Crypto analyst Michael van de Poppe predicted a 100% altcoin rally matching Bitcoin’s. He expects the decline to end in the next weeks.

The altcoin market remains sluggish as we approach the final week of June.

Over the weekend, the whole altcoin market lost more than $25 billion, with Ethereum (ETH) and the other top ten altcoins dropping between 3 and 10%.

However, analysts anticipate that this may be the final correction before new capital resumes its inflow into the altcoin market.

Capital Rotation Into Altcoin To Begin Soon

Michael van de Poppe, a renowned crypto analyst, expects the end of the crypto slump for altcoins.

In his recent tweet, Poppe stated: “The final downtrend weeks for altcoins are ending. Perhaps from the next week, or the week after, the big capital rotation should start”.

Poppe anticipates that the risk-ON period will commence soon, expressing confidence in his current position on altcoin.

According to analyst van de Poppe, the altcoin market is on the brink of its final stage of decline, and investors are preparing for a potential favorable rotation.

Additionally, Poppe stated that the alt. market is currently in a state of disarray, as the BTC valuation of numerous altcoins has reached new lows.

However, he claims that the last time this happened, some altcoins soared as much as 300-500%.

Additionally, analyst van de Poope expressed a positive outlook for alts in the future.

He observed that the alt market cap has declined by 50% since the all-time high in 2021, and the recent correction has further reduced it by 30%.

Poppe anticipates a potential 100% rally in altcoins that could be consistent with Bitcoin’s trajectory as the correction approaches its end.

Crypto Market Cracks

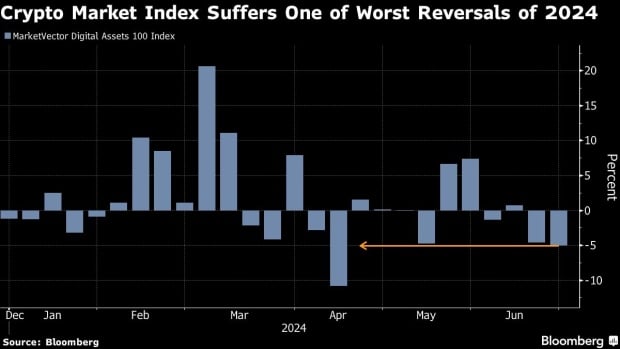

Last week was the second-worst weekly decline in the crypto market for the year 2024.

This is evidently attributable to the uncertain monetary policy and the declining demand for Bitcoin ETFs.

Bloomberg’s data indicates that the top 100 digital assets experienced a 5% correction last week.

The crypto market is presently experiencing cracks amid uncertainty regarding the Federal Reserve’s decision to transition to rate cuts, as interest rates are at near two-decade highs.