Argo Blockchain investors have filed a class action lawsuit, claiming that the miner misled investors and omitted important details during its 2021 initial public offering (IPO).

On January 26, a brand-new complaint was launched against Argo and a number of its executives and board members. It asserts that the company concealed its vulnerability to cash limits, energy prices, and network issues.

“The Offering Documents were carelessly written and, as a consequence, included inaccurate assertions of significant fact or neglected to mention other facts,” the complaint said.

The investors contend that this made the company “less sustainable” than it had seemed to be to them, which resulted in an overestimation of the miner’s financial prospects. The lawsuit stated:

“Had [the investors] known the truth, they would not have purchased or otherwise acquired said securities, or would not have purchased or otherwise acquired them at the inflated prices that were paid.”

On September 23, 2021, Argo made the material in issue public by filing paperwork pertaining to its initial public offering (IPO) with the Securities and Exchange Commission of the United States (SEC).

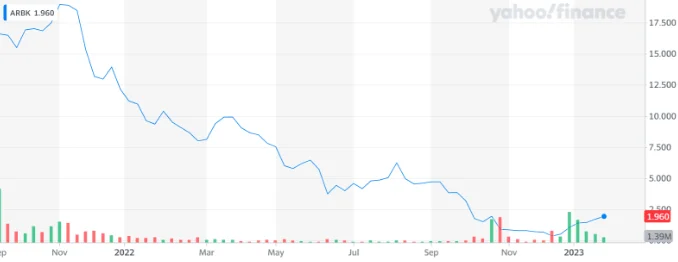

On the same day, 7.5 million shares were made available to the general public for $15 a share, generating earnings before expenditures of $105 million.

The miner’s stock price has suffered since then and is now trading at $1.96 per share after dropping as low as $0.36.

A few days after Argo resumed compliance with the Nasdaq listing requirement, which requires a business to maintain a minimum closing bid price of $1 for 10 consecutive trading days, on January 23, the company filed a recent complaint.

Argo has had to make some difficult choices in order to survive the current bear market and the challenging circumstances faced by cryptocurrency miners. On December 28, it disclosed plans to sell Helios, its premier mining facility, to digital asset investment management Galaxy Digital for $65 million.

High power costs, declining cryptocurrency prices, and greater mining difficulty all hurt the bottom line of cryptocurrency miners in general in 2022.