This significant decline was triggered by Bitcoin and Ether’s sharp value drops and broader market turmoil.

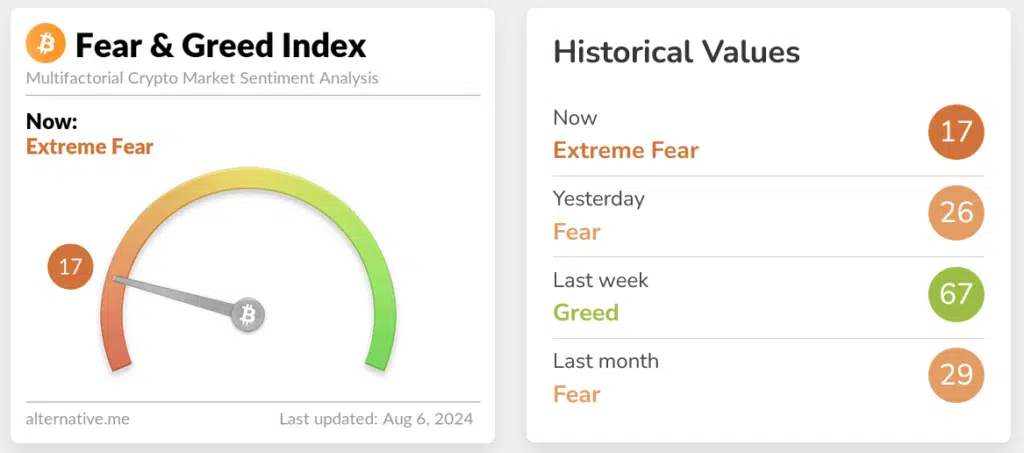

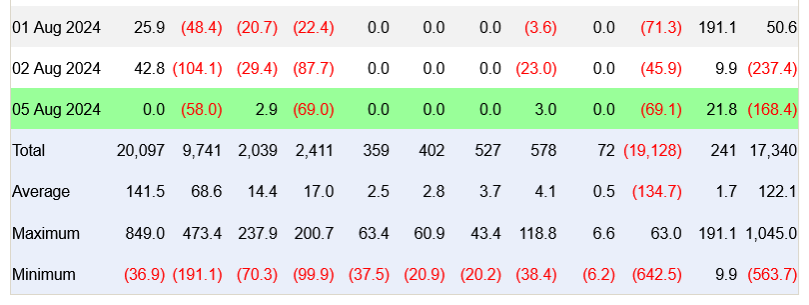

On August 5, US spot Bitcoin exchange-traded funds reported outflows of $168.4 million in trading, causing the Crypto Fear & Greed Index to just dip into the “Extreme Fear” zone for the first time in two years.

Bitcoin Hits Extreme Fear Index

This marks the first time that the index has entered this zone. The index, which tracks market sentiment for BTC and the cryptocurrency sector overall, fell to a score of 17 out of 100 on August 5, the lowest level since July 12, 2022.

At this time last week, on July 29, the index score was 67 which represents one of the most significant percentage drops from one week to the next in recent years. On August 5th, spot Bitcoin exchange-traded funds showed outflows of $168 million.

According to the data provided by Farside Investors, the majority of the funds came from the Grayscale BTC Trust and the ARK 21Shares Bitcoin ETF, with a total of $69.1 million and $69 million, respectively.

It was possible for the Grayscale Bitcoin Mini Trust, the VanEck Bitcoin ETF and the Bitwise Bitcoin ETF to record inflows of $21.8 million, $3 million and $2.9 million, respectively. On the other hand, BlackRock’s iShares Bitcoin Trust was able to record a completely negative amount.

According to Farside Investors, the spot Ether (ETH) exchange-traded funds (ETFs) experienced a net inflow of $48.8 million, with iShares Ethereum Trust being the most successful with $47.1 million.

In addition, sales of Ether products offered by VanEck and Fidelity brought in a total of $16.6 million and $16.2 million, respectively. When BTC and Ether experienced a 10% and 18% drop in value within a two-hour window on August 5, sentiment began to decline.

Leveraged long bets suffered a loss of nearly $600 million, affecting many other cryptocurrencies more severely than BTC and Ether. Additionally, the US stock market lost trillions of dollars on August 5.

These factors, which have led to the market’s slippage, include weak employment data, slowing growth among large technology firm and rekindled fears of a recession.

According to Bob Loukas, an independent trader, the past three days have been a once in seven to ten-year occurrence that has resulted in a loss of more than $500 billion from the total market capitalization of cryptocurrencies.

According to reports, Jump Trading’s “aggressive” selling caused the cryptocurrency market to crash. Tuur Demeester, an expert who specializes in BTC, is of the opinion that the cryptocurrency might reach a low of between $40,000 and $45,000, although he cautioned against placing any bets on this possibility.

“In a Bitcoin bull market you don’t take bearish bets because prices can whipsaw back up in no time.”

Since BTC reached its lowest point of $49,780 on August 5, according to statistics provided by CoinGecko, the cryptocurrency has largely recovered, climbing 11.85% to $55,680.