in opposite ways under the same environmental conditions. It is crucial that a trader not only knows which role they fall into but also which one dominates the market.

Technical analysis is necessary not only to position yourself in this ever-changing market but also to actively manage the ups and downs that occur.

Chasing the whales

Price movements are largely driven by “whales” – individuals or groups that have large funds to trade with. Some whales act as ‘market makers’, bidding and soliciting both sides of the market to create liquidity for an asset while making a profit in the process. Whales are present in virtually every market, from stocks and commodities to cryptocurrencies.

A cryptocurrency trading strategy should be aware of the trading instruments preferred by whales, such as their favorite AT indicators. Simply put, whales usually know what they’re doing. By anticipating whales’ intentions, a trader can work with these experts to capitalize on their own strategy.

Psychological cycles

With a zoo full of metaphors, it’s easy to forget that behind these negotiations are – for the most part – real people and thus subject to emotional behaviors that can significantly affect the market.

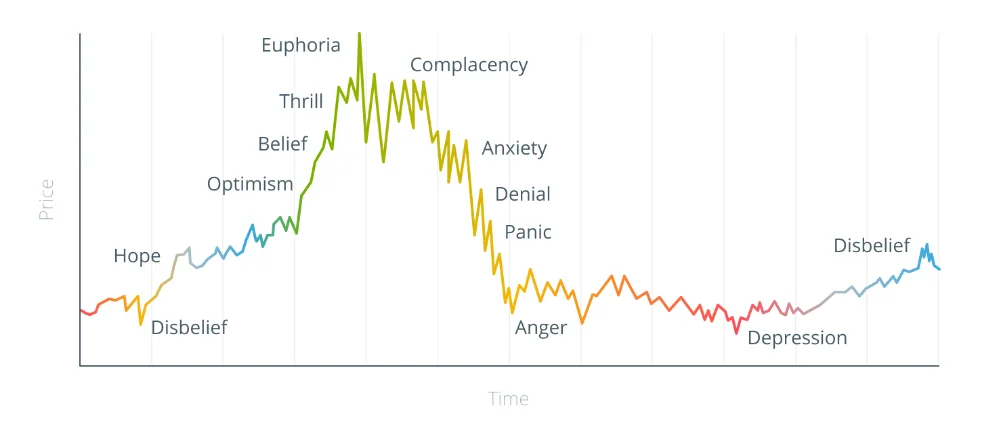

This aspect of the market is illustrated in the classic Psychology of a Market Cycle chart below:

While the bull/bear structure is useful, the psychological cycle outlined above provides a more detailed spectrum of market sentiment. While one of the first rules of negotiation is to leave emotions at the door, the power of group mentality tends to prevail. The rally from hope to euphoria is being driven by the FOMO – the fear of losing – of those who have yet to position themselves in the market.

Navigating the valley between euphoria and complacency is crucial to planning an exit before bears take over and panicked people sell out.

Here it is important to consider high-volume price movements, which may indicate general market dynamics. The “buy low” philosophy is quite evident as the best time to accumulate within the market cycle is during the depression after a sharp price decline. The greater the risk, the greater the reward.

The challenge for the serious trader is not to let emotions dictate his trading strategy amidst the deluge of heated opinion and analysis from the media, chat rooms or so-called thought leaders.

These markets are highly susceptible to manipulation by whales and those who can affect the pulse of the market. Do your homework and be decisive in your cryptocurrency trading actions.

Basic trading tools

Being able to spot patterns and cycles in the market is crucial to having clarity from a macro perspective. Knowing where you stand in relation to the whole is paramount.

You want to be the experienced surfer who knows when the perfect wave is coming, instead of paddling listlessly through the water waiting for something big to happen.

However, the micro perspective is also crucial in determining your actual strategy. Although there are a large number of TA indicators, we will only cover the most basic ones.

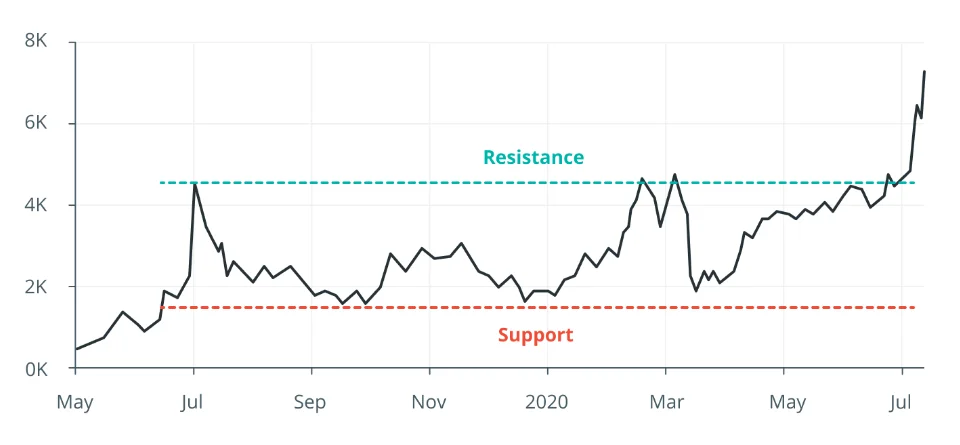

Support and resistance

Perhaps two of the most commonly used AT indicators, under the terms support and resistance, refer to price barriers that tend to form in the market and prevent price action from going too far in a particular direction.

Support is the price level where the downtrend tends to stop due to increasing demand. When prices fall, traders tend to buy at the low, which creates a support line. On the other hand, resistance is the price level where the uptrend tends to stop due to a sell-off.

Many cryptocurrency traders use support and resistance levels to bet on the direction of the price, and quickly adjust when the price level breaches its ceiling or floor.

Once traders have identified the bottom and top, this provides an activity zone where traders can enter or close positions. Buying on the floor and selling on the ceiling is the usual standard operation.

When the price breaks these barriers in either direction, it gives an indication of the overall market sentiment. This is an ongoing process as new support and resistance levels form when the trend breaks out.

Read More: How To Use Support And Resistance To Call Better Trades In Crypto

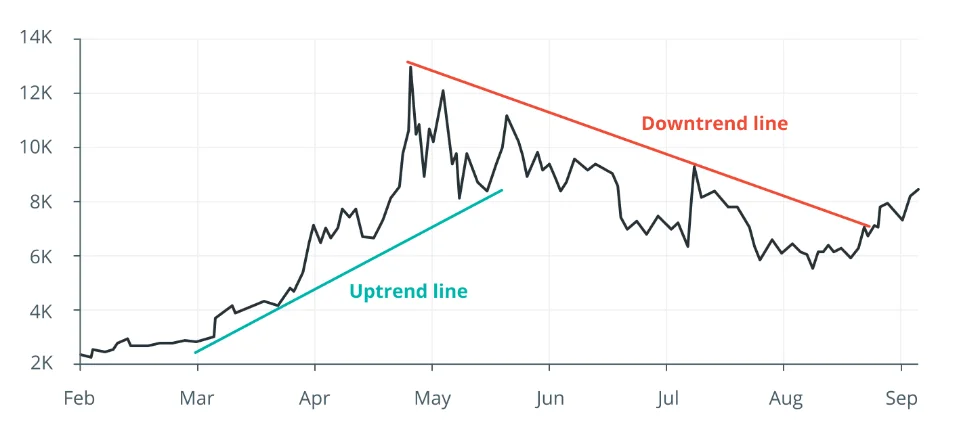

Trendlines

While the static support and resistance barriers shown above are common tools used by traders, the price action tends to go up or down as the barriers change over time. A series of support and resistance levels can indicate a larger trend in the market, represented by a trend line.

When the market is trending up, resistance levels start to form, the price action slows down and the price is pulled back to the trend line.

Cryptocurrency traders pay close attention to the support levels of an ascending trendline as they indicate an area that will help keep the price from falling significantly.

Likewise, in a downtrend market, traders will track the sequence of falling spikes to connect them to a trendline.

The central element is the history of the market. The strength of any support or resistance level and the resulting trend lines will increase as they repeat over time. Therefore, traders will record these barriers to inform their ongoing trading strategy.

Round numbers

One influence on support/resistance levels is the fixation on round price levels by inexperienced or institutional investors.

When a large number of trades revolve around a good round number — as Bitcoin typically does each time its price approaches a value divisible by, say, $10,000 — the price can have a hard time making this point to transcend and generate resistance.

This common occurrence is evidence that human traders are easily influenced by their emotions and tend to take shortcuts. Certainly, when a certain price is reached, Bitcoin tends to generate an enthusiastic burst of market action and anticipation.

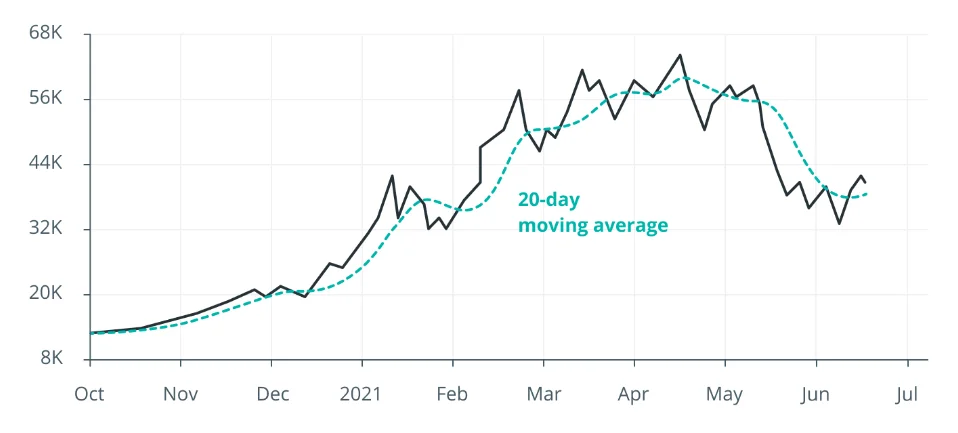

Moving averages

With a market history of support/resistance levels and the resulting down/up trend lines, traders often smooth this data to create a single visual line plot called a “moving average”.

The moving average does a good job of tracing the lower support levels of an uptrend along with the resistance spikes along with a downtrend. When analyzing trading volume, the moving average provides a useful indicator of short-term dynamics.

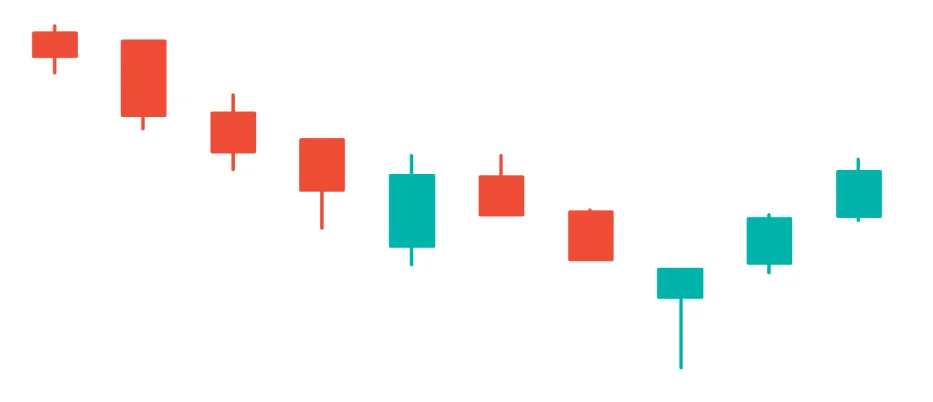

Chart pattern

There are several ways to map the market and find patterns in it. One of the most common visual representations of market price movement is the “candlestick”. These candlestick patterns provide a kind of visual language for traders to anticipate possible trends.

Candlestick charts originated in 17th-century Japan as a way of assessing the way traders’ emotions have a powerful impact on price action, beyond the simple economics of supply and demand.

This market view is most preferred by traders as it can contain more information than simpler lines or bar charts. A candlestick chart has four price points: open, close, high, and low.

How does this relate to cryptocurrency trading? They are called candlesticks because of their rectangular shape and the lines above and/or below that resemble a wick.

In the wide part of the candle, the price opens or closes depending on the color. The wicks represent the price range in which an asset will trade during the defined period of the candle.

Candlesticks can span various time intervals from a minute to a day and beyond, and show different patterns depending on the timeline chosen.

Fundamental analysis

So how do we determine the potential of a given crypto asset in addition to or before its behavior in the trading market?

While technical analysis involves the study of market data to determine an individual’s trading strategy, fundamental analysis is the study of the industry, technology, or underlying assets that make up a particular market. In the case of cryptocurrencies, a trading portfolio will likely consist of bitcoin and altcoins.

How to tell if an asset is built on solid fundamentals and not hype, hyped tech, or worse – nothing? There are several factors to consider when fundamentally analyzing new assets:

Developers

Before investing in any cryptocurrency asset, it is imperative to assess the integrity and capability of the builders behind it. What’s her story? What software ventures have you launched in the past? How active are they in developing the underlying protocol of the token? Because many projects are open source, you can see this activity directly through collaborative code repository platforms like GitHub.

Community

The community is vital for cryptocurrency trading projects. The combination of users, token holders, and enthusiasts create much of the driving force behind these assets and the technologies behind them.

After all, every new technology always has a social element. However, with so much money at stake — and with the frequent presence of non-professional retail investors — the space is often subject to toxicity and warring factions. Therefore, a healthy and transparent discourse within the community is welcome.

Technical specifications

Not to be confused with technical market analysis, the key technical specifications for a crypto asset include the choice of network algorithm (how it maintains security, uptime, and consensus) and issuance/emission features such as lock, maximum token supply, and distribution schedule.

By carefully evaluating a cryptocurrency network’s protocol stack along with the monetary policy imposed by the protocol, a trader can determine whether these characteristics support a potential investment.

Innovation

While Bitcoin’s intended use case when it was first introduced was electronic money, developers and entrepreneurs not only discovered new use cases for the Bitcoin blockchain, but also designed entirely new protocols to cover a broader range of applications.

Liquidity (and whales)

Liquidity is critical to a healthy market. Are there reputable exchanges that support a specific crypto asset? If so, what trading pairs are there? Is there a healthy trade/transaction volume? Are the major players present in the market and if so, what are their trading patterns affecting?

However, generating liquidity takes time as a new innovative protocol may be active but may not have instant access to liquidity. Such investments are risky.

When volumes are low and few or no trading pairs are available, you are essentially betting that a healthy market will eventually form around the project.

Branding and Marketing

Most cryptocurrency networks have no central figure or entity to facilitate branding and marketing around their technology, resulting in a brand that may not have a coherent plan or direction.

This is not to disregard branding and marketing that will result from a log over time. In fact, a comparative analysis of the marketing efforts of leading developers, corporations, foundations, and community members can provide an in-depth look at how specific actors are communicating value propositions to the masses.

Infrastructure

This quality of cryptocurrency trades can be seen as a manifestation of a project’s technical specifications. Regardless of what is written in white papers or presented at conferences, what is the actual physical manifestation of the protocol in question?

It pays to map the stakeholders: the developers, block validators, merchants/companies, and users. In addition, it is important to understand who the network administrators are, what their role is in network security (mining, validation), and how power is distributed between these stakeholders.

On-chain analysis

Since all cryptocurrencies are fundamentally based on blockchain technology, a new type of analysis has emerged that relies on data from blockchains – on-chain analysis.

By looking at supply and demand trends, transaction frequency, transaction costs, and the rate at which investors hold and sell a cryptocurrency, analysts can make accurate qualitative and quantitative observations about the strength of a cryptocurrency’s blockchain network and its dynamics of markets.

On-chain data also provides valuable insight into investor psychology, as analysts are able to correlate various macro and microeconomic events with investor actions, which are immutably recorded on the blockchain.

Analysts look for trading signals, patterns and anomalies in buying, selling and holding cryptocurrencies in correlation with market rallies, sell-offs, regulatory events, and other network-related events.

This is to make predictions about possible future price movements and investor reactions to future events such as network updates, currency halvings, and stocks happening in traditional financial markets.

Cryptocurrency Trading vs Stock Trading

Stocks and cryptocurrencies are two very different types of investment vehicles. While both are liquid assets that belong in your speculative portfolio, that’s where the similarities end. These are two completely different types of securities that should be kept in separate parts of your portfolio.

Stocks are the equity shares of a listed corporation. Each share you buy gives you a percentage of the company. This property is proportional to the number of shares issued by a company.

An investor can benefit by selling their shares to other investors. The difference between what you pay for the asset and what you get when you sell it is called the capital gain.

Furthermore, the benefits of stock ownership are entirely dependent on the particular company. Stocks can also increase in value by providing dividends to their shareholders and exercising voting rights.

A cryptocurrency is a digital asset that only exists on the internet. This means it has no physical component and only exists as records in an online ledger that tracks ownership.

This is in contrast to the US dollar, which has a physical component (you can withdraw and keep a dollar bill) and a digital component (you can own a dollar as nothing more than an entry in your bank account by registering that ownership). The single unit of a cryptocurrency is called a token, just like the single unit of a stock is called a share.

Risk management and final tips

Risk management is also an important aspect of trading. Before entering any trade, it is important to know how much you are willing to lose on that cryptocurrency trade if it goes against you.

This can be based on a number of factors such as your trading capital. For example, a person wants to risk losing just 1% of their total trading equity, either in total or per trade.

Trading is simply a risky endeavor in itself. It is almost impossible to predict future market activity with certainty.

At the end of the day, it’s important to make your own decisions, using the information available and your own judgment, and making sure you are properly educated.

Also, trading strategies can vary greatly from person to person based on preferences, personalities, trading capital, risk tolerance, etc.

Trading comes with significant responsibility. Anyone wishing to trade must assess their personal situation before deciding to trade.