FTX received court approval to inquire if creditors would prefer to receive their recovered funds in cash, as per the liquidation plan, or in crypto at its current market value.

On June 25, United States Bankruptcy Judge John Dorsey approved FTX’s voting plan.

The company’s most recent liquidation plan, which was proposed in May, was met with dissatisfaction by numerous FTX creditors. The plan recommended a 118% return for 98% of the creditors who had claims under $50,000, based on the U.S. dollar value of asset prices at the time of FTX’s bankruptcy filing in November 2022.

Nevertheless, a significant number of FTX creditors are requesting a reimbursement in crypto in-kind, which would account for the 165% increase in the total market cap of the crypto market since the exchange’s collapse.

Bitcoin was trading at approximately $16,900 when FTX filed for bankruptcy; however, it increased by 265% to $61,770 at the time of publication. This serves to illustrate the reluctance of certain creditors to accept cash repayments.

The objective of the vote is to gather feedback from the majority of FTX customers who have yet to participate in the repayment negotiations, according to FTX’s counsel, Andy Dietderich, during the court hearing.

Conversely, the attorneys for FTX emphasized that bankruptcy laws necessitate the company to appraise its claims before filing for Chapter 11, which is consistent with its proposed strategy.

Lawyers concluded that the current cash repayment plan would be more straightforward, as creditors would not be subject to capital gain tax.

It is important to note that just because creditors vote in favor of in-kind crypto repayments does not necessarily obligate the court to approve them.

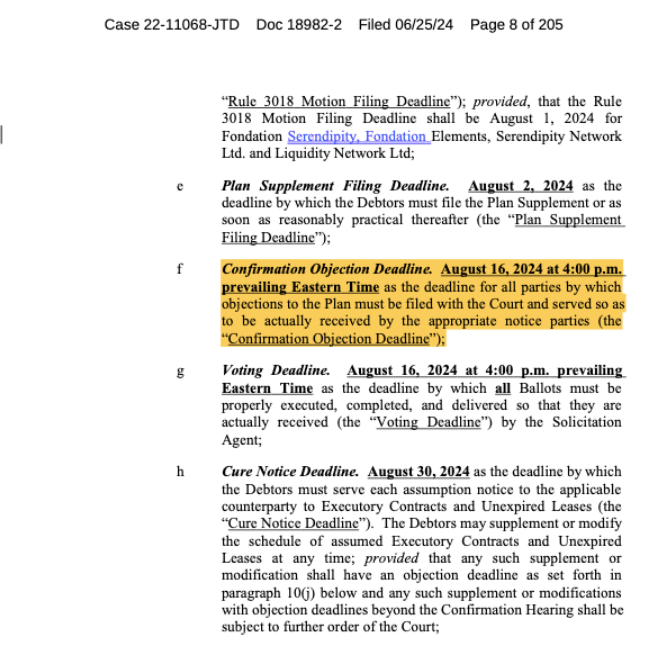

According to court documents, creditors will have until August 16 to vote on the proposal, and Dorsey will determine whether or not to approve it on October 7.

Since declaring bankruptcy, FTX has amassed $11.4 billion in cash. However, Dietderich anticipates this figure will increase to $12.6 billion by October 31, when the company’s Chapter 11 plan could be effective.

Before its collapse in November 2022, FTX was considered one of the world’s largest cryptocurrency exchanges.

The misappropriation of approximately $8 billion in funds from millions of consumers occurred. Alameda Research, the trading firm of FTX, misappropriated a significant portion of these funds, resulting in a liquidity crisis as customers attempted to liquidate their assets.

John Ray, the current CEO of FTX, took over the defunct exchange. Ray is a turnaround specialist still actively involved in the bankruptcy case.

In November 2023, the firm’s former CEO, Sam Bankman-Fried, was convicted of numerous fraud and money laundering offenses. Subsequently, in March, he was sentenced to 25 years in prison.