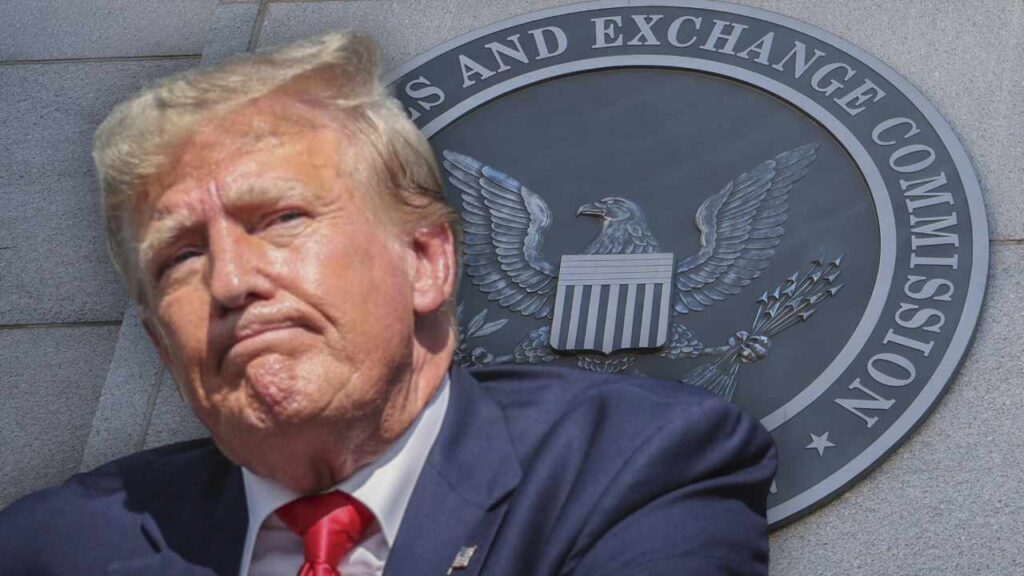

Former SEC official Jennifer Lee predicts Trump’s reelection won’t alter the crypto regulation approach, citing prior vigorous enforcement.

On May 2, former SEC Division of Enforcement Assistant Director Jennifer Lee stated that the SEC’s position on cryptocurrencies will likely stay the same in the event of Donald Trump’s re-election.

Lee told CNBC that the SEC “vigorously pursued crypto cases” and introduced “daylight and regulation” to the burgeoning industry during Trump’s first presidential term.

With a re-election in 2020, she predicted that the SEC would further “define its space and extend its reach over cryptocurrencies.”

Lee stated that while the SEC is more consistent in determining which cryptocurrencies fall under its purview, the scope of its authority over the industry still needs to be discovered.

Lee refrained from providing any commentary regarding the SEC’s precise actions during Trump’s inaugural term. In 2018, however, then-SEC chair Jay Clayton cautiously regulated certain cryptocurrency sales, including a Senate hearing in which he stated that all initial coin offerings (ICOs) he had observed were securities.

Clayton also believed that specific cryptocurrencies, such as Bitcoin, did not qualify as securities then.

Former SEC chief of the SEC Office of Internet Enforcement John Reed Stark, an additional former SEC member, has argued that the SEC under Trump may be more relaxed on cryptocurrencies.

According to Stark in September, a Republican-appointed SEC chair would “significantly slow down” the agency’s crypto enforcement efforts. He also speculated that Trump might alter his anti-crypto stance to appeal to crypto voters with a singular concern.

Stark observed that Trump possesses substantial cryptocurrency holdings, a claim supported by financial documents about Trump’s NFT ventures.

Similarly, others have proposed employing a delicate approach. House Majority Whip Tom Emmer stated in January that a re-election administration under Trump might be “more amenable” to cryptocurrencies.

Trump advocated for a measured approach to cryptocurrency regulation in March.

A change in the presidential administration could affect SEC leadership, irrespective of policy shifts. Typically, SEC chairpersons tend to tender their resignations amidst transitions in administration. Thus, in the event of a Trump victory, current SEC chair Gary Gensler, whose term runs until June 2026, could resign.

Unknown is the probable outcome of the United States presidential election. FiveThirtyEight projects that the probabilities of victory are equivalent for both Trump and Biden, with Trump having 41.7% and Biden having 40.7%.