The US Federal Reserve is set to implement a ‘Hike and Pause’ policy, resulting in a price rally for Bitcoin and other cryptocurrencies.

During the FOMC meeting on July 26, the US Federal Reserve is expected to raise interest rates by an additional 25 basis points, although traders are more focused on a Fed pause than a rate increase. The Fed’s dovish stance will boost market sentiment, driving up Bitcoin and Ethereum prices.

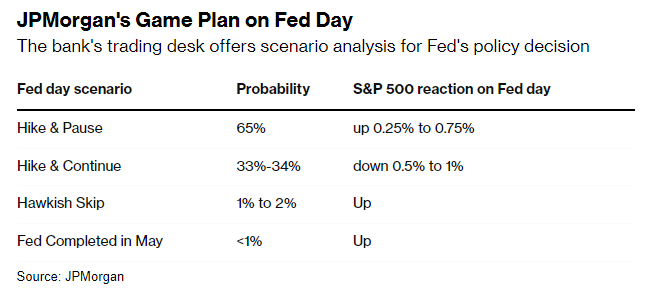

Bloomberg reported that JPMorgan’s trading desk anticipates a “hike and pause” as the most probable outcome of the FOMC meeting, which will boost the market.

With earnings season for the second quarter in full gear, the Fed’s decision to pause or confirm one more rate hike will provide additional upside momentum. Falling headline inflation and employment data approaching the Fed’s expectations also indicate a pause in rate hikes.

Analysts from Wall Street banks, including Morgan Stanley, Goldman Sachs, Bank of America, Citigroup, and Wells Fargo, predicted a 25 basis point rate hike and pause, with a potential rate hike by the end of the year. The CME FedWatch Tool indicates a 99% chance of a 25 basis point rate increase.

Dow and S&P 500 futures are up approximately 0.1%, while Nasdaq 100 futures are unchanged ahead of a crucial US Federal Reserve rate decision. Treasury yields and oil prices are declining, and the US dollar index (DXY) is moving to 101, indicating that Bitcoin and other cryptocurrency prices will continue to rise.

Bitcoin And Ethereum Costs to Increase

CredibleCrypto, a prominent cryptocurrency analyst, forecasts that the Bitcoin price has been replicating a pattern since its bottom at $15,000 and that “It’s almost time for the next impulse..”

Michael van de Poppe, Rekt Capital, and Crypto Tony are also optimistic that the Bitcoin price will begin to rise following the Fed’s rate hike. In the past twenty-four hours, the price of BTC has risen 0.5%, with the price currently trading at $29,278.

#Bitcoin | Expanding onchain activity can be seen when the monthly average of new wallets (green) exceeds the yearly average (grey), which suggests improving network fundamentals and growing utilization.

After a short contraction, $BTC on-chain activity is once again expanding! pic.twitter.com/ThBm8RIozO

— Ali (@ali_charts) July 25, 2023The low and high for the past 24 hours are $29097 and $29382, respectively. In the interim, the price of ETH trades above $1850, recovering from the support. The prices of XRP and Dogecoin (DOGE) are anticipated to continue rising, driving the recovery of altcoins.