Following an in-principle approval to offer virtual asset trading services in August 2023, Swiss crypto bank SEBA has obtained a license to operate from the Hong Kong Securities and Futures Commission (SFC).

SEBA Bank, headquartered in Switzerland, has recently obtained a license from the Hong Kong SFC as the most recent crypto-focused institution to do so.

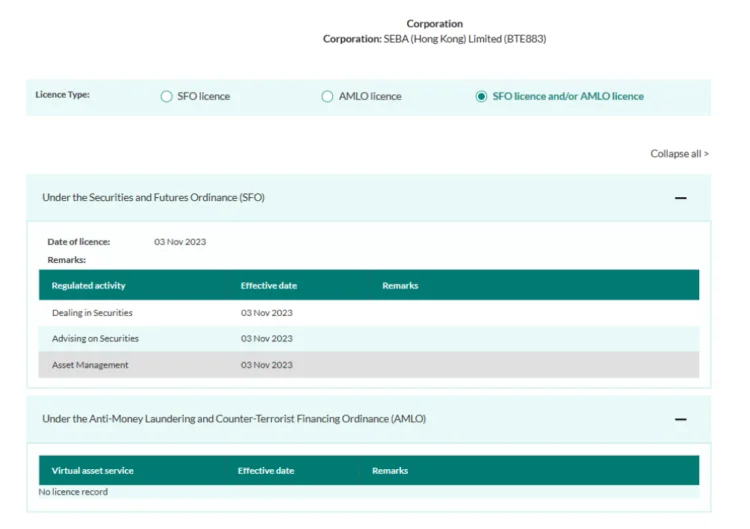

SEBA Hong Kong, a subsidiary of SEBA headquartered in Hong Kong, has obtained regulatory approval to provide various services on cryptocurrencies in the area. The data on the SFC website indicates that SEBA obtained the license on November 3.

The authorization grants SEBA the ability to engage in the trading and distribution of any security, which includes products associated with digital assets like over-the-counter (OTC) derivatives. With this license, SEBA establishes its initial presence in the Asia-Pacific area.

Intending to expand its services in the region, SEBA established its first office in Hong Kong in November 2022. In August 2023, the bank received preliminary approval from SFC to provide virtual asset trading services. Beyond Switzerland, SEBA maintains an operational presence in Abu Dhabi as well.

Asset management for discretionary accounts in traditional and digital assets, as well as providing advice on securities and digital investments, will be capabilities of SEBA under the SFC license.

Institutional and professional investors, such as corporate treasuries, funds, family offices, and high-net-worth individuals, will be able to avail themselves of the services provided by the Swiss firm using the license.

Since the inception of Bitcoin, Hong Kong has been at the epicenter of the cryptocurrency economy, according to SEBA CEO Franz Bergmueller, who stated in an official statement that the bank is delighted to join the Hong Kong digital asset economy. His further statement was:

“The region’s robust legal system provides a solid foundation to conduct crypto-related service. This regulatory clarity not only benefits our business but also supplements Hong Kong’s status as a global financial services hub, home to a multitude of market leaders in banking, asset management, and capital markets.“

Hong Kong acknowledged its entry into the global cryptocurrency economy in 2023 by instituting regulations conducive to the growth of cryptocurrency companies.

The municipality has implemented a stringent licensing system, permitting access to its services by retail and international clients exclusively through a limited number of platforms.

A limited number of the nearly one hundred companies that expressed interest in establishing branches in Hong Kong at the time the government issued licensing requirements were successful in obtaining authorization.