One expert said that options are getting more expensive and that some traders are getting ready to “sell volatility,” which means that now is the time to sell volatility.

Soon, Bitcoin (BTC) traders will get what they love most: a volatile market. That’s the signal from a technical indicator called Bollinger bandwidth, which is used to figure out when volatility is high or low and when volatility trends change.

The indicator is made by dividing the difference between the Bollinger bands by the average price of the cryptocurrency over the last 20 days. Bollinger bands are lines that are two standard deviations above and below the average price for the last 20 days.

When standard deviation bands get smaller, the bandwidth goes down, which means that volatility is low. On the other hand, when the bands get wider, the bandwidth goes up, which suggests that the volatility will go up.

Volatility is said to revert to its mean, which means that periods of high volatility are often followed by periods of low price movement, while periods of low volatility are usually followed by periods of higher price movement.

Since the end of June, the bitcoin market has become much less volatile. The bandwidth indicator has dropped from 0.76 to 0.08, which is the lowest it has been since October 2020.

So, a big move in either direction seems overdue. This is especially true since below-0.10 readings on the bandwidth have always been followed by a huge increase in price volatility.

CoinDesk data show that Bitcoin has been trading in a narrow range of $18,500 to $20,500 for nearly a month.

Good time to buy options or Bitcoin volatility?

When traders expect a big move in either direction, they build a “net long volatility” portfolio so that the value of their investments goes up when prices move quickly.

One strategy that experienced traders often use is to buy options, either a “call,” a “put,” or both. This is because investors are scrambling to find hedges because price volatility is getting worse. That makes more people want options, which makes them more expensive.

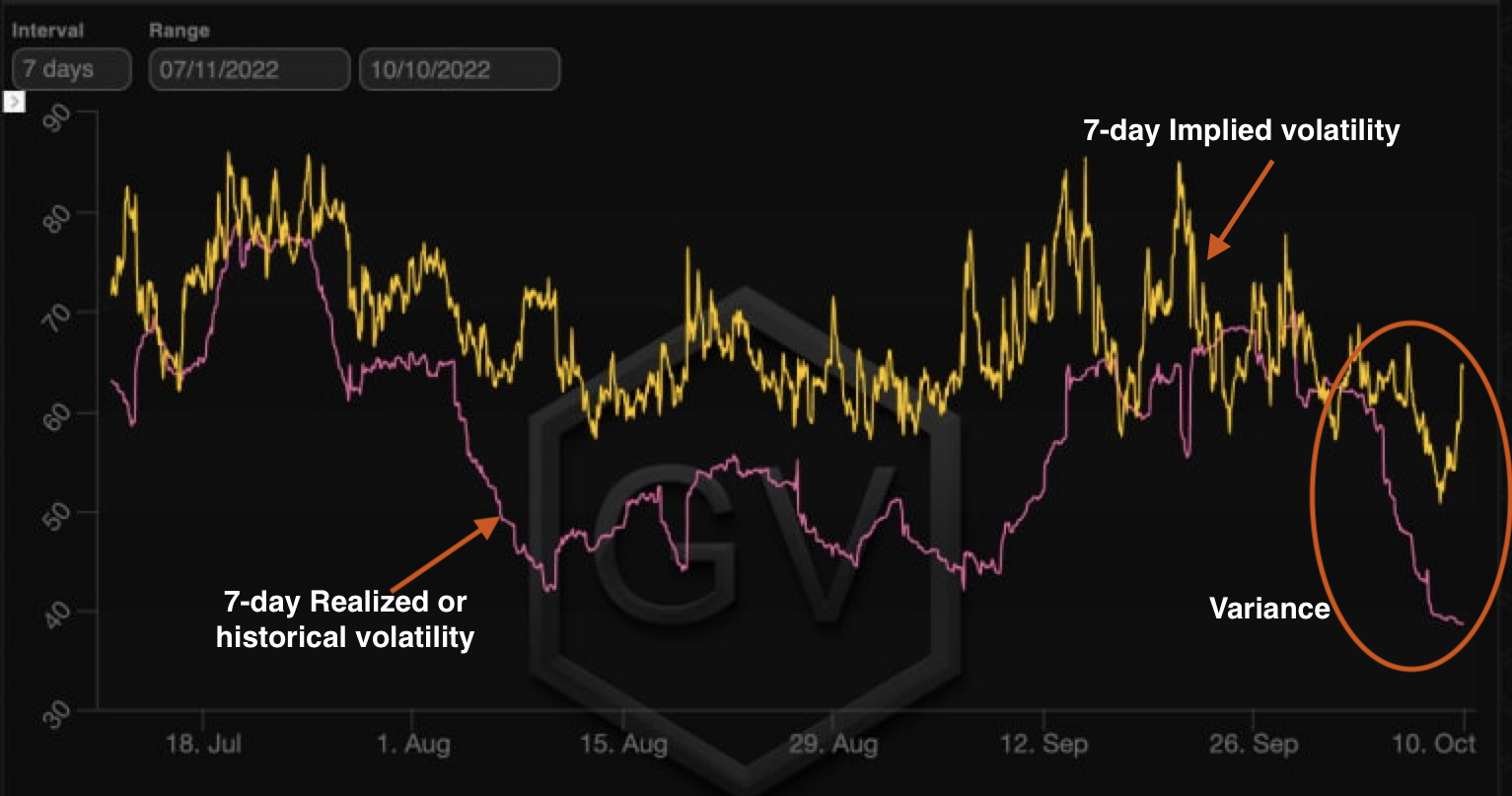

Most traders, though, do this when options look cheap, which is when the expected or implied volatility already priced in the options market is lower than the historical or actual volatility. When implied volatility is much higher than realized volatility, traders who know what they are doing sell options or go short on volatility.

At the time of press, short-term options seem to be more expensive because the seven-day implied volatility is higher than the actual volatility. The difference between the two, called the variance risk premium, has recently gotten bigger.

Gregoire Magadini, CEO of the options analytics platform Genesis Volatility, told CoinDesk that now would be a better time to sell volatility than to bet on a sudden rise in volatility. “The variance risk premium has gone up, so even though overall volatility has gone down, options are still more expensive.”

Markus Thielen, who is in charge of research and strategy at crypto services company Matrixport, said that the markets are overestimating how volatile the crypto market will become after Thursday’s U.S. inflation report.

“This year, on average, ether has dropped by 1.5% in the week after the release of inflation data. The options market is currently pricing in a +5/-5% change in ether after inflation “Thielen reported. “I would say the market is charging too much for expected volatility, so I would sell volatility here.”

Thielen added, “My favorite trade is to sell the ether $1,200 expiry put and the ether $1,400 expiry call.” Traders sell call and put options when they think the market will stay in a narrow range.