On exchanges where the digital asset is listed, there is still little interest among cryptocurrency traders to bet on ETHPOW

Some cryptocurrency exchanges hurried to offer ETHPOW, the token of a hypothetical, competing Ethereum protocol, earlier this month in the hopes that cryptocurrency traders would wager on the token’s price even before it was released.

Their hopes have evaporated after more than a week of trading as interest in cryptocurrencies has diminished.

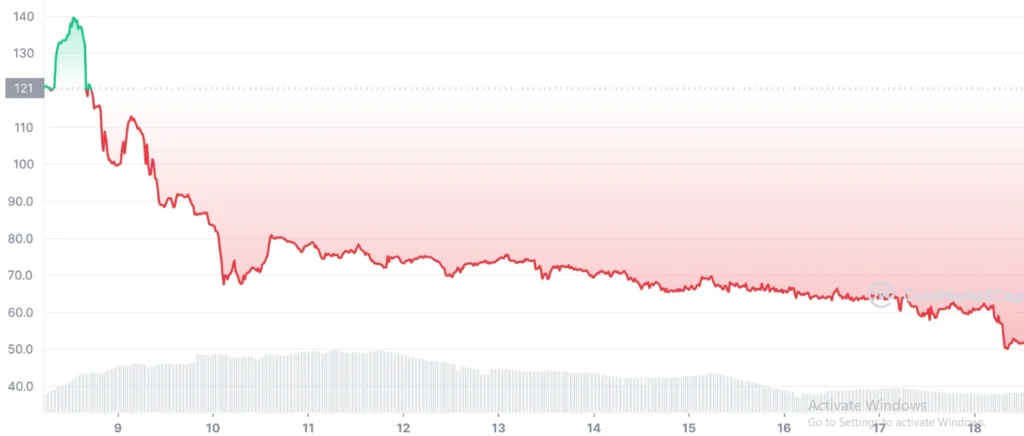

According to data, after the first trading week, the daily trade volume decreased by 66%, from $13 million to $4 million. The price of ETHPOW dropped from as high as $140 to $50 in the interim, according to cryptocurrency market tracker CoinMarketCap.

Low trading activity and declining prices are also evident in the trade statistics on Poloniex and BitMEX, two exchanges that featured the cryptocurrency.

The failing fortunes of ETHPOW highlight the unpredictability of forks and highlight how erratic investor interest may be. The precedent could deter other cryptocurrency exchanges from listing the token too quickly.

The Merge

The much-anticipated “Merge,” an update to proof-of-stake technology that would render ETH miners useless, is about to take place on the Ethereum blockchain.

In response, well-known cryptocurrency miner and investor Chandler Guo suggested creating a clone of the Ethereum blockchain via a hard fork that would maintain proof-of-work mining. Every owner of Ether should get the same amount of ETHPOW tokens as Ether at the time of the fork.

The Ethereum hard fork “may create a lot of enthusiasm,” according to BitMEX experts, who also predicted that ETH/ETHPOW “may be a popular trading pair post-split.”

However, the protocol hasn’t gained much traction outside of exchange listings and Justin Sun, the inventor of Tron, as support. There has been little information available regarding the apps that the Ethereum hard fork would enable or how it would attract users.

Will stablecoin providers support currencies on ETHPOW in whole or in part? Contributors to the decentralized finance protocol will they continue to work on ETHPOW products or will they need help from others?

Will the fork’s IP addresses be recognized by non-fungible token (NFT) projects?

According to a recent report, crypto analyst Walter Teng of Fundstrat has this to say:

“Pertinent details on its core functioning are few and far between. These are key questions in determining the value of the PoW fork after the Merge, yet they remain unanswered,”