A fake Ethena Labs token recently faced an exploit for 480 BNB tokens worth $290,000 on the Binance farming launch pool.

The exploit’s underlying vulnerability remains undisclosed. PeckShield, an on-chain security firm, issued an X post detailing the incident at 8:31 am UTC on March 29.

A few hours before the exploit, on March 29, Ethena Labs introduced the ENA token on the Binance Launchpool. This allowed users to acquire the token by staking BNB or First Digital USD (FDUSD).

On February 19, Ethena Labs introduced the USDe synthetic dollar to the public mainnet. On March 8, Ethena surpassed all other decentralized applications (DApps) in earnings by providing investors with a 67% annual percentage yield (APY).

The total magnitude of the exploit is relatively modest compared to other crypto breaches. The assault occurred one day after the violation of Prisma Finance, which compromised funds exceeding $11 million on March 28.

Hacking into cryptocurrencies has been an industry concern for quite some time, eroding investor confidence. As of February 29, 2024, breaches and rug pulls have reportedly ruined cryptocurrencies worth more than $200 million in 32 separate incidents, according to blockchain security firm Immunefi.

When $173 million worth of digital assets were stolen in January and February 2023, the loss increased by 15.4% to more than $200 million.

17% of the $1.8 billion lost to crypto breaches and scammers in 2023 was attributable to the North Korean Lazarus Group, according to a report published by Immunefi on December 28.

Stolen Crypto Funds Increase by 54% in 2023

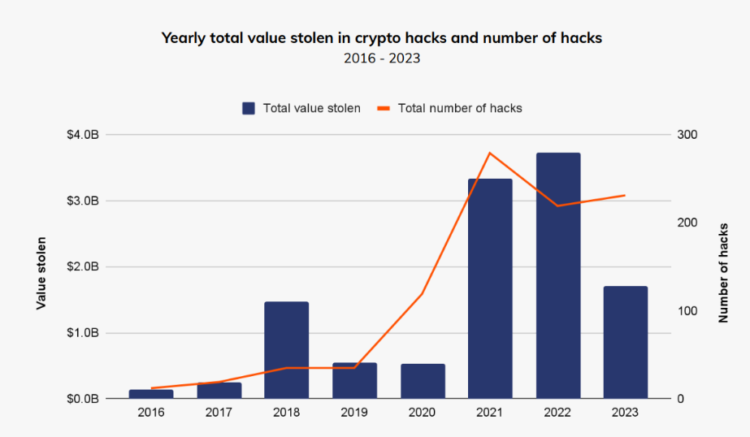

2022 was the busiest for crypto criminals, stealing over $3.7 billion. “The 2024 Crypto Crime Report” by Chainalysis indicates that the value of stolen funds declined by 54.3% to $1.7 billion in 2023.

The number of incidents increased from 219 in 2022 to 231 in 2023, notwithstanding the decline in funds, which indicates that the quantity of stolen value is diminishing from each occurrence.

The report states that Chainalysis ascribed the substantial annual decline to a reduction in decentralized finance (DeFi) theft.

“Hacks of DeFi protocols largely drove the huge increase in stolen crypto that we saw in 2021 and 2022, with cybercriminals stealing more than $3.1 billion in DeFi hacks last year. But this year, hackers stole just $1.1 billion from DeFi protocols. This amounts to a 63.7% drop in the total value stolen from DeFi platforms year-over-year.”