Strike expands services to Europe, facilitating BTC transactions for new users, aiming to boost crypto adoption.

Strike, a payment platform for Bitcoin (BTC), intends to extend its services to European clients to promote greater cryptocurrency adoption. The company announced the expansion to eligible European consumers in a recent press release.

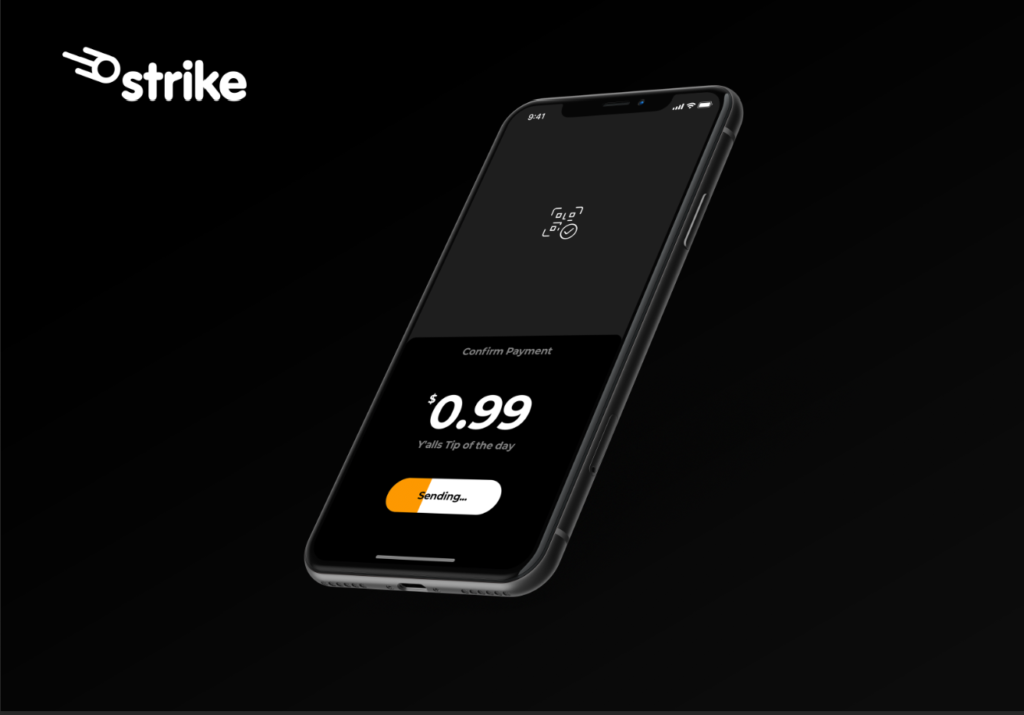

Strike releases an all-encompassing bundle designed to facilitate the integration of new users into the Bitcoin ecosystem in Europe. As per the announcement, clients can register and facilitate Bitcoin transactions.

“Customers can sign up in a few clicks, seamlessly and securely buy bitcoin with free, instant, and unlimited deposits, and sell, send, and withdraw just as easily. The platform also facilitates global payments and offers advanced Bitcoin and Lightning wallet services.” Bitcoin adoption has increased significantly in recent months due to price peaks and institutional inflows. The CEO of Strike, Jack Mallers, emphasized the significance of Bitcoin across multiple industries as a technological advancement that promotes interoperability and savings.

“Bitcoin transcends borders, enhances financial inclusion, and solves some of the biggest economic problems we all face today such as inflation. As the third-largest economy globally Europe presents vast opportunities for Bitcoin adoption and we believe that Strike is uniquely positioned to serve millions of people across the continent.” The foray into Europe follows expansions into numerous jurisdictions in the past. Strike serves clients in approximately one hundred African, Latin American, and American nations.

Strike announced that, besides onboarding European clients, it will take business applications to support Bitcoin-related functions such as SWPa transfers and buying/selling transactions.

European users can purchase Bitcoin using unlimited SEPA Euro deposits and withdraw funds to self-custody Bitcoin wallets or alternative methods. Additionally, the cross-border payment feature enables users to transfer funds, which includes withdrawal options.

Europe maintains many cryptocurrency firms due to its regulatory environment characterized by transparency and friendliness. Other jurisdictions were encouraged to adopt the Markets in Crypto Assets (MiCA) regulation, heralded as a landmark statute.