Bitcoin ETFs see a 32K BTC inflow as whale wallets move, with PlanB predicting BTC scarcity rivaling gold and changing crypto’s future.

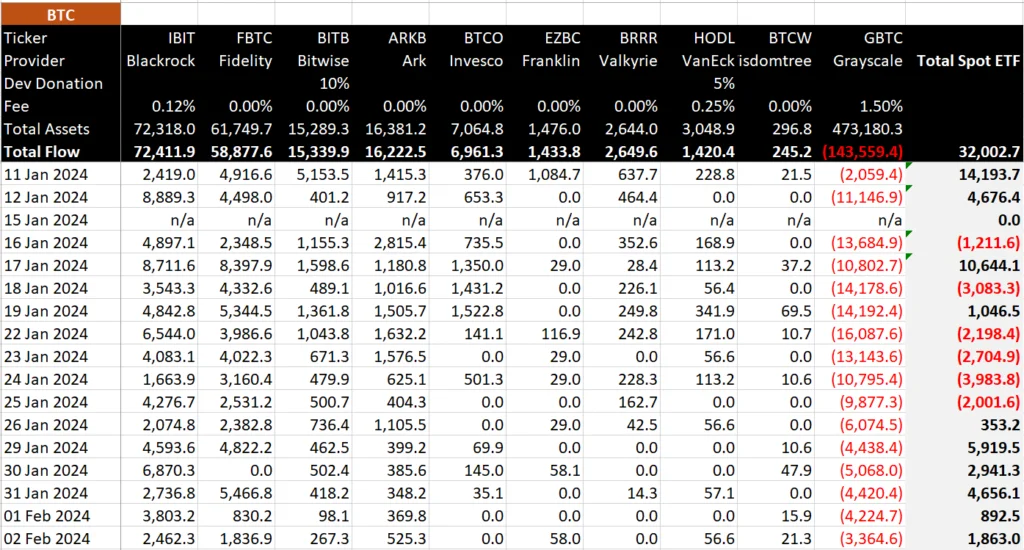

BitMEX Research recently published a report detailing the flow data of U.S. Spot Bitcoin ETFs since their inception.

The data reveals a significant net inflow of more than 32,000 BTC in a span of only seventeen trading days.

Significantly, this upsurge, estimated to be worth around US$1.459 billion, has incited a dynamic transformation in the market dynamics, particularly due to the substantial motion exhibited by whale wallets.

Consequently, let us examine the complexities of these market dynamics and their possible ramifications.

Bitcoin ETFs Record 32,000 BTC Inflow Amid Whale Wallets Move

The most recent findings of BitMEX Research demonstrate a paradigm shift in the market, with the U.S. Spot Bitcoin ETF at the forefront of this transformation.

Since their inception, Spot Bitcoin ETFs have received a cumulative inflow of 32,002.7 BTC, or $1.459 billion, according to the report.

Meanwhile, Grayscale GBTC encountered a net outflow of 143,559.4 BTC, which is equivalent to an estimated $5.967 billion.

In contrast, a net inflow of 175,562.2 BTC from the remaining nine ETFs was sufficient to compensate for the outflow of Grayscale.

Notably, BlackRock IBIT established itself as the frontrunner with a substantial net inflow of 72,411.9 BTC, while Fidelity FBTC followed suit with a net inflow of 58,877.6 BTC.

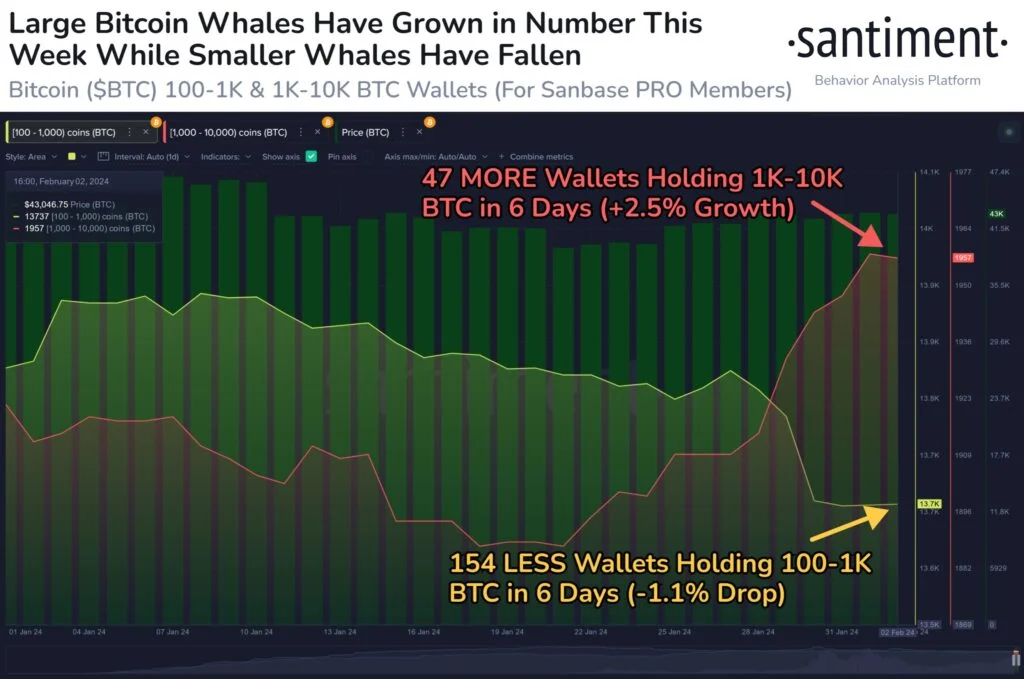

Conversely, Santiment, an on-chain data provider, contributes an additional dimension to the evolving storyline by uncovering significant activity among whale wallets, notwithstanding Bitcoin’s range-bound price of $41,000 to $44,000.

The update indicates that the quantity of 1K-10K BTC wallets increased to 1,958 on February 1, the highest level since November 2022.

In addition, the number of wallets holding 100-1K BTC dropped to 13,735, the lowest level since the corresponding time frame.

Meanwhile, the data from Santiment indicates the possibility of market volatility due to the strategic positioning of whales during the ongoing price consolidation, which has an impact on sentiment and trading patterns.

Will Bitcoin Prosper Over Gold And Real Estate?

Prominent crypto analyst PlanB made a daring forecast regarding the future scarcity of Bitcoin in a recent X post, drawing parallels to gold and real estate.

PlanB argues that after the April Bitcoin halving, the scarcity of BTC will transcend that of gold and real estate, which could result in a market cap that surpasses $10 trillion.

Given the present Bitcoin market cap of less than $1 trillion, this forecast indicates the possibility of a Bitcoin price increase exceeding $500,000.

Furthermore, PlanB provides support for this prediction through the utilization of Stock-to-Flow (S2F) ratios.

Specifically, it assigns an approximate S2F-ratio of 110 to Bitcoin, which surpasses the S2F-ratios of 60 for gold and 100 for real estate.

CoinGlass data revealed, however, that Bitcoin Futures Open Interest (OI) is declining, which contradicts this optimistic outlook.

Notwithstanding a 1.21% decline in overall Bitcoin OI over the last 24 hours to 408.57K BTC or $17.53 billion, certain platforms such as CME and Binance recorded marginal losses and gains, respectively.

As of this writing, the price of Bitcoin was fluctuating near $43,000, reflecting a 0.10% decrease over the past 24 hours.

However, the price of Bitcoin has increased by 3% over the past week and decreased by about 4% over the past thirty days.

Significantly, these observations regarding the Spot Bitcoin ETF, PlanB’s forecast, and the simultaneous fluctuations in Bitcoin Futures Open Interest underscore the continuous debates on the prospective capabilities of Bitcoin and its changing function as a means of safeguarding value within the worldwide financial system.