Coin Center, a leading crypto advocacy group, argues that OFAC’s indictment of Tornado Cash developers for operating an illegal money transmission business is unfounded and inconsistent with FinCEN’s guidance.

OFAC Accuses Tornado Cash Developers of Money Transmission Crimes

On August 23, the U.S. Office of Foreign Asset Control (OFAC) announced that it had indicted Roman Storm and Roman Semenov, two developers of Tornado Cash, a decentralized protocol that allows users to send and receive Ethereum anonymously.

The OFAC accused them of conspiring to operate an unlicensed money transmission business and violating U.S. sanctions laws.

Tornado Cash is a non-custodial service that uses zero-knowledge proofs to obfuscate the link between the sender and receiver of Ethereum transactions.

Users can deposit and withdraw Ether from the protocol’s smart contracts without revealing their identities or addresses. The protocol aims to enhance the privacy and fungibility of Ethereum, which is otherwise a transparent and traceable network.

Coin Center Challenges OFAC’s Claims

However, Coin Center, a prominent cryptocurrency advocacy organization, has expressed concerns over the OFAC’s indictment.

Coin Center’s research director, Peter Van Valkenburgh, wrote an opinion piece in which he argued that the evidence presented by the OFAC does not conclusively prove any money transmission-related crimes.

Valkenburgh pointed out that Tornado Cash merely offers software for money transmission but does not provide the money itself.

He said that this distinction is important, as it contradicts the guidance of the U.S. Financial Crimes Enforcement Network (FinCEN), which is the primary regulator of money transmission activities in the U.S.

FinCEN’s definition under the U.S. Bank Secrecy Act states, “an anonymizing software provider is not a money transmitter.” FinCEN also clarifies that only program users can be considered money transmitters, depending on the purpose of their transactions.

The program’s developers have a clear stance on this. They state, “A person that uses the software to anonymize their transactions can be a user or a money transmitter, depending on the transaction’s purpose.”

Therefore, Valkenburgh contends that Tornado Cash’s role is straightforward. By simplifying the process for users to send money via the protocol’s smart contracts, it does not label the developers as money transmitters.

“Providing tools for others to transmit their money doesn’t make them transmitters.”

Peter Van ValkenburghSmart Contract Control Is Not Relevant

Additionally, Valkenburgh challenged another claim made by the OFAC. It alleges that Storm and Semenov controlled the protocol’s underlying smart contracts, which implies that they had some influence over the funds deposited and withdrawn by users. Valkenburgh believes this is a misconception.

He explained that Ethereum smart contracts can be designed in various ways, and users can have different levels of control over their execution.

For instance, some smart contracts can be upgraded or paused by their creators, while others can be immutable or governed by a community vote.

Consequently, understanding this nuance is essential in determining if someone is truly involved in money transfer.

Valkenburgh said that Tornado Cash’s smart contracts are not upgradeable or pausable by anyone, including the developers.

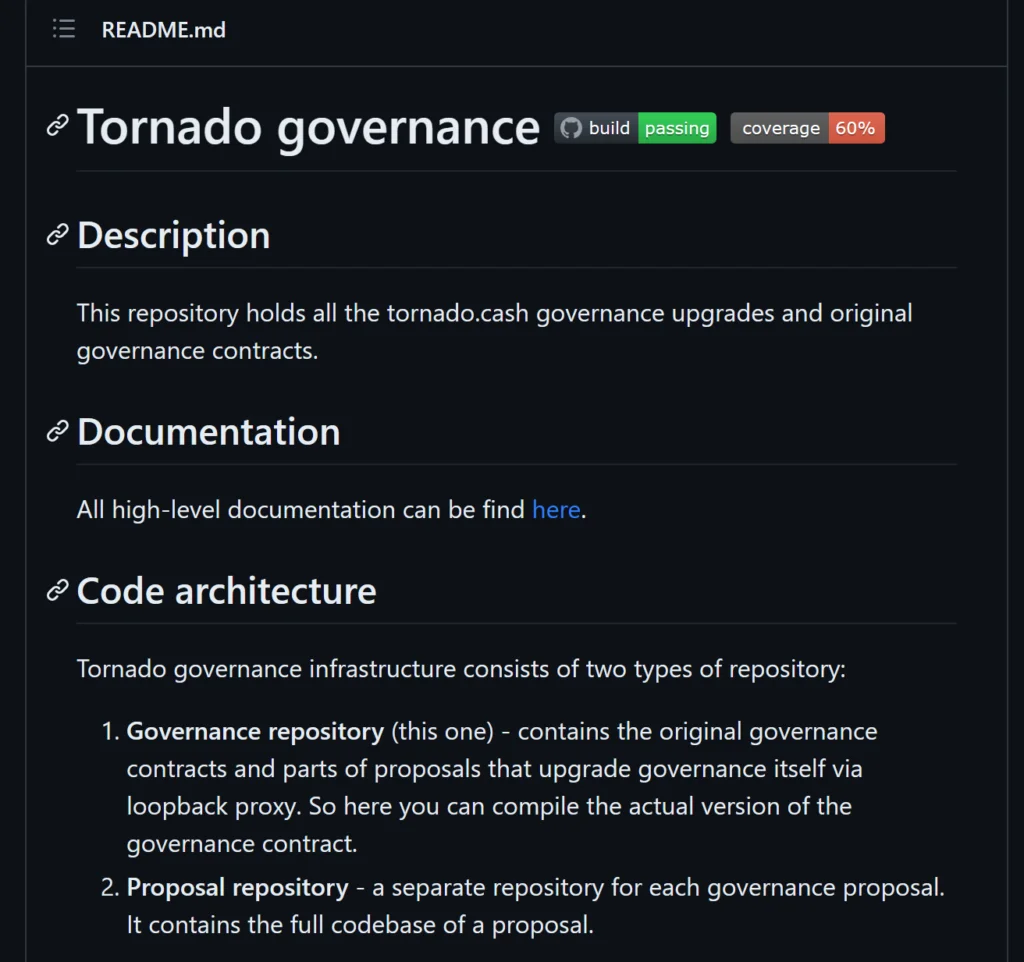

He also stated that the protocol employs a decentralized governance system called TORNADO, which allows token holders to vote on proposals and modifications.

Therefore, he concluded that Storm and Semenov lacked control or authority over the protocol’s smart contracts or funds.

A Threat to Crypto Innovation and Privacy

Valkenburgh warned that the OFAC’s indictment of Tornado Cash developers could have a chilling effect on crypto innovation and privacy.

According to him, the OFAC’s actions contradicted FinCEN’s guidance and ignored the technical features of decentralized protocols.

He warned that this could deter developers from creating valuable and lawful tools for crypto users who cared about their privacy and security.

The Research Director appealed to the crypto community to back Coin Center’s campaign to protect Tornado Cash developers and contest the OFAC’s allegations.

He assured that Coin Center would persist in promoting reasonable and equitable regulation of crypto activities in the U.S. and elsewhere.

He also invited crypto users to contribute to Coin Center’s legal defense fund, which supports legal counsel for developers facing unfair prosecution or persecution.