Bitcoin bottoming to around $17,000 has stirred up many debates about “Bitcoin Dead” on Google last weekend.

Bitcoin (BTC) fell below $18,000 over the weekend, sending the entire market into a frenzy. Surprisingly, Google searches for “Bitcoin Dead” reached an all-time high over the weekend.

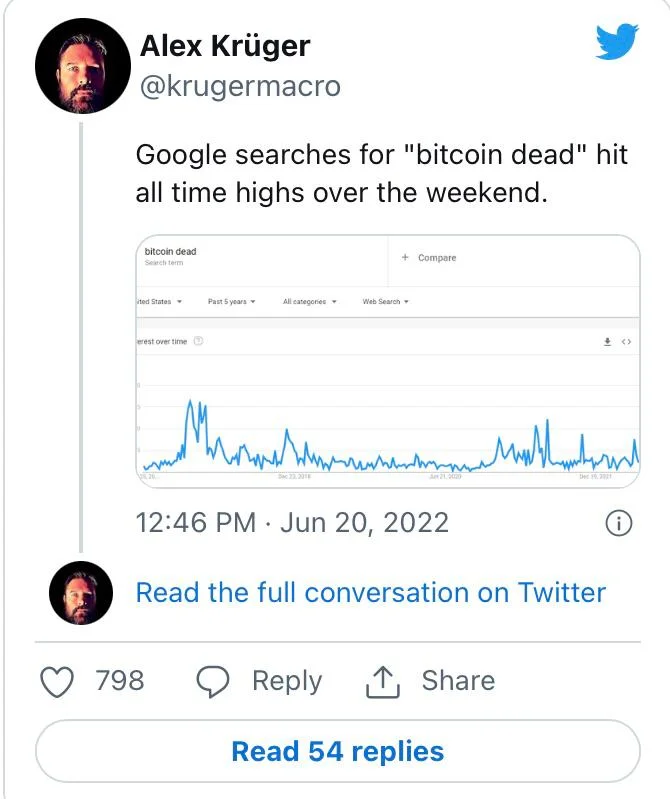

Popular market analyst Alex Kruger discovered that searches for “crypto is dead” had also reached an all-time high.

Binance CEO Changpeng Zhao also stated, “Historically speaking, you would have done well if you bought Bitcoin every time there is a “bitcoin is dead” headline.” When people lose hope, that’s when the bottom falls out.” Santiment, an on-chain data provider, explains:

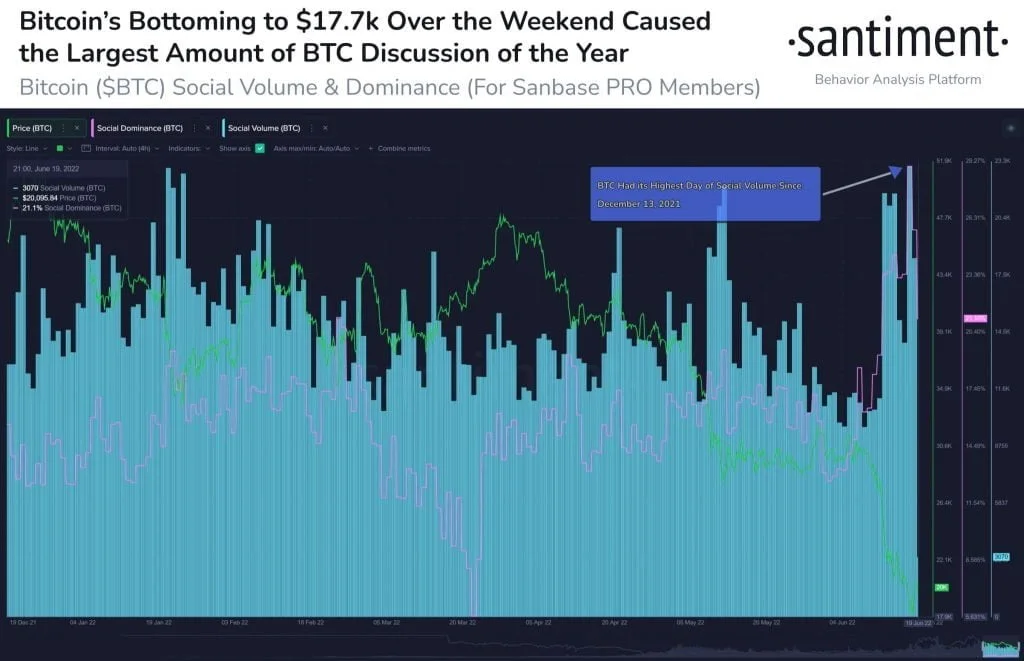

“Bitcoin’s plummet to $17.7k this weekend brought out the most discussion related to the #1 market cap asset in 2022. We often see major price reversals correlate precisely with high social volume rates, and $BTC has jumped +15.8% since”.

Bitcoin Bottom or No Bottom – Why One Should Start Buying?

Few people have ever predicted the bottoms of the bear market cycle. Following a plunge to under $18,000 over the weekend, the BTC price has recovered and is now trading above $20,000.

According to popular market analyst Rek Capital, this may be the optimum moment for Dollar Cost Averaging (DCA) rather than waiting for the next BTC bottom. He wrote:

“Many BTC indicators are suggesting that we are close to an absolute bottom in this macro bottoming period But the more confluence we get, the more there is an emotional urge to focus on the one or two metrics that suggest that $BTC could go lower Dollar-Cost Averaging helps”.

He goes on to say that it is best to average down BTC from present prices and keep the amount until the next bull cycle, which is expected to last at least 4-5 years. “Bitcoin data science suggests that anything below $35,000 is a region that has historically delivered outsized ROI for long-term Bitcoin investors, which is why anything below $20,000 is a gift,” the analyst continues.

Bitcoin will very probably fall in the global macro context. The Fed is poised to announce more interest rate hikes, and the United States is on the verge of entering a recession. However, it would be prudent for investors to begin accumulating wealth and maintain investment discipline.